Stablecoins entered the market for those who wanted steadiness while being able to explore the digital world. However, the whole meaning of these assets was questioned following TerraUSD’s [UST] descent.

Let’s rewind a bit. How do stablecoins remain sturdy? These assets are backed by or pegged to an underlying asset. An array of popular stablecoins are pegged to the US dollar or to something that remains stable, unlike the volatile crypto market. Therefore, the price of these assets is eternally formulated to stay at $1. UST, on the other hand, was backed by LUNA, another native cryptocurrency of Terra. A fancier name for this asset is “algorithmic stablecoin.”

But what’s the difference? In UST’s case, LUNA did not entail external real value like fiat or commodities like gold. In order to maintain the stability of both assets, the moment Terra plummets below $1 it could be exchanged for LUNA. If the asset surged over the same zone, then investors would swoop in and use LUNA to buy UST and sell it on other platforms.

This seems like a different way of approaching stablecoins. Yet the absence of real-world collateral made it rather difficult for the community to view TerraUSD as a stablecoin.

What went wrong?

It all summed down to an anonymous whale that dumped UST worth a whopping $285 million. This whale movement occurred between 7 and 8 May 2022 on Binance and Curve applications. The bubble had slowly begun to burst. Soon after this movement, the 1:1 USD peg was disrupted. Following this, everything went downhill.

UST, bidding adieu to its $1 peg, dropped to $0.98. This was just the beginning of an earthward whirlwind.

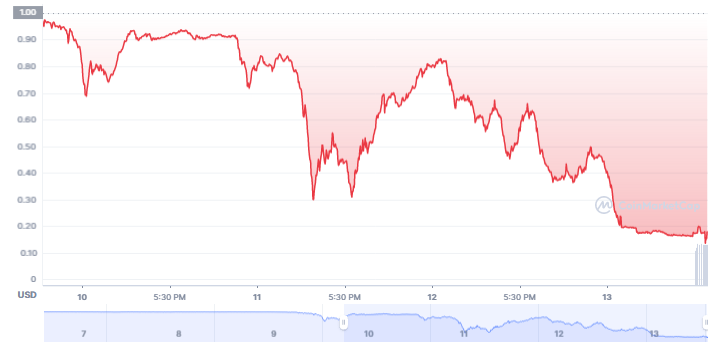

The above chart depicts the stability of Terra’s stablecoin. At press time, UST’s value was at a low of $0.164 following a 73.57% price drop.

Just as the entire community began panicking, Citadel and BlackRock were being dragged into the mess. Several alleged that these platforms had borrowed 100,000 BTC from Gemini in order to convert it into UST, only to dump it. However, both the firms as well as Gemini brushed off all these rumors.

Why did LUNA lose balance?

As mentioned previously, LUNA is the underlying asset of the UST. As a result, LUNA was being extensively minted with an increased amount of UST being sold. This further caused a surge in the volume of the altcoin.

Fear was induced among LUNA holders. With most of them, panic selling the asset and the fact that there were no buyers pushed the price of LUNA down to the ground. Similar to UST, LUNA endured a major drop. The altcoin nosedived from a high of $77.49 to a low of $0.00004319, at press time. The asset was close to demise as it was witnessing a daily drop of 99%.

Labeling the entire crash a “death spiral” the community awaited amends from the Terraform Labs as well as the creator of the project Do Kwon.

How effective was Do Kwon’s UST “recovery plan”?

There was absolute radio silence for hours after Kwon hinted at a rescue mission. At the same time, acknowledging the fact that the previous 72 hours were “extremely tough” he decided to let the world in on his plan. Kwon’s plan required the extensive minting of LUNA on a daily basis. He affirmed that this was the only way forward. He added,

“Before anything else, the only path forward will be to absorb the stablecoin supply that wants to exit before $UST can start to repeg. There is no way around it.”

Along with his plan, several platforms came forward and extended support for the diminishing project. Anchor Protocol carries out the majority of the UST staking and borrowing. As a result, the firm pitched the idea of lowering the minimum interest rates to 3.5% while pushing the maximum deposit rates to 5.5%.

With this change, the platform intended to temporarily prevent the Anchor reserve from diminishing, allowing TFL to avoid deploying further UST and therefore halting the de-peg death spiral.

Sadly none of these seemed to make a difference to the price of the depleting assets.

This wasn’t all. An asset manager listed on the SIX Swiss Exchange, GAM Holding arrived as Terra’s savior. The platform reportedly still sees potential in the project and is even willing to pour in $2 to $3 billion to aid Kwon’s plan.

Red Light – Green Light – Red Light? What was Terra trying to do?

Recently, the Terra blockchain confirmed that it had officially halted at a block height of 7603700.

Following this, the validators resumed the blockchain. However, it was once again stopped at block 7607789. This time, the validators revealed that they were working on a place that would reconstitute the blockchain.

TerraUSD: The aftermath of the bloody crash

As predicted several exchanged dropped support for Terra’s native assets. Binance has been time and again disabling and adding support to the altcoin following the stability of the network. While withdrawals and deposits were temporarily suspended, Binance Liquid Swap shut its door to Terra liquidity pools and disabled its swap function.

Crypto.com, Bybit, CoinSwitch, as well as OKX either temporarily suspended LUNA and UST or delisted them.

Suicide attempts, homelessness, poverty, UST’s decline, and its repercussions

Band-aids don’t fix bullet holes, the community says. While the latest crash might not have made a difference to some, a multitude of people has revealed that they have lost everything.

The crypto market is undoubtedly a risky place to pour all your money into. However, with proper distribution of assets and DYOR, surviving crashes wouldn’t seem so hard. But, several individuals seemed to have put a significant amount of money into LUNA. A Reddit forum took the front stage as an array of them went on to share their condition post the crash.

An increased number of people who were suicidal began flooding the forum. As a result, a post that entailed details pertaining to the National helpline was pinned in the forum.

One Reddit user shed light on how his colleague had tried to commit suicide as he moved all of his savings into crypto back in 2021. The worst part was that he had most of his money in LUNA. Another user wrote,

“I lost over 450k USD, I cannot pay the bank. I will lose my home soon. I’ll be homeless. suicide is the only way out for me.”

As posts like this began surging, the community grew furious at Kwon. Older Twitter posts about Kwon calling people poor began surfacing. While several suggested that Kwon deserved the demise of LUNA and UST, the investors are the ones that are most affected.

The government now has eyes on the crypto-verse

The crypto-verse has fought long and hard to get in the good books of the government. While governments across the globe have still not entirely embraced crypto, they seemed to have warmed up a little to the industry. However, with the latest crash and loss that was attached to it, the industry was back under the radar of the regulators.

US Treasury Secretary Janet Yellen addressed the situation and suggested that this was a “rapidly growing product” which poses a risk to financial stability. She further pointed out the need for a framework that was appropriate.

While the fate of TerraUSD as well as LUNA remains uncertain, the network seemed to be bullish about its recovery plan. But the question here is, who would go back and trust the network?