Donald Trump’s trade tariffs officially went live on Tuesday impacting China, Mexico, and Canada. Global trade could experience a significant imbalance as tariffs impact prices of goods making consumers shell out more to procure products. On the day the tariffs went live, the US stock market and the dollar headed south losing a chunk in value.

Also Read: Walmart (WMT): Top Stock to Accumulate as Tariffs Kick In

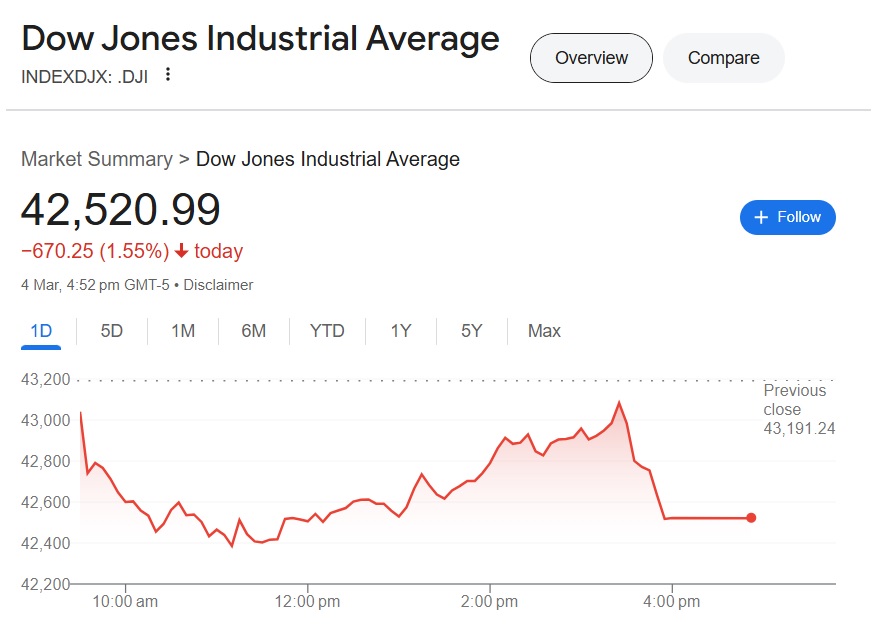

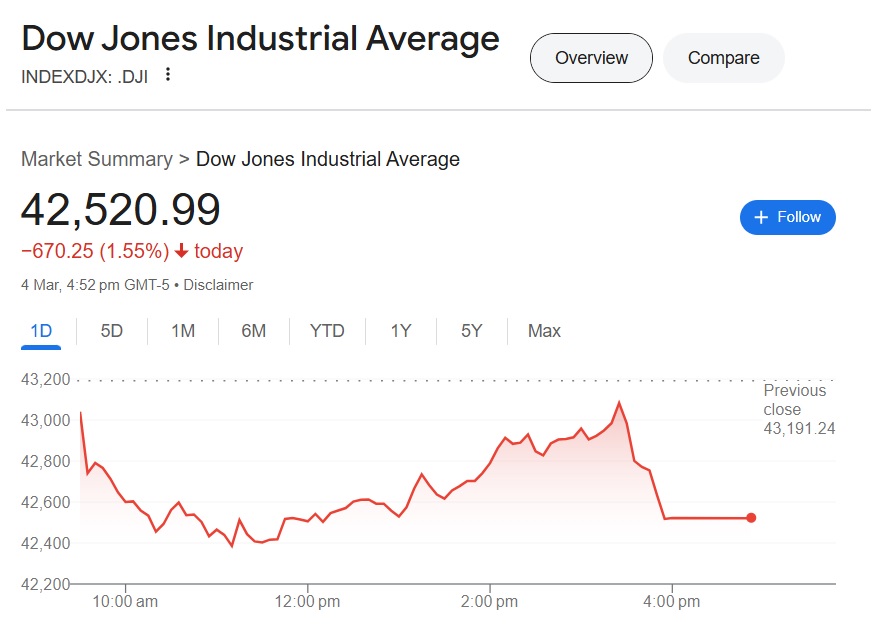

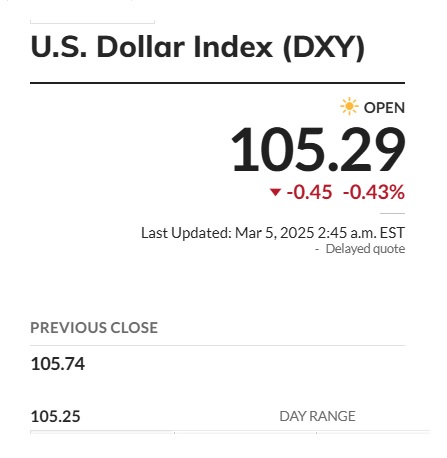

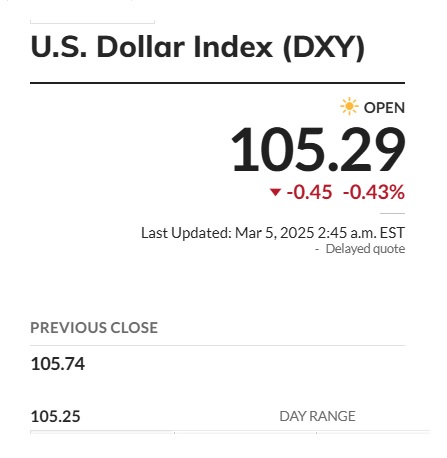

The Dow Jones Industrial Average plunged 670 points while Nasdaq and the S&P 500 index dipped 65 to 71 points, respectively. The DXY index, which measures the performance of the US dollar shows the currency falling to the 105.30 mark on Tuesday. It dipped by 0.43 points shedding 0.40% in value in the day’s trade. The US stock markets and the dollar are dipping indicating that investors remain worried about the market prospects.

Also Read: Here’s Why Bitcoin (BTC) May Not Cross $100K for the Next 3 Months

Trump Tariffs: What Next For the US Dollar & Stock Market

While the US dollar and the stock market surged after Trump reclaimed the White House in November, they are now moving south as tariffs kick in. The weakness in the US dollar and the stock market could signal weakness and raise a cause for alarm. If the markets go further south, investors’ confidence in the markets could take a hit.

Also Read: Ripple: AI Predicts XRPs Price For The Cryptocurrency Summit Day

“The dollar going up on tariff news isn’t scary. The day it goes down on tariff news will be,” said Lily Francus, Chief Investment Officer at Novi Loren. Therefore, traders need to get ready for turbulence as the markets reacted negatively when the tariffs went live. The US stock market and the dollar remain at risk as tariffs could impact its performance in the charts.

“There are times to be dismissive of the market reaction, but not today,” said George Saravelos, Global Head of Foreign-Exchange Research at Deutsche Bank. In conclusion, the dollar and the US stock market could face corrections as Trump’s tariffs kick in.