Tech stocks to buy are, at the time of writing, presenting some exceptional opportunities as the Nasdaq continues to navigate through correction territory. With several of the so-called “Magnificent Seven” tech giants leading the recent market declines, investors are finding what might be considered attractive entry points for companies with strong AI capabilities and promising growth prospects.

Also Read: A “Concerning” Future: World Economic Forum Predicts The Fate Of US Dollar

Top Tech Stocks to Buy in 2025 for Explosive Growth and Market Dominance

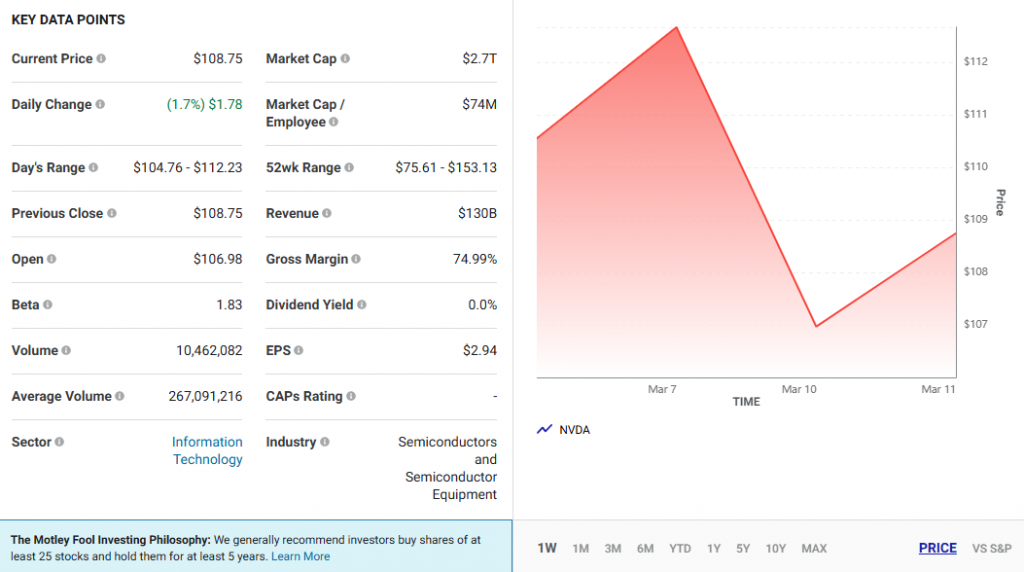

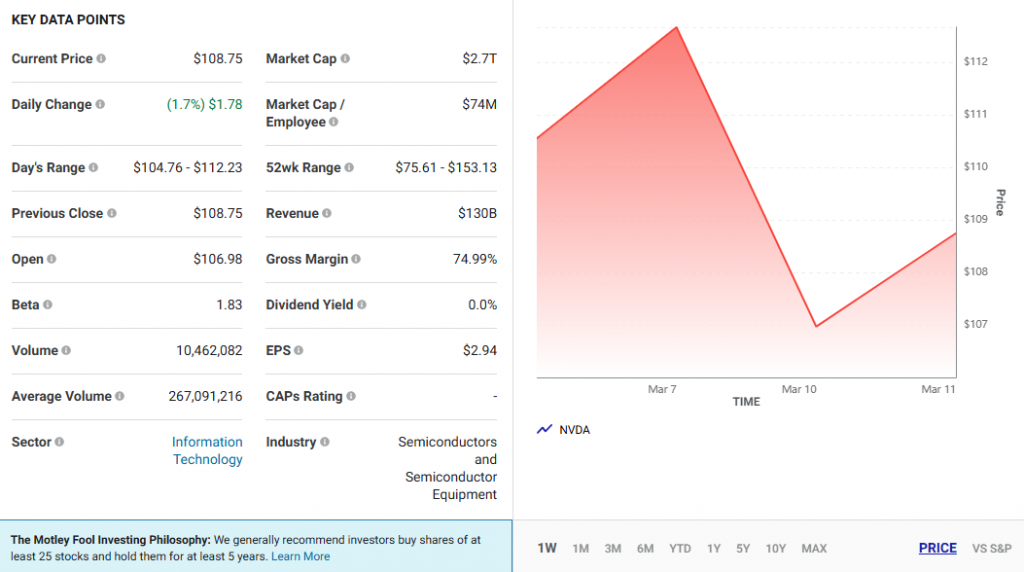

1. Nvidia (NVDA): The Undisputed AI Champion

Nvidia stands as probably the premier tech stock to buy right now in the AI sector. As of March 2025, it’s trading around $108.75, and is showing some resilience with a 1.66% daily gain despite all the broader market volatility we’re seeing these days.

Nvidia’s competitive advantage stems from its innovative CUDA software platform, which essentially transformed gaming GPUs into AI computing powerhouses years before competitors could even begin to respond. And AI infrastructure spending continues to increase, with major cloud companies expected to invest well over $250 billion in various AI-related expenditures this year alone.

From a valuation perspective, these tech stocks to buy are currently trading at what many analysts consider compelling levels. Nvidia shares have a forward P/E ratio below 24 times 2025 estimates and also a PEG ratio under 0.5, which is generally considered to be in undervalued territory.

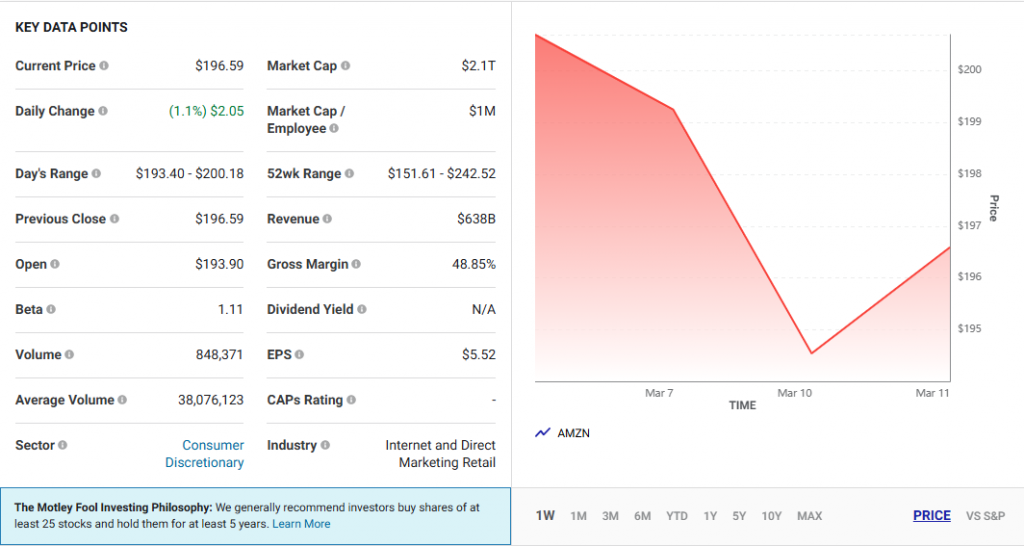

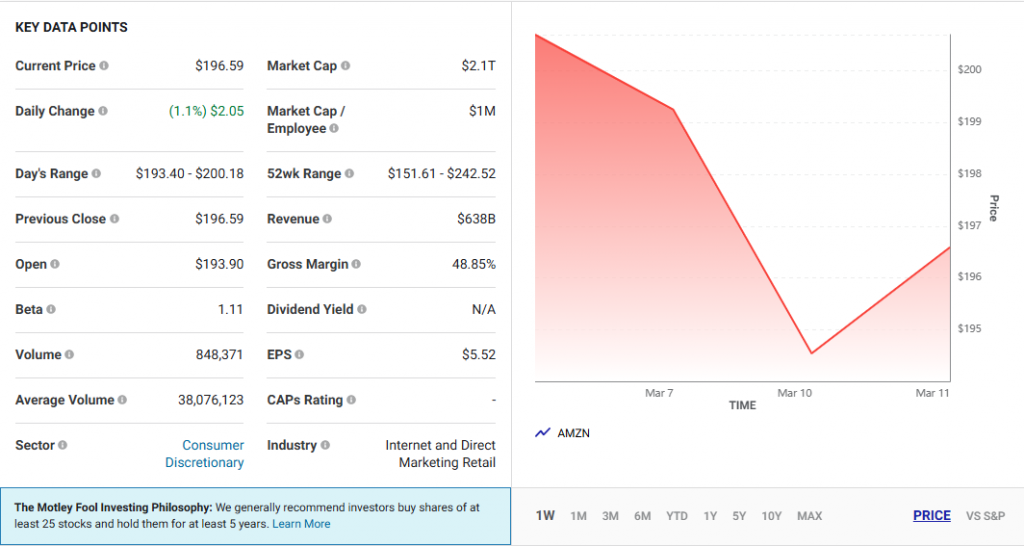

2. Amazon (AMZN): Cloud Giant Doubling Down on AI

Amazon represents another prime tech stock to buy for 2025, currently trading at approximately $196.59. AWS has definitely emerged as Amazon’s fastest-growing segment, with revenue increasing by around 19% in the most recent quarter.

Geoffrey Seiler from Motley Fool stated:

Amazon has a history of spending big to win big and it’s no exception with AI.

Also Read: Lummis Proposes 1 Million US Bitcoin Reserve & MetaPlanet Acquires 162 BTC—What’s Next?

Yahoo Finance analysts also noted:

Trading 20% beneath its 52-week high of $242 a share, Amazon’s stock hasn’t been immune to recent market volatility but investor sentiment had been high for AMZN before the surge in economic uncertainties. To that point, Amazon reported record revenue of $637.96 billion last year, with its top line projected to increase over 9% in fiscal 2025 and FY26. Edging toward annual sales of over $700 billion, Amazon’s market dominance as the leading e-commerce and cloud provider (AWS) is even more appealing thanks to the company’s AI initiatives.

The company plans to invest about $100 billion in various AI infrastructure projects this year. Their development of custom AI chips after licensing technology from Marvell gives Amazon a significant cost advantage. At a forward P/E ratio of about 31, Amazon is trading at one of its lowest valuations in years, making it an interesting tech stock to buy.

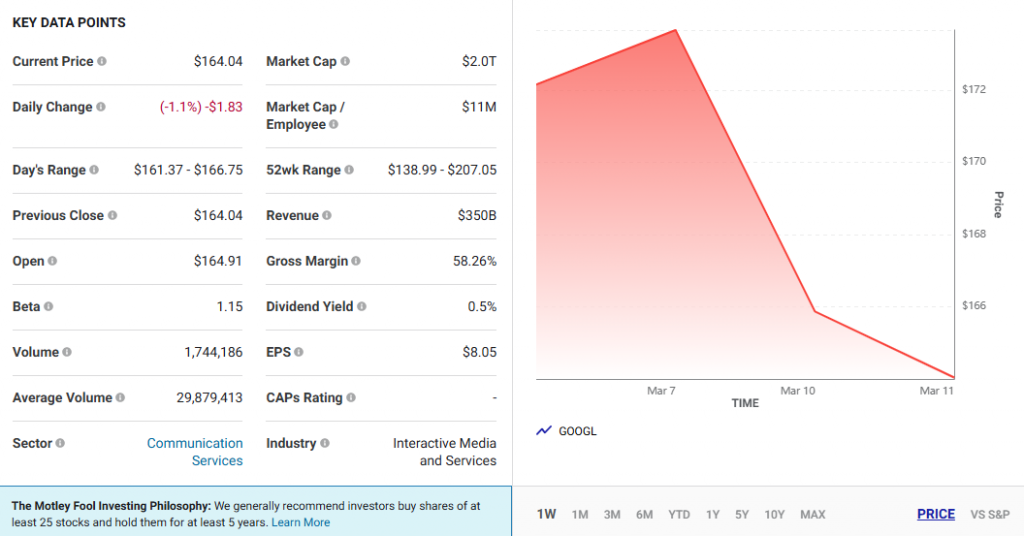

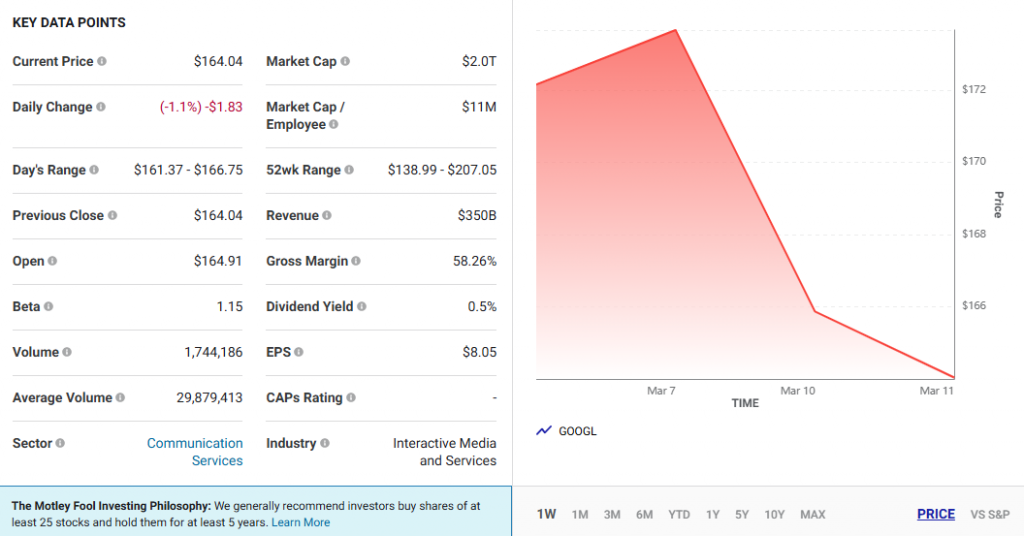

3. Alphabet (GOOGL): Diverse Tech Portfolio at a Discount

Alphabet completes our list of tech stocks to buy with exceptional potential. Currently trading around $164.04, Google’s parent company recently reached an important profitability milestone with its cloud business.

In Q4 2024, Google Cloud revenue jumped 30% while operating income surged by an impressive 142%. Like other tech stocks to buy on this list, Alphabet has also developed custom AI chips to improve performance and reduce costs.

Motley Fool analysts emphasized:

Alphabet is a digital advertising juggernaut. Google search is the leading digital advertising platform in the world by revenue, while Alphabet’s YouTube streaming platform is the most watched video platform and the world’s fourth-largest digital advertising platform. Trading at a forward P/E of only 18.5, Alphabet stock is in the bargain bin.

AI represents a major opportunity, with Alphabet actively using it to enhance search results through what they call “AI overviews.” And with the company historically serving ads on only about 20% of search queries, there’s substantial potential for new monetization strategies.

Also Read: Rumble Buys $17M in Bitcoin as Part of New Treasury Strategy

The recent Nasdaq correction has created some truly compelling buying opportunities in these tech stocks to buy. Nvidia, Amazon, and Alphabet stand out due to their strong competitive positions, substantial AI investments, and relatively modest valuations compared to their growth potential.

With inflation showing signs of cooling and potential Federal Reserve rate cuts possibly on the horizon, these tech giants are exceptionally well-positioned to benefit from the ongoing AI revolution that is rapidly transforming industries worldwide.