While Binance Coin had done well to record its mid-May gaining spree, the bullish bias swiftly faded away on Thursday after the price broke below a rising wedge. Investors need to be wary over the next 24-48 hours and hedge their risks by making short calls below $300.

A regular crypto investor would likely be familiar with Binance Coin’s recent progress. Its price has recovered steadily since 11-12 May, becoming the only altcoin to flash a positive weekly return on investment.

Now, at first glance, one would assume that BNB had started to look bullish on the daily chart. The price had formed higher highs and higher lows while the RSI was aboard a steady uptrend – a sign that bulls were commandeering the market.

However, Thursday’s retracement indicated that a bullish outlook was rather premature. The candles had breached below a rising wedge pattern and were dangerously close to closing below the daily 20-SMA (red). This breakdown coincided with an RSI rejection at 50. All in all, the developments indicated that bears were still very much in command of the BNB market.

So if BNB does manage to close below its 20-SMA (red), what’s going to happen next? Well, looking at recent exchange volumes, the sell-off could be devastating for BNB holders.

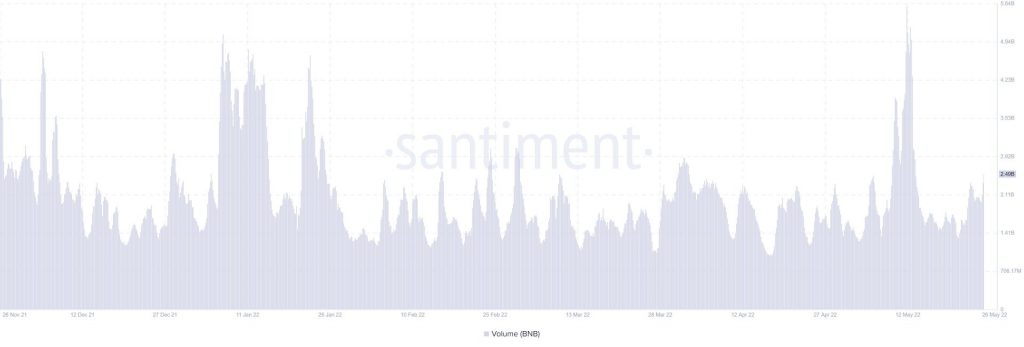

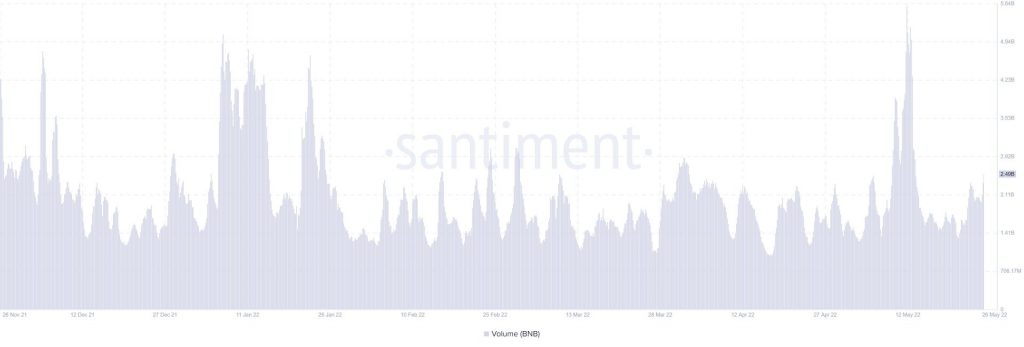

According to Santiment, exchange volumes have been on the higher end since 21 May. Unfortunately, trading volumes can turn out to be a double-edged sword – during a breakdown, high volumes can trigger an even sharper price decline and vice-versa during a breakout.

Furthermore, the breakdown could force holders who participated in BNB’s rally to cash out and avoid taking a loss on their investment.

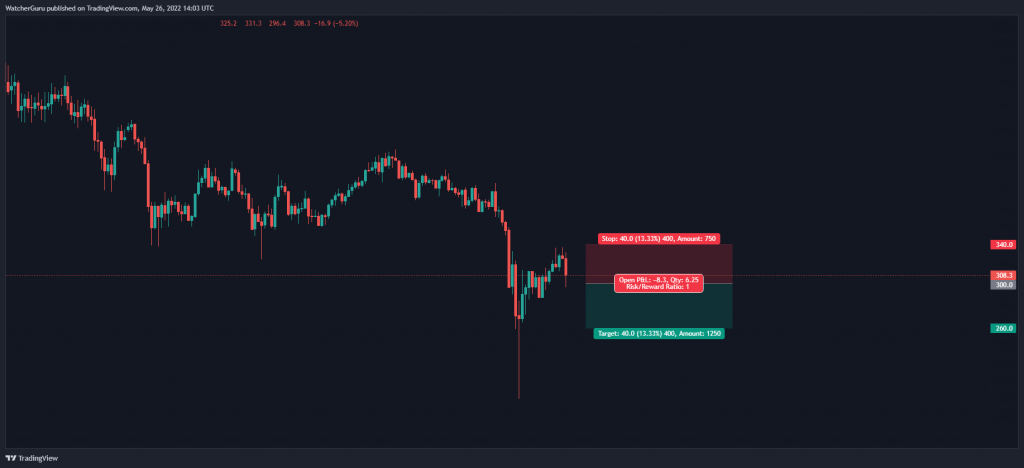

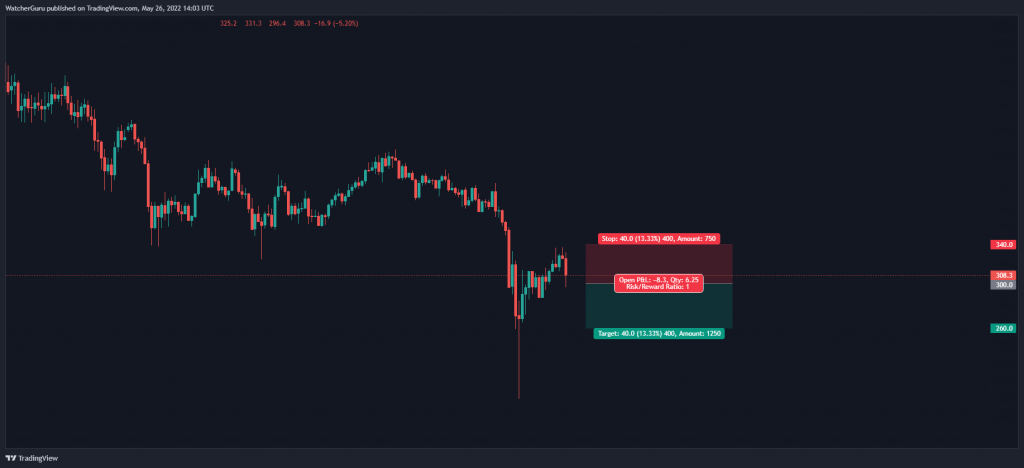

Binance Coin trade setup

Those who are actively trading BNB should be cautious of a further decline over the short term. A close below the 78.6% Fibonacci level (calculated through BNB’s drop from $333 to $207) could extend to a 32% decline, especially if BNB is unable to cut losses between the 61.8% and 50% Fibonacci levels.

To capitalize on this weakness, traders can set up short calls below $300 and cash out at $260. A stop-loss can be kept at $340, above the upper trendline. The trade setup carried a risk/reward ratio of 1.