The US stock market is currently witnessing its most prosperous time, with the S&P 500 claiming record highs. The domain is currently under its most disruptive phase as AI and related tech continue to leverage current market momentum, bringing in more capital and attention towards the sector. That being said, two stocks, notably PayPal (PYPL) and Microsoft (MSFT), are currently in the spotlight, with both firms sharing a tumultuous road ahead in light of the plunging share scenario. What’s ahead for PYPL and MSFT in the long run? Let’s explore it further.

Also Read: Software Stocks Slide as AI Stocks Spark Business Model Fears

PayPal (PYPL) and Microsoft (MSFT) Stock News and Narratives

PayPal (PYPL) and Microsoft (MSFT) stocks are witnessing a downward trend as of late. Speaking about PayPal, the recent exit of the firm’s CEO has ended up casting a layer of doubt over its future. Investors are particularly wary of PYPL CEO Alex Chriss’s exit from the firm, with its share plunging as low as 20%, dampening the 2026 PYPL stock forecast. The firm has selected HP’s Enrique Lore as its new president and CEO.

“The big question is whether he will bring in a formidable payments team to attempt yet another multi-year turnaround or look to start reviewing options for strategic assets,” analysts at Evercore ISI said.

In addition to this, Microsoft’s recent earnings report has also raised a new question for the company to combat. The fact that Microsoft’s shares are down 10% despite delivering a stellar earnings report speaks volumes about the changing investor expectations. The firm is projecting a bearish stance, as investors were earlier expecting a high delivery output from MSFT’s cloud computing service Azure, which reported earnings near 39% as compared to 40% in the fiscal first quarter.

“It now looks like the company will not really accelerate Azure further from here. Due to the law of large numbers and extra capacity being used for its own. Higher-margin, first-party offerings like Co-Pilot and its own AI R&D efforts,” he said.

Projection For 2026 for Both the Stocks

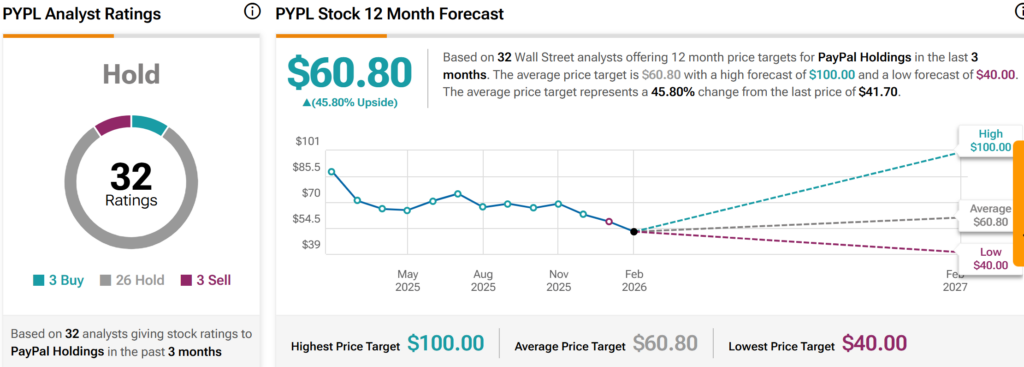

Per TipRanks, PYPL stock is currently eyeing a high of $90, which it can achieve in the next 12 months, provided the new CEO-elect could help drive the firm in the right direction.

“The average price target for PayPal Holdings, Inc. is 62.22. This is based on 29 Wall Street analysts’ 12-month price targets, issued in the past 3 months. The highest analyst price target is $100.00; the lowest forecast is $40.00. The average price target represents a 49.20% increase from the current price of $41.7.”

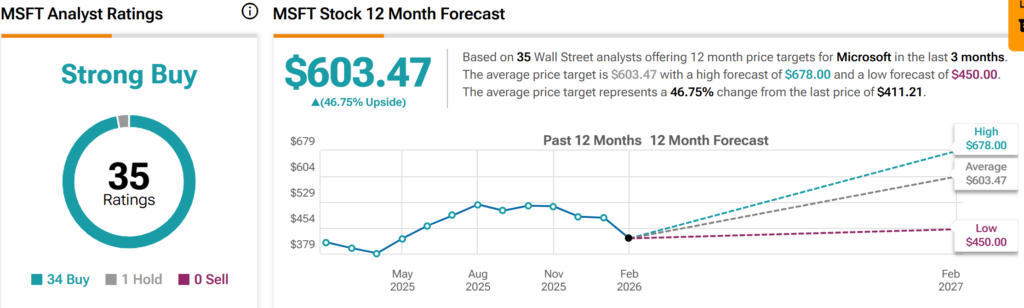

TipRanks later shared an analysis for Microsoft (MSFT) stock, claiming how this stock is eyeing a high worth of $678 in the next 12 months.

“The average price target for Microsoft is 603.47. This is based on 35 Wall Street analysts’ 12-month price targets, issued in the past 3 months. The highest analyst price target is $678.00; the lowest forecast is $450.00. The average price target represents a 46.75% increase from the current price of $411.21.”

Also Read: Gold Rates Six Month Prediction: Can Gold Top The $8K Mark?