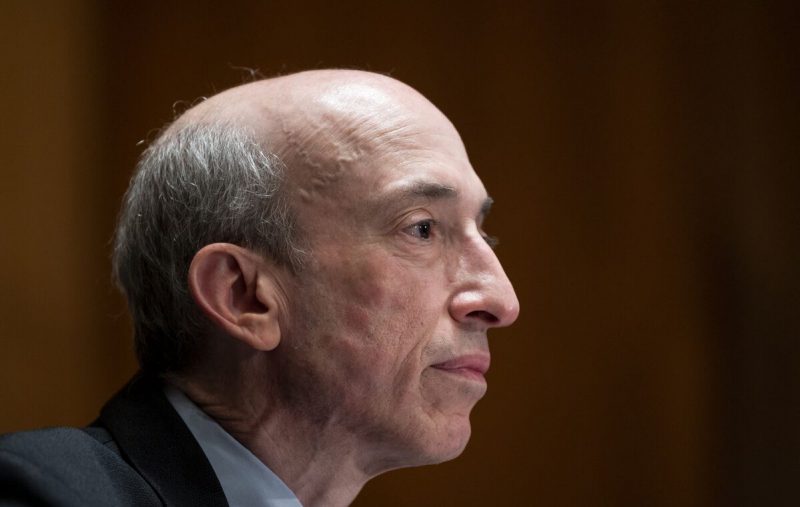

In a post to X (Formerly Twitter), US Congressman Warren Davidson says US Securities and Exchange Commission (SEC) Chair Gary Gensler should be fired in 2024. Moreover, he called for Congressional action to “hold the SEC accountable” for its corruption. Additionally, he linked to a news article highlighting an SEC administrative court scandal.

Congressman Davidson had previously introduced the SEC Stabilization Act which would remove Gensler from his current position. Consequently, the legislation would restructure the agency and correct the “long series of abuses” that have occurred under Gensler’s leadership.

Also Read: US Congressman Warren Davidson Stresses Crypto Self-Custody for Defending Freedom

Warren Davidson Wants Gensler Fired and SEC Held Accountable in 2024

For much of 2023, the conflict between the SEC and the digital asset sector has been increasingly on display. Indeed, under the guidance of Gary Gensler, it has firmly embraced an enforcement-first approach to regulation. Subsequently, it has crafted a combative relationship with the industry as a whole.

Now, US Congressman Warren Davidson has continued his stance against the chairman, as he has recently said the SEC’s Gensler should be fired in 2024. Moreover, he noted the year as a good time to “hold the SEC accountable” for its corruptive behavior over the last year.

Also Read: US Congressman Warren Davidson Calls to Ban CBDC

Congressman Davidson has not been shy about his position regarding the SEC and Gensler’s role as its chair. Subsequently, he introduced a stabilization bill in June of 2023 that would completely restructure it. Ultimately, the bill would remove Gensler as its head to correct its past abuses.

“US markets must be protected from a tyrannical Chairman, including the current cone,” Davidson stated when the bill was introduced. “That’s why I’m introducing legislation to fix the ongoing abuse of power and ensure protection that is in the best interest of the market for years to come. It’s time for real reform and to fire Gary Gensler as Chair of the SEC.”