VeChain is hovering around the $0.024 mark on Monday and has been up nearly 11% in the last seven days. VET is slowly yet steadily scaling up in the charts after being in the downturn for almost six months. The leading altcoin saw a relentless dip in Q2 of 2024 but is performing slightly better in Q3 this year.

Also Read: US Dollar in Dangerous Waters: DXY Index Could Fall Below 100

Now that VET remains on the greener side of the spectrum this month, should you invest in it today, wait for the short term, and enjoy profits in September next month?

This article will highlight how high or low VeChain could trade in the charts in September 2024.

VeChain: Buy VET Today to Make Profits in September?

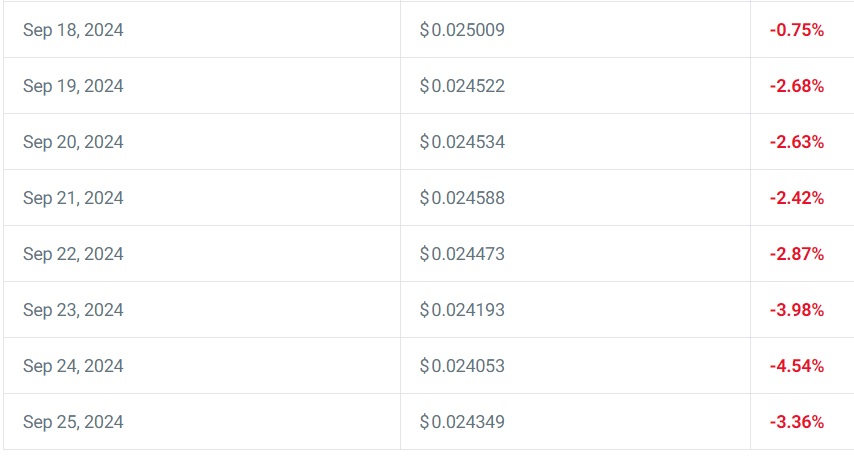

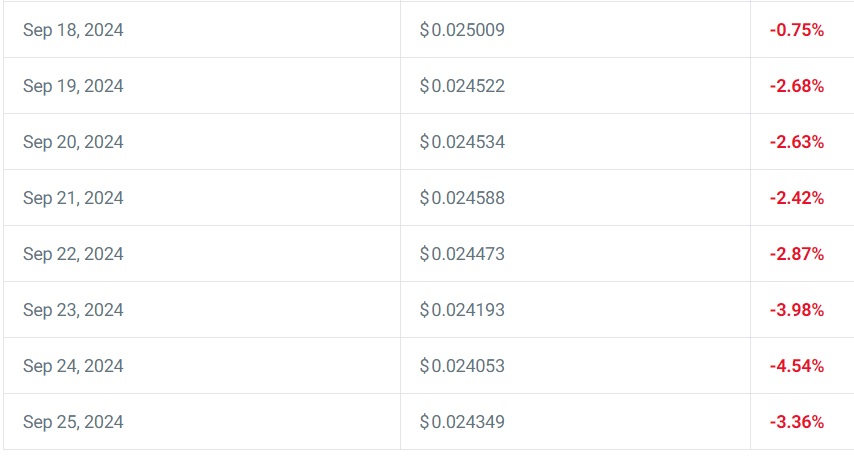

Leading on-chain metrics and price prediction firm CoinCodex painted a rather bearish picture for VeChain in September. According to the price prediction, VET could dip briefly next month leading to losses to investors. All indicators point towards a ‘sell’ option for the cryptocurrency and not ‘buy’.

Also Read: Cardano: ADA Price Prediction For September 2024

The forecast estimates VeChain to dip between 2% to 3.5% next month and remain in the red during the last week of September. Therefore, an investment of $1,000 made today in VET could turn into $960 next month. The short-term holding for the supply-based cryptocurrency is bearish.

Also Read: AI Predicts Tron (TRX) Price For September 1st, 2024

It is advised to stay cautious and not take an entry position into VET today. The altcoin has more chances of a downturn and burning a hole in investors’ wallets. Its 24-hour trading volume is also decreasing, hitting $23.7 million on Monday’s trade.

Only traders who want to invest in VET for the long term can now consider taking an entry position. The forecast estimates that VeChain could rise by nearly 208% in 2030 and reach the price target of $0.07. Long-term investors could consider VET, but short-term holders must avoid cryptocurrency.