The leading supply chain-based cryptocurrency VeChain is currency trading around the $0.045 mark in the charts on Tuesday. It’s up close to 20% in the last 30 days and attracted heavy bullish sentiment when Bitcoin topped a new all-time high of $73,737 this month. VET is among the top-performing cryptocurrencies this year and delivered handsome returns to investors who took an entry position in both January and February.

Also Read: What Will XRP’s Price Be If Bitcoin Hits $150,000 After Halving?

Moreover, VeChain is now cooling down in price after reaching a peak high of $0.050 in mid-March of this month. Cryptocurrency investors are indulging in profit-bookings and initiating sell-offs making its price remain stagnant in the charts.

Can VET replicate its success into April 2024 and deliver the same profits to investors as it did this month? In this article, we will highlight if investing in VeChain cryptocurrency is a good option to consider for April 2024.

Also Read: Bitcoin (BTC) Will Be Much Different In The Next 10 Years

Cryptocurrency: Can VeChain (VET) Deliver Good Returns In April 2024?

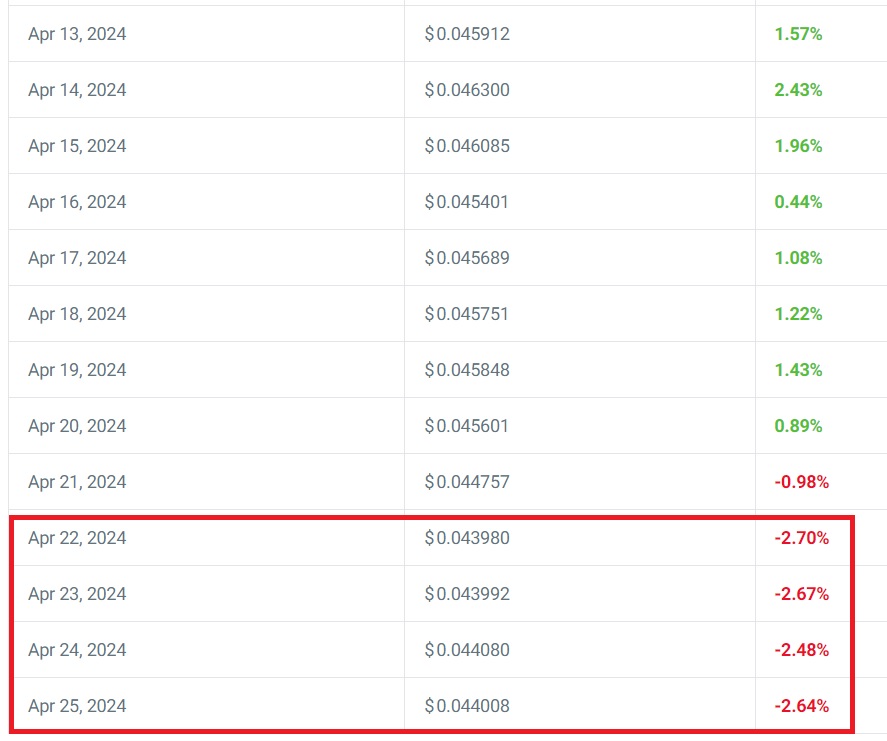

Leading on-chain metrics and price prediction firm CoinCodex remains bearish on VeChain cryptocurrency for April 2024. The price prediction for VET remains sideways with no profits but minimal losses next month. According to the price estimates, VET could deliver 2% to 3% profits by mid-April 2024.

Also Read: Gold Delivered 25% Profits Year-On-Year For 25 Years

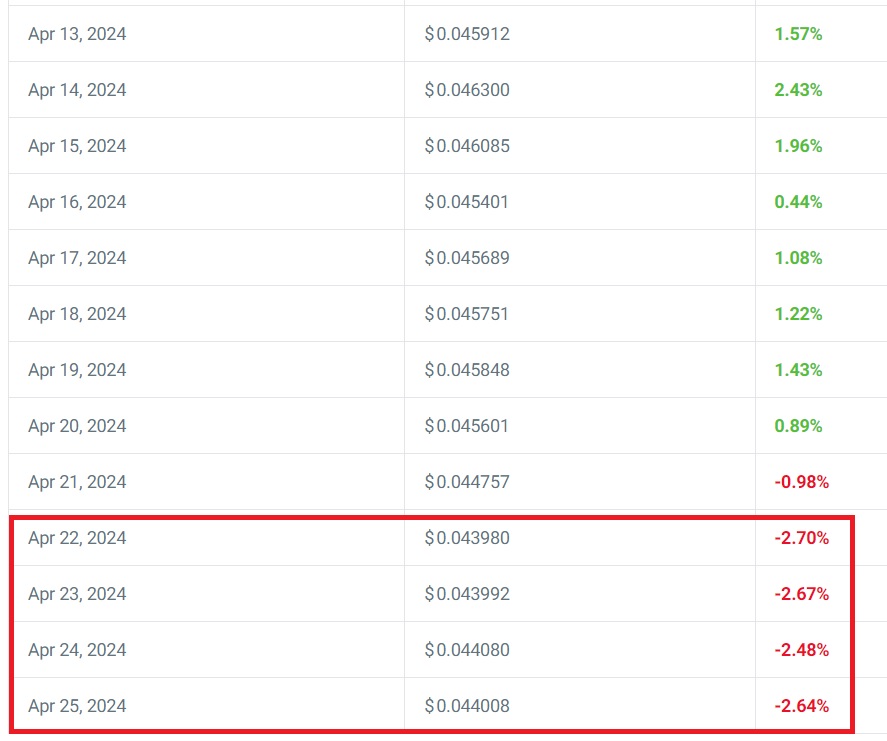

However, the cryptocurrency might shed the gains during the month’s end and fall by 2% to 3% again. Therefore, investors can only break even in VeChain and not enjoy profits next month, according to the forecast. The estimates forecast that VET could briefly fall to $0.044 levels by the month’s end.

In conclusion, it is advised to remain out of VeChain next month as the cryptocurrency might not deliver profits. Do thorough research before taking an entry position into VET currently. The cryptocurrency market is experiencing a downturn and a cool-off in prices after a stellar rise in Q1.