Amidst the rising “Solana Killer” in the market, Solana (SOL) witnessed a massive drop. Earlier today, SOL was trading at a high of $135, but this didn’t last long as the altcoin dipped to a low of $130. At press time, SOL was trading at $130.70, with a 1.23% decline in the past 24 hours. This is certainly a slight uptick from Monday’s low of $129.

Also Read: Central Banks to Slash Rates: Bitcoin to Explode to $100K?

Factors Influencing Solana’s Price Surge

Community Optimism And Analyst Predictions

Despite this, the community remains optimistic about the altcoin. An analyst who goes by Joji revealed that $500 was on the cards for Solana sooner than later. According to a recent post, SOL is inching closer to a breakout. Following this, the asset could surge by a staggering 379%. The analyst predicted a future price spike by pointing to an accumulation period in Solana’s historical price chart.

SOL surged 884% from a comparable position during the bull run in 2021, and Joji pointed out that this cycle will repeat. The asset saw an uptick from a similar price level in August 2021 to its November high of $260. Currently, SOL is 49% below this peak.

Also Read: How High Can Binance Coin Surge After CZ Is Released?

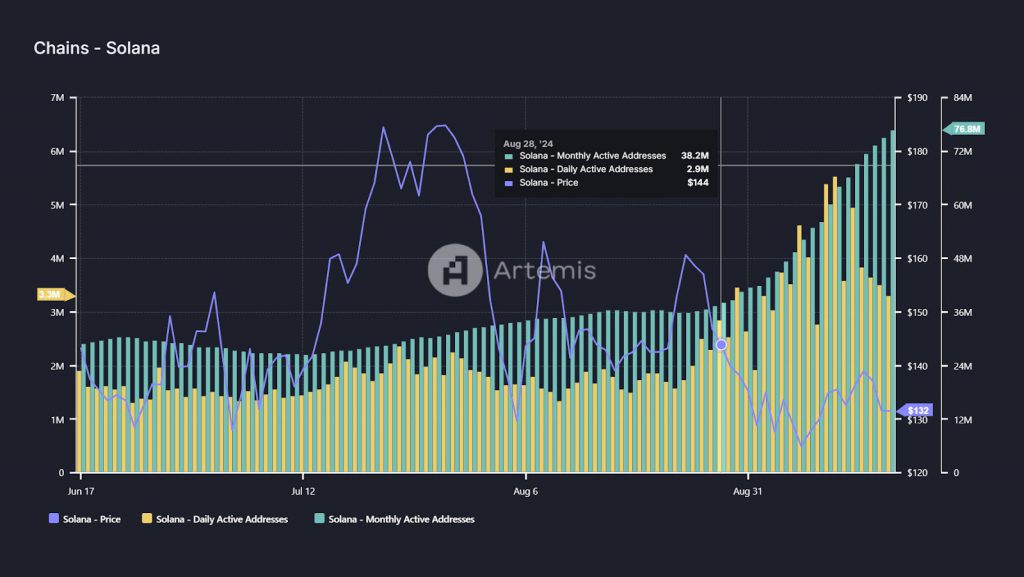

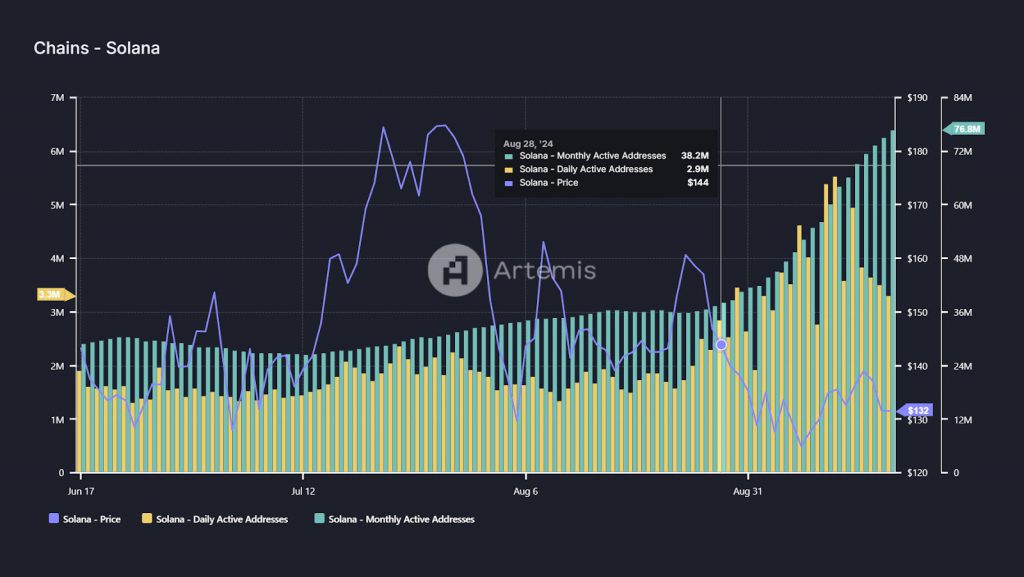

Solana Witnesses Major Spike in Active Addresses

According to data from Artemis, Solana’s monthly active addresses have risen to an all-time high. This sign, which has been steadily rising since the beginning of the year, is usually bullish. Currently, there are over 76 million of these addresses, which further highlights a prominent increase from 42 million on September 1.

Additional Factors Impacting Solana’s Price

Multiple factors will impact Solana’s potential surge to $500. The rise in active addresses will certainly aid the altcoin’s growth. In addition, the overall market cap, regulatory climate, and network activity could impact SOL’s price trajectory.

Also Read: De-Dollarization: JP Morgan Explains The Major Threat To the US Dollar