Inflation has started cooling down gradually in major economies. Last week, the Bureau of Labor Statistics announced that US’s inflation dropped to 6.5% in December. The same marked the sixth straight monthly deceleration since the mid-2022 peak.

The UK released its numbers on Wednesday. The British Office for National Statistics revealed that inflation eased to 10.5% in December, down from November’s 10.7%. In fact, the latest number is at a 3-month low.

A panel of economists polled by Reuters had forecast that the British CPI would reach 10.5% in December, and evidently, the number is in line with the prediction.

The low fuel and clothing prices rubbed off positively and helped in the softening of inflation. Nevertheless, the cost of food and non-alcoholic beverages was 16.8% higher than a year earlier. The same marked the biggest increase since September 1977.

Also Read: US Inflation Rate Falls to 6.5%

Interest Rates Expected To Rise

In November, the Bank of England projected that the CPI would drop to around 5% by the end of 2023. Even though the situation seems to be under control and the economy is gradually getting back on track, monetary tightening is expected to continue.

The Bank of England raised its interest rate by 0.5 percentage points to 3.5% in mid-December. Reuters pointed out that the financial markets expect the BoE to further raise the number to 4% on Feb 2.

On the news of inflation easing, the Pound noted an uptick. At press time, it was trading around 1.2316 to the US Dollar.

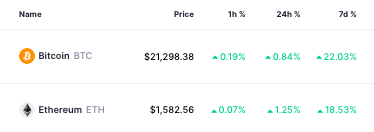

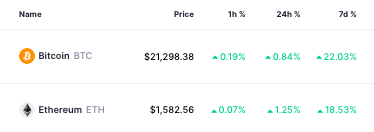

Alongside, Bitcoin and Ethereum noted minor inclines and were trading in the green as well. At press time, the largest crypto was trading at the brink of $22.3k, while the largest Altcoin was priced quite close to the $1.6k psychological level.

Also Read – Bitcoin: Trader Earns 1228% Profit, Turns $167K To $2.2M