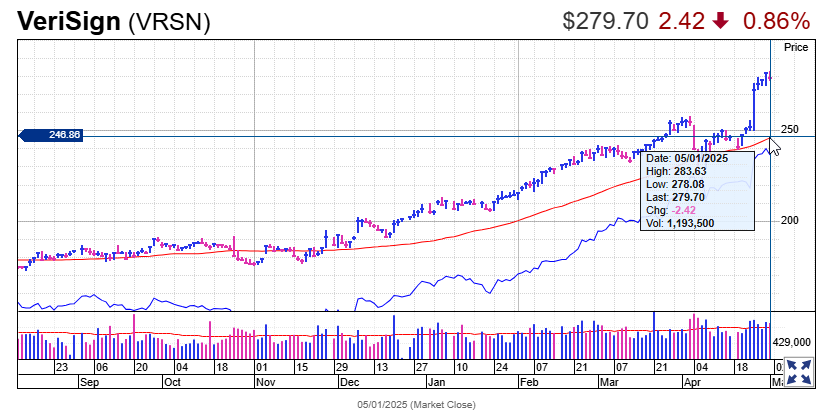

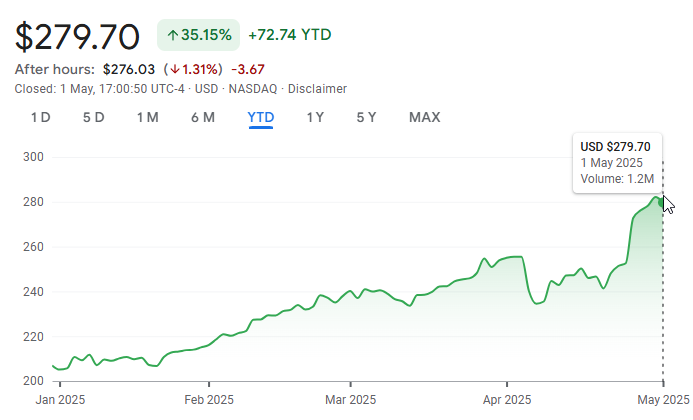

Warren Buffett’s investment strategies continue to really surprise market watchers as, right now, the legendary investor is actually putting his massive cash reserves to work. The Oracle of Omaha and his Berkshire Hathaway portfolio have recently, like just in the past few weeks, expanded with a significant $73 million stake in what many consider an undervalued tech stock that’s part of the S&P 500. Buffett has been quite steadily accumulating shares of VeriSign (VRSN), that internet domain-name registry company that had, until recently, largely underperformed the broader market.

Also Read: Solana vs Litecoin: 5% Drop for SOL & LTC Eyes $200 Resistance

How Berkshire’s S&P 500 Stock Pick Reveals a Smart Tech Strategy

Buffett’s increased interest in VeriSign sort of highlights a strategic shift in his stock market strategy. The regulatory filings, which came out not too long ago, revealed that Berkshire Hathaway purchased about 377,736 shares for approximately $73.95 million over six trading sessions ending December 24.

According to Fortune:

“Berkshire invested $74 million in domain name and internet infrastructure company VeriSign this month.”

VeriSign’s Market Position

VeriSign stock has actually gained some pretty good momentum despite previously underperforming the S&P 500 index. This Warren Buffett investment choice, when you think about it, makes a lot of sense when examining the company’s strong fundamentals. The company, which was basically a top domain registry during the late 1990s internet boom, has created a stable business model that apparently caught Buffett’s attention.

Billy Duberstein of The Motley Fool stated:

“VeriSign operates the authoritative registry for the .com and .net domain names worldwide, and also operates two of the 13 global root servers for the internet.”

Also Read: Cryptocurrency: Top 3 Memecoins Predicted To Rally In May 2025

Buffett’s Growing Tech Position

This Warren Buffett investment marks, like, a significant development in Berkshire Hathaway’s portfolio strategy. Buffett began buying VeriSign in Q1 2024 and has now, at the time of writing, amassed around 13.2 million shares, representing a nearly 14% stake in the company, which actually makes Berkshire the largest shareholder.

Adam Patti, CEO of VistaShares, said:

“It’s a really well-balanced portfolio chosen by the most successful investor the world has ever seen.”

Analyst Outlook on this S&P 500 Stock

The undervalued tech stock has, in recent months, garnered some pretty positive analyst sentiment. Citi analysts have projected strong performance for VeriSign in 2025:

“Citi analysts have projected a promising 2025 for VeriSign, setting a $238 price target, which indicates a potential upside of 16% from the current levels.”

Also Read: Dogecoin Is Breaking Out Of Its Meme Coin Status, Here’s Why

The Warren Buffett Investment Signal

Buffett’s substantial investment in VeriSign sends, like, a really strong signal about this undervalued tech stock from the S&P 500. With Berkshire Hathaway’s cash reserves exceeding $300 billion right now, every Warren Buffett investment decision is closely watched by investors and analysts alike. The domain registry business provides the stability and competitive advantage that aligns with Berkshire’s long-term stock market strategy.