The US stock markets are currently a mix of bullish and bearish elements. With the fall in the price of gold and silver, alongside the crypto domain bleeding red, the stock market domain continues to project robustness, with major US stock companies such as Amazon (AMZN) and Meta (META) reporting strong future plans. What’s next for Amazon and Meta stock in the near future? Are these assets worth a shot?

Also Read: US Stocks 12 Months Analysis: Paypal (PYPL) & Microsoft (MSFT)

Amazon (AMZN) Stock Analysis

Amazon stock is currently experiencing a bearish outlook, as the company’s fourth-quarter earnings report projected a staggering $200B AI spending segment. The firm shared how it expects the firm’s capital expenditures to continue surging as it heavily pivots towards data centers and infrastructure to cater to its rising AI demand.

“With such strong demand for our existing offerings and seminal opportunities like AI, chips, robotics, and low earth orbit satellites, we expect to invest about $200 billion in capital expenditures across Amazon in 2026 and anticipate strong long-term return on invested capital,” CEO Andy Jassy said in a statement.

The announcement was met with a mix of strikingly bearish reviews, with investors skeptical about the firm’s plan to spend $200B to embrace the AI revolution. The company’s stock tumbled down post the announcement, falling 10% in the process.

Meta Stock Analysis

In addition to Amazon, Meta stock, on the other hand, is also under investors’ watchful radar; additionally, as a result of the rising AI mechanism, the company plans to bolster its spending toward infrastructural support. The firm is planning to boost its AI spending, ready to spend nearly $135B on AI infrastructure.

“It’s an unusual opportunity. I passionately believe every customer experience we have today will be reinvented by AI… We’re going to invest aggressively,” Jassy added.

Meta and Amazon stocks are both under pressure at present, with the firm’s heavy leaning towards AI causing distress among its investors.

12-Month Forecast for Amazon (AMZN) and Meta (META)

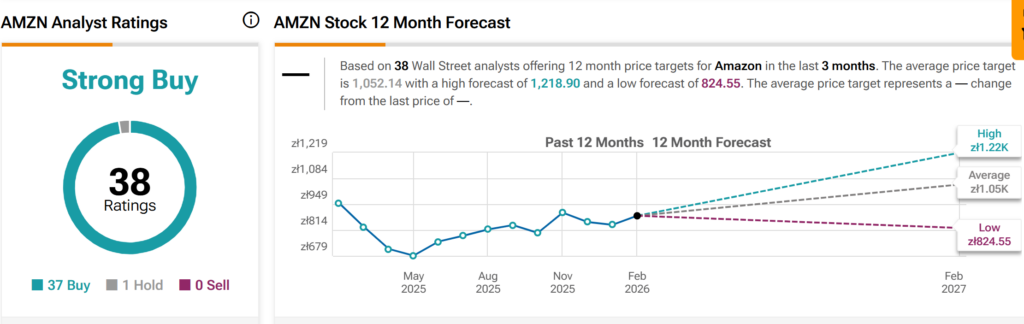

According to TipRanks Amazon (AMZN) stock stats, the firm, if successful in redirecting its AI narratives, could make its stock surge to hit $340 in the next 12 months.

“The average price target for Amazon is 297.50. This is based on 37 Wall Street analysts’ 12-month price targets, issued in the past 3 months. The highest analyst price target is $340.00, and the lowest forecast is $230.00. The average price target represents 33.59% increase represents a from the current price of $222.69.”

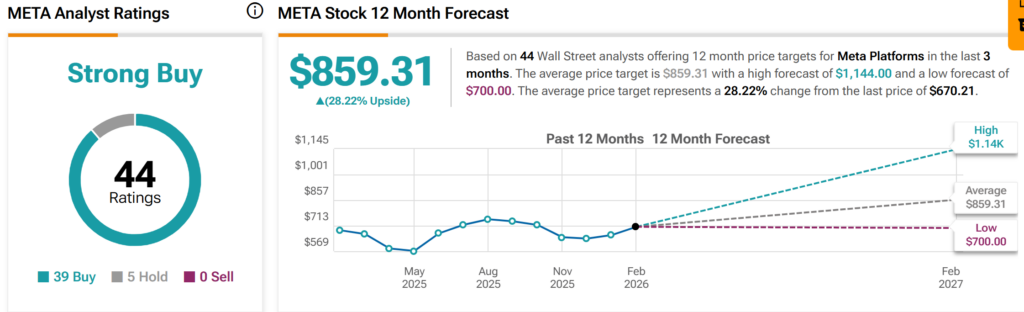

Additionally, for the Meta (META) stock, TipRanks stats suggest that the firm’s shares may surge to as much as $1.14K.

“The average price target for Meta Platforms is 859.31. This is based on 44 Wall Street analysts’ 12-month price targets, issued in the past 3 months. The highest analyst price target is $1,144.00, and the lowest forecast is $700.00. The average price target represents a 28.22% increase from the current price of $670.21.”

Also Read: Amazon (AMZN) Earnings: Will Heavy AI Focus Fuel, Harm Stock?