Cryptocurrency whales are making a beeline for leading altcoins such as Cardano (ADA), The Sandbox (SAND), and Decentraland (MANA). On-chain metrics and analytical firm Santiment highlighted the surge, saying that whales have shown “major interest” in Cardano this month.

“Don’t mind the five-day anomaly gap in data for Cardano. Just take a look at what the asset has done since February. Clearly, a huge spike indicating some major interest from whales at this level,” wrote Santiment.

Also Read: VeChain Price Prediction: How High Can It Go In 2023?

However, despite the spike in whale activity, ADA has mostly remained on the back foot in February 2023. The cryptocurrency is trading sideways, with no spurt in price in the last two weeks.

Also Read: Reddit Co-Founder Purchased 50,000 Ethereum in 2014

After Cardano, Cryptocurrency Whales Enter Sandbox & Decentraland

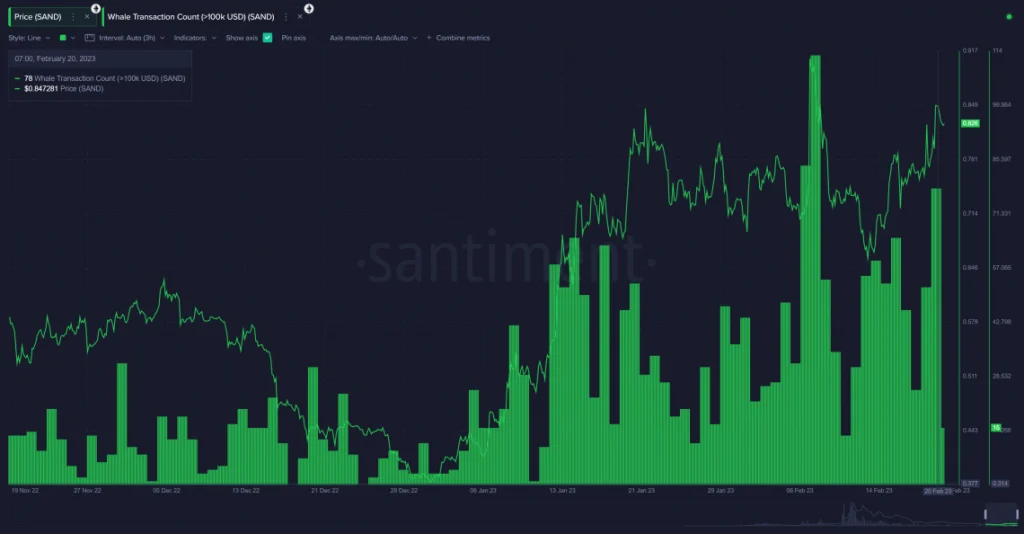

The leading metaverse altcoin The Sandbox saw a sudden surge in February for the first time in the last three months. SAND saw a surge in price until mid-February but is now dipping due to sell-offs and profit bookings. “Yesterday was the third highest whale spike in the past 3 months,” reported Santiment.

Also Read: 1.1 Million: Arbitrum Eclipses Ethereum on Daily Transactions

SAND’s price action “increases the probability of at least a short-term correction,” wrote the on-chain metrics firm. Its price is slipping on Wednesday and is down nearly 7% in the day’s trade.

In addition, Decentraland is also experiencing large whale transactions this month. One notable whale moved 256.31 million MANA tokens to an unknown wallet address. The tokens were worth a staggering $190.2 million.

“Decentraland had one of its largest transactions of all time on its network today, with 256.31 million MANA moved out of a known whale address. This move was worth $190.2 million. Typically, these massive transactions foreshadow price swings in a new direction,” wrote Santiment.

Also Read: Bitcoin To Reach $50,000 by May 2023? ‘Numbers Could Get Big Fast’

At press time, MANA was trading at $0.68 and was down 4.5% in the 24-hour day trade.