With cryptocurrency becoming popular every year, much Decentralized Finance (DeFi) have come up over the last few years. One of these projects is Uniswap whose success has revolutionized other platforms. In this article, we take a look at its interface and all you need to know about Uniswap.

Why Uniswap Is Such an Innovative Platform and How It Works

Compared to other exchanges, there are no specific listings or buy orders. Any user on the platform can add liquidity for any token pain in Uniswap. However, it’s important to note that just as easily, a user can take away liquidity which means that you cannot trade your tokens. Because of such cases, ensure that the pair you want to swap is available and locked.

Uniswap exchange is where you can swap tokens and Uniswap.info allows you to track data in real-time on the exchange. Data you can track include the price of different tokens on the exchange, total trade volumes and numbers of transactions over the last 24 hours, and the total current liquidity in the exchange.

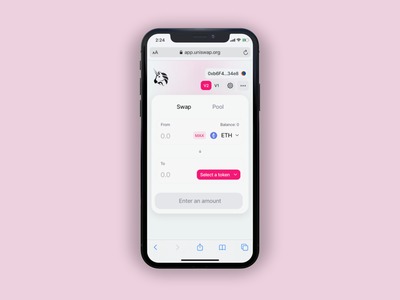

How to Use the Uniswap Interface

With Uniswap, you are assured of a user-friendly interface without an account or any Know Your Customer (KYC) procedures. Therefore, if you want to start swapping (trading) tokens, you will use the following procedure:

- Go to a valid Uniswap domain.

- Connect any supported Ethereum wallet e.g., Trustwallet, MetaMask etc.

- Select a token you want to “exchange from” from the list

- Select a token you want to “exchange to” from the list

- Click the Swap icon

- A pop-up window will appear where you can preview if what you have input is correct

- Click confirm if the details are correct

- Wait for confirmation of the transaction on the Ethereum blockchain. You can use Etherscan to track the status of your transaction in real-time.

Risks You Have to Know While Using Uniswap

1. Fake Smart Contracts

The biggest challenge Uniswap faces are fake smart contracts that masquerade themselves as real ones. This is because anyone using the platform can create an ERC 20 token and upload it to the platform.

If a major liquid provider decides to pull out of the liquidity pool, he causes what is called a rug pull to occur. This leads to other users in the liquidity pool making a massive loss. You can avoid this scam by using Etherscan to search for the token’s address to ensure its authenticity.

2. High Gas Fees

Because of Ethereum’s high demand and heavy traffic, the transaction fees (gas fees) go up. As a result, this causes using Uniswap to become very expensive with single token transactions being as high as $20. Since you have to approve every token you want to transact with, your transaction fees will add up and you might make a loss.

3. Phishing Attacks

It’s not uncommon for some sites to masquerade as Uniswap. You, therefore, have to ensure that you are using either one of Uniswap’s official domains i.e., Uniswap.exchange and Uniswap.info.