VanEck will launch its Bitcoin futures ETF in the US next week. The speculated launch date is on Monday, October 25. The launch comes after approval by the United States Securities and Exchange Commission (SEC).

VanEck will be the third Bitcoin futures ETF to trade in the New York Stock Exchange (NYSE). ProShares launched the first BTC Strategy ETF was launched on NYSE earlier this week. The company whose EFT approval was given last week Friday, had applied back in August.

Bitcoin Strategy Future ETFs in the US

The launch of ProShares ETF was a super successful one. Investors traded shares worth $280 million in just 20 minutes. Nearly $1 billion had been traded by the end of the trading day. ProShares opened at an initial price of 40 USSD. The shares closed at 41.94 USSD, a drop from the 42.15 USSD that the shares had traded for during the day.

Valkyrie Bitcoin Strategy Fund is set to trade on Nasdaq today, making it the 2nd Bitcoin futures ETF to trade in the US. The ETF will trade under the ticker BTO. AdvisorShares Managed Bitcoin ETF, the Galaxy Bitcoin Strategy ETF and the Invesco Bitcoin Strategy ETF are some of the ETFs awaiting approval by the SEC.

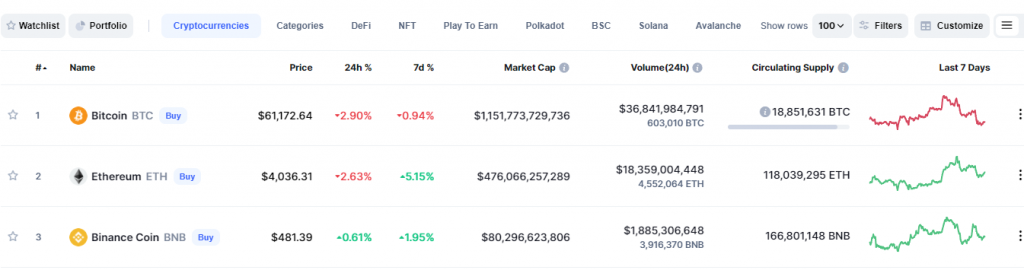

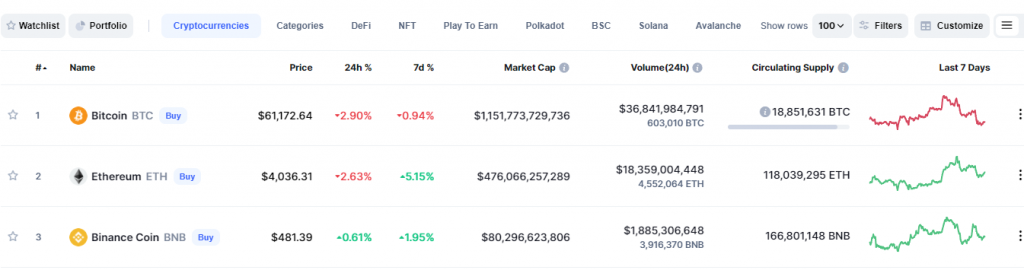

The launch of Bitcoin ETFs in the US has brought a lot of excitement to the crypto industry. This excitement has translated to ETH and BTC meeting their all-time highs. ETH and BTC are, respectively, trading at $4,036 and $61,172.

According to Theresa Morrison, a CFP with the Beckett Collective, US crypto enthusiasts have been trying for several years to get Bitcoin-linked investment products approved. The launching of Bitcoin ETFs is a huge milestone in this journey.

All You Need To Know About Bitcoin Futures

First and foremost, it is essential to note that Bitcoin futures and Bitcoin are not the same things. With the trading of futures, you are not directly buying and selling Bitcoin.

So how exactly do Bitcoin futures work? With futures, you agree to trade Bitcoin in the future at a specified price. When the date arrives, you buy or sell Bitcoin at the agreed price regardless of the actual BTC price on that day.

If Bitcoin ends up being more than what you agreed upon, you make money as an investor; trading at a premium. Suppose Bitcoin’s price ends up being less than you expected, you lose money; trading at a discount.

To put it quite plainly, investing in Bitcoin ETFs means that you are betting on the potential of ETF shares to be worth more eventually. It’s important to note that the price of Bitcoin doesn’t necessarily correlate with the price of ETFs.

Bitcoin is not the only asset that trades futures. Some assets that trade futures are gold, coal, oil or grain.

Disclaimer

If you want to invest in ETF, it is important to consider that the crypto industry is relatively new. There’s, therefore, no historical track record to compare to before investing. With this in mind, be sure to invest amounts that you are personally OK with. The money being invested should never be at the expense of other important financial goals such as paying off debt.