Bullish and Bearish are two extremely defined market conditions. 18th April was a bit of both for Bitcoin. While the largest digital asset dropped down to a monthly low of $38,560, it registered a late rebound above $40,000. Currently consolidating above the latter range, this is the 4th time in the past 30-days, that BTC has clawed back above $40,000.

While optimism is a regularly consumed pill by Bitcoin supporters, let us analyze some fundamental indicators to justify its current market position.

Bitcoin had some ‘particular’ supports

Before its collapse, Bitcoin registered a massive exchange outflow of $1.3 billion on Coinbase. Speculations highlighted institutional involvement, and it did assist in reducing sell pressure.

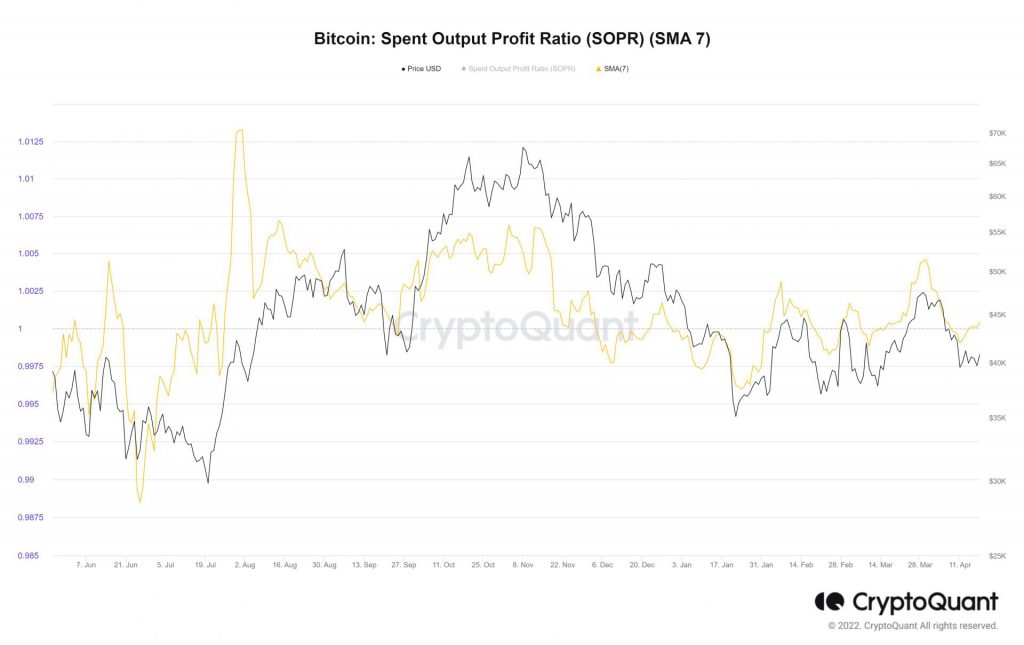

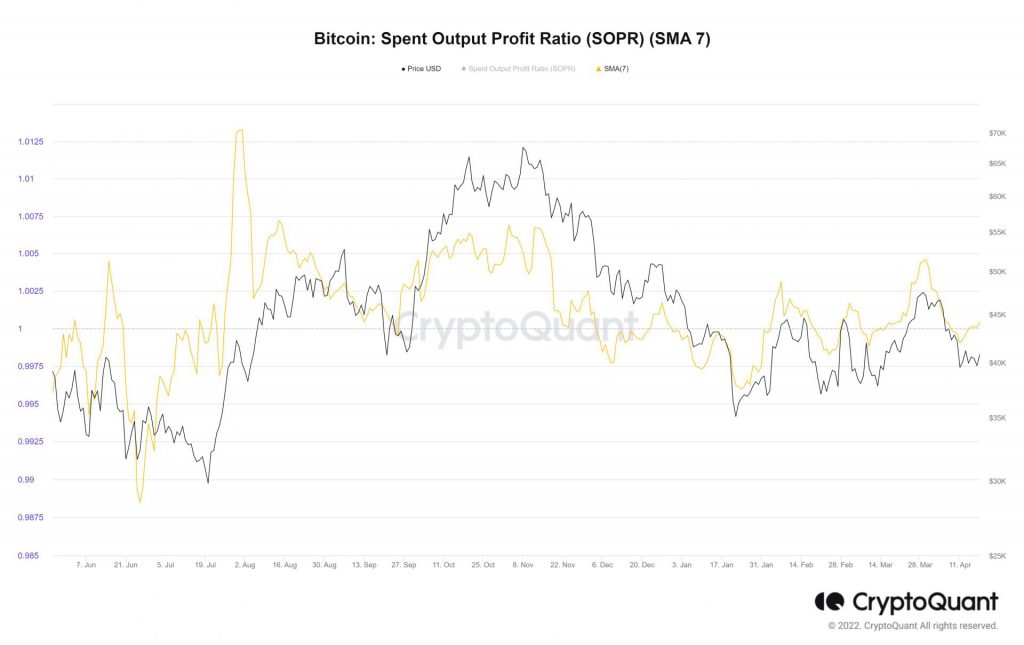

As observed in the above chart, collective exchange outflows were met with decreasing seller ratio during Bitcoin’s recovery. Basic order book flow and historical support at $40,000, kept BTC above the range. Now, while this particular metric might have been triggered, BTC SOPR might be undergoing a reversal.

According to the chart above, whenever SOPR has managed to remain above 1, during a price drop, the possibility of a market bottom increases. Spent Output Profit Ratio reached a yearly low of 0.995 on 25th January 2022, but since then, it was formidably recovered making higher peaks in the chart. Continued consolidation above $40,000 only improves this sentiment and it may lead to sustained recovery as well.

Is this too Optimistic?

Technically, the above reasoning has valid and historical data points. Yet, Bitcoin is hardly repetitive during a major volatility period.

At the moment, Bitcoin has managed to break past the recent monthly downtrend as highlighted in the chart. A close above the 0.5 Fibonacci resistance is also a positive. However, the bullish narrative is weakening for Bitcoin. The larger market structure is still bearish but unlike certain meme tokens, BTC is not relying on the community’s faith. Investors should continue to follow fundamentals and coin movement, to decipher the next direction for the largest digital asset.