After a consolidating period that lasted 3 weeks, Bitcoin finally breached above its $64,000 resistance. At the moment, the digital asset is valued at $65,950. The market rejoiced over its bullish move but the worst might not be over for Bitcoin. Its positive breakout took over the weekend, and it led to the creation of a CME gap. In this article, we will analyze the importance of a CME gap, and how it may affect BTC’s value going forward.

What is a Bitcoin CME gap?

A Bitcoin CME gap is the difference between the trading price of a CME Bitcoin futures contract when the market opens on Sunday, and when it closes on Friday. Bitcoin spot prices are traded on a 24×7 window while CME futures have a limited trading period. A similar situation occurred over the past 24-hours.

Bitcoin breached above the $64,000 resistance when the CME market was closed but spot prices increased in the charts.

As illustrated in the charts, a CME gap is currently present between $61,605 and $62905, which is roughly $1300. Now, the question is why does it matter?

According to statistics, due to institutional trading, 77% of these CME gaps are often filled in the market. This means the market covers the spread in the charts. A CME gap was created on 26th October as well, which was filled immediately the following day. Yet, similar to every market condition, CME gaps are also not completely accurate. A CME gap currently exists between $31,500 and $34,300 which was created on 25th July 2021, and it is yet to be filled.

Why is it important to track the CME gap right now?

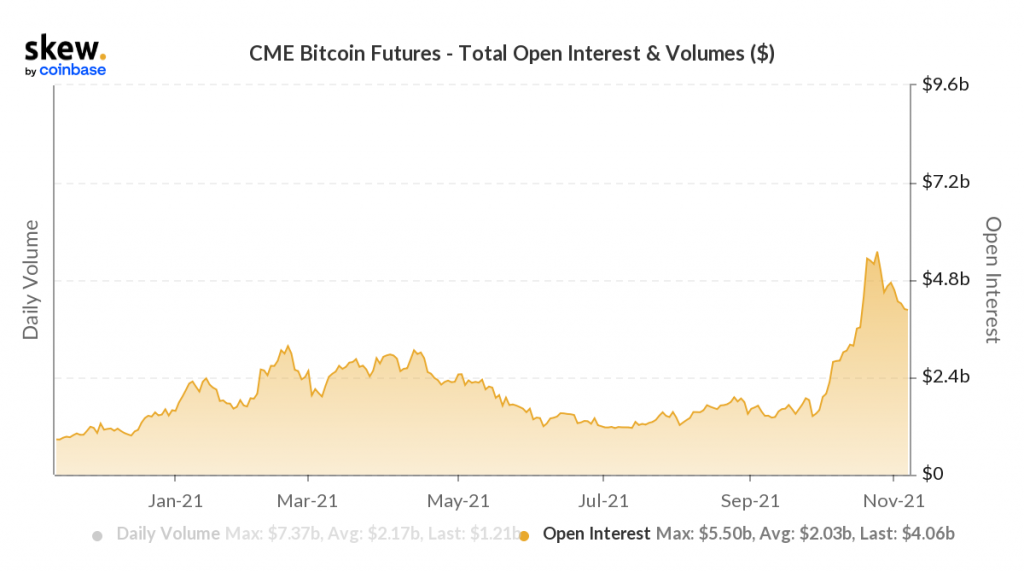

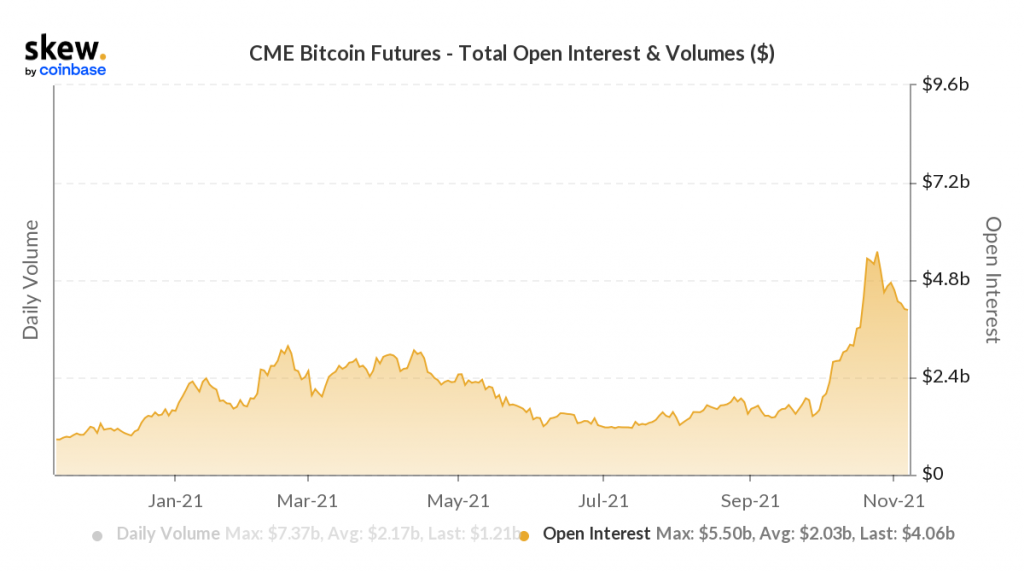

CME Bitcoin futures has attracted a lot of market activity recently. The first Bitcoin ETF, ProShares also buys their futures contracts on CME, and presently the Open-Interest on CME is $4 billion. It means $4 billion worth of Bitcoin contracts is currently trading on the exchange.

Hence, it increases the likelihood of BTC dropping down to $61600 at least yet again. It is important to note that Bitcoin could record a new all-time high before the gap is filled, as these gaps remained unfilled for months. However, traders who may have missed the $60,000 re-test, could wait till $61,600 for re-entry at a lower valuation.