Riding the favorable tide set by Bitcoin, mid-cap alt WAVES was creating a stir in the market. While some could argue that its recent spike was a long-time coming, certain metrics revealed that more effort would be needed to shake off a bearish bias.

Helped by a risk-on broader market, WAVES climbed up a few notches on the crypto ladder and held the 55th position at press time. A green candle reflected gains of 7% on Thursday following a massive 29% spike yesterday. Combined, these gains were the highest WAVES has made in over 3 months.

Now, it’s certainly curious to see why WAVES saw such a drastic price increase after it shed 80% of its value during a month-long downtrend in April. Well, for one, its price bottomed out at $11.8 on 3 May – an area which was extremely important for price rebounds. During the same time last year, WAVES bunkered at the aforementioned support and recorded three major spikes, each over 60%.

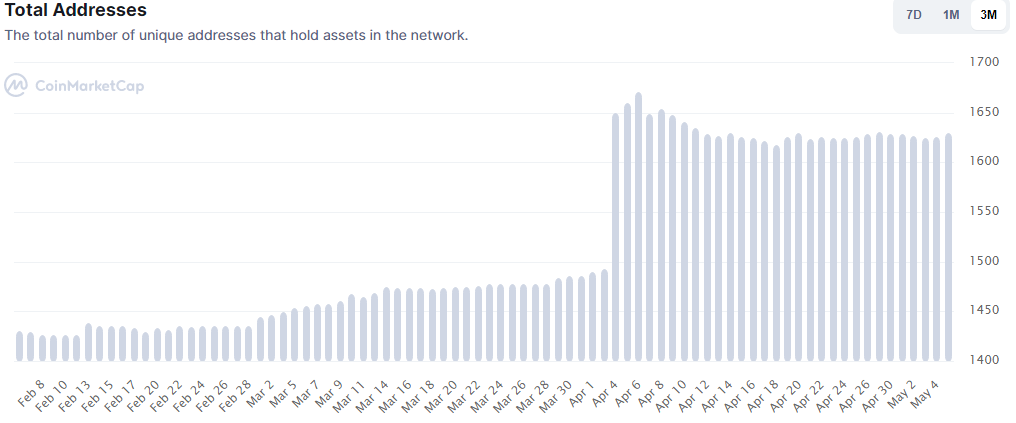

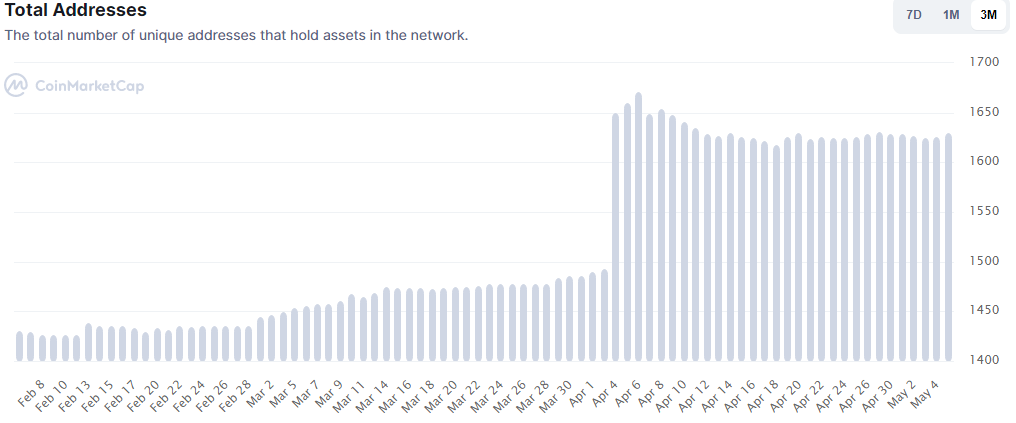

Secondly, the native stablecoin Neutrino, which is widely considered the main utility of the Waves blockchain, was worth keeping an eye on. According to CoinMarketCap, total holders of Neutrino have risen dramatically in April, also making it one of the highest stablecoin gainers for the week. Oddly enough, investors seemed to be turning a blind eye towards its de-pegging fiasco which stirred a major debacle last month.

Furthermore, efforts to stabilize the system following a reallocation of WAVES tokens to the neutrino smart contract could alleviate more FUD among market participants, although it’s still slightly premature to say so.

Can WAVES keep turning heads?

A 30% price bump in an overall choppy crypto market is not an everyday occurrence. However, the chances of an extended spike were another story. The Relative Strength Index used to gauge momentum, still traded below 50 while the MACD was in a similar predicament below the mid-line. Overall, the readings suggested that the price hike was temporary and the longer trend would still be dictated by bears.

Furthermore, the total value locked (TVL) on the network wasn’t anywhere close to its early-April levels to support organic growth. Up until last month, WAVES price growth was well supported by users staking more tokens on the platform. However, the situation was vividly different now, with its TVL down by nearly 60% from April levels.

Conclusion

Getting back to the chart, recent gains pushed WAVES to its 20-SMA (red) and $17.8-resistance – the first major threat to its rally. Should a breakout be denied, bears could resume normality and enforce a correctional round heading forward.

Is a 30% rise enough to renew long-term confidence among investors? Based on the overall metrics, it seems unlikely. The next few days would provide more clarity for investors, especially if WAVES fails to advance above $17.