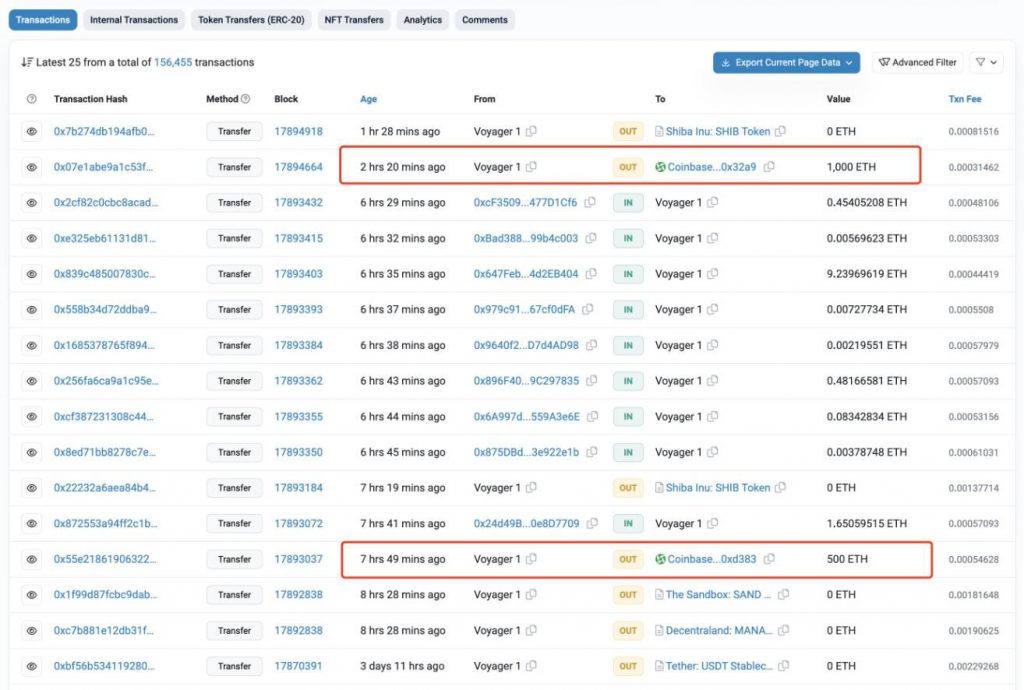

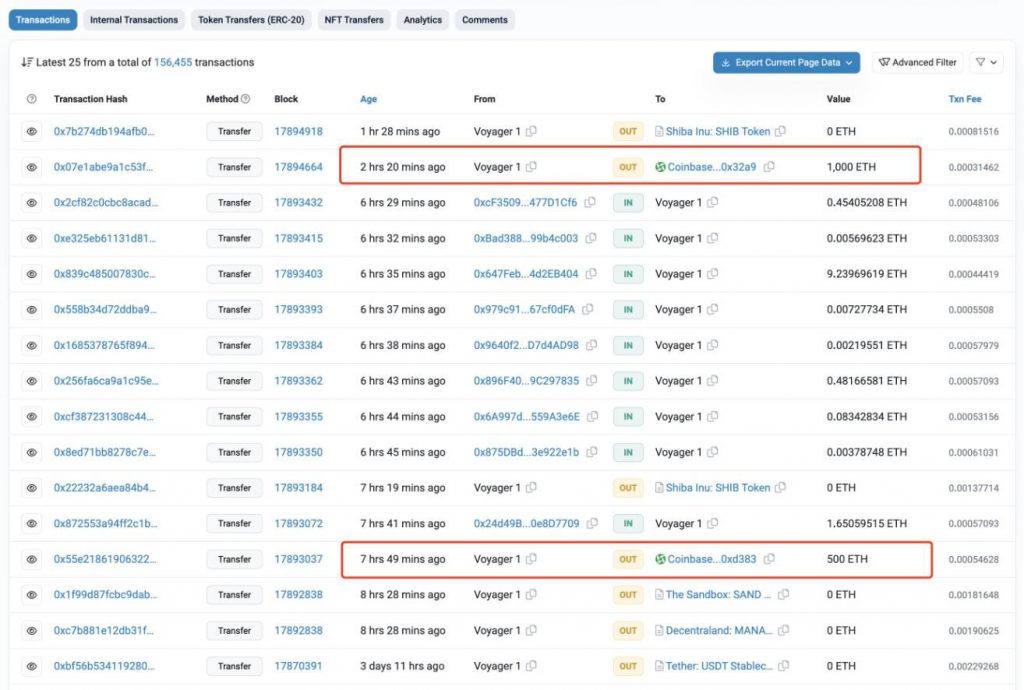

Cryptocurrency lender Voyager Digital, currently facing bankruptcy, initiated significant token transfers to crypto exchange Coinbase on August 11. Notably, the transfer included 1,500 Ether (ETH) valued at around $2.77 million and an additional 250 billion Shiba Inu (SHIB), worth roughly $2.7 million, according to data from Etherscan.

This move has set off speculation within the cryptocurrency community. Some suggest that these transactions might be a precursor to a potential sell-off. This is due to the fact that the transfers have significantly reduced the distressed lender’s digital asset holdings, now standing at $81.63 million.

Also read: SEC Will Not Approve a Spot Bitcoin ETF, Says Former SEC Chief

Voyager’s transfers happened with a one-hour interval

The transfers were executed at a one-hour interval, according to the data. This sudden token movement has triggered discussions about a possible liquidation. However, some insiders have indicated that Voyager could be consolidating its tokens from various addresses into a central address.

The notion of an imminent sell-off gains further traction from Voyager’s ongoing sell-off of its SHIB holdings since the beginning of the year. Back in February, the company conducted sizable transfers of cryptocurrencies, totaling nearly $10 million.

This notable divestment included 270 billion SHIB, valued at $3.2 million, 4.9 million Voyager Tokens (VGX) worth $2.1 million, 3,050 ETH valued at $3 million, and 221,000 Chainlink (LINK) tokens worth $1.5 million. Furthermore, the combined movement of these assets has raised intriguing questions about Voyager’s strategic intentions amid its challenging financial situation.