Cryptocurrencies come with their own pros and cons. People from one extreme end of the spectrum adore it and tend to only look at the positives, while people from the other side keep pinpointing out all the fallacies associated with this comparatively novel digital monetary variant.

Boomers and their crypto aversion

Consumer Affairs recently surveyed 1,074 adults from a range of generations and educational backgrounds to discover how most Americans viewed their financial decisions. “Crypto” was one of the most regretted financial decisions, especially for the older generations. Often referred to as “Boomers,” this group of people felt remorse about investing in this still-developing assets class.

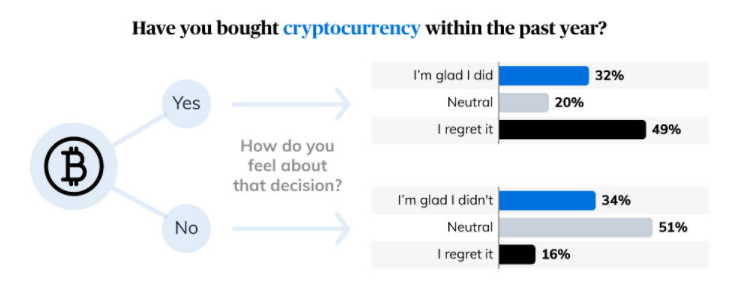

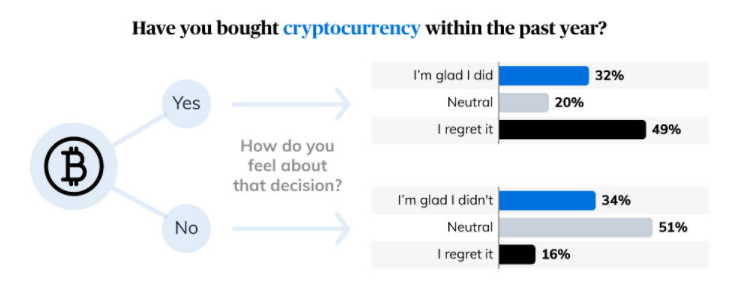

Over the past year, almost half [49%] of the respondents regretted buying cryptos. Only less than one-third of them [32%] were “glad” doing so, while the remaining 20% remained neutral.

On the other hand, 34% of the respondents who did not buy cryptos over the past year were “glad” they didn’t and merely 16% of them were upset about it. The remaining half remained neutral about their choice.

Well, the said numbers do not come as a surprise because the market has been in a dreary state since November last year and most top-coins have not fetched investors with handsome returns.

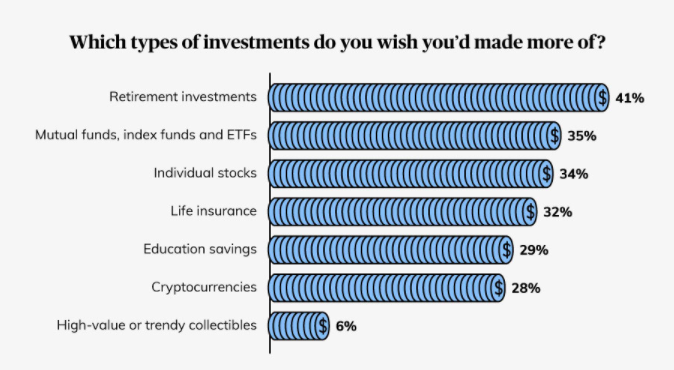

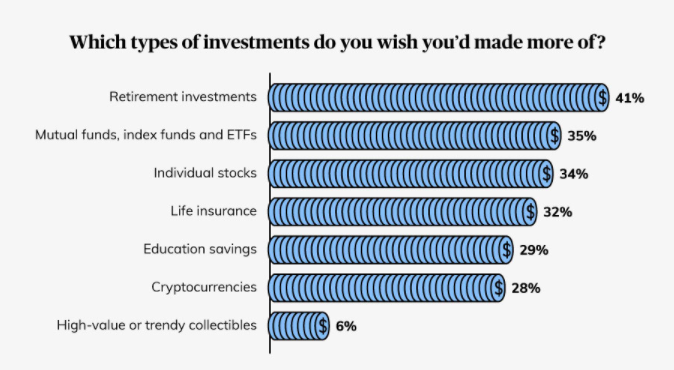

Close to 28% of them, however, wished that they had diverted more funds into crypto much earlier. Fair, to a large extent because a majority of investors who bough cryptos right after last year’s May flash crash are currently in profits, despite the market conditions not being favorable at the moment.

Trendy collectible HODLers, including that NFTs, recorded similar results, with 46% of the buyers regretting their purchase v. 40% of non-buyers saying they were glad that they didn’t invest. The study claimed,

“Cryptocurrency and unique collectibles became hot investment opportunities during the COVID-19 pandemic. But, as we know, what goes up must come down, and what’s hot one week can be cold the next.”