BabyDoge, one of the most ‘popular‘ coins from the space, has seen its share of favorable and unfavorable days. In the period between November to mid-December, this coin, by and large, witnessed a downtrend. Right after that, it kicked off its uptrend phase. In retrospect, BabyDoge attained a local peak on 17 January.

After registering two particularly long candles in the latter fortnight of the same month, BabyDoge began its consolidation phase and continues to remain in the same zone even now.

Outlining the ‘why’ aspect

Over the past 18-odd days, BabyDoge’s performance has lacked vitality, force, and conviction. The same could be attributed to low buy-side pressure. CoinGecko’s data brought to light the token’s suppressing cumulative volume numbers.

Now, it is a known fact that BabyDoge is typically a whale-dominated coin and the actions of such HODLers have an imposing say in its price trend.

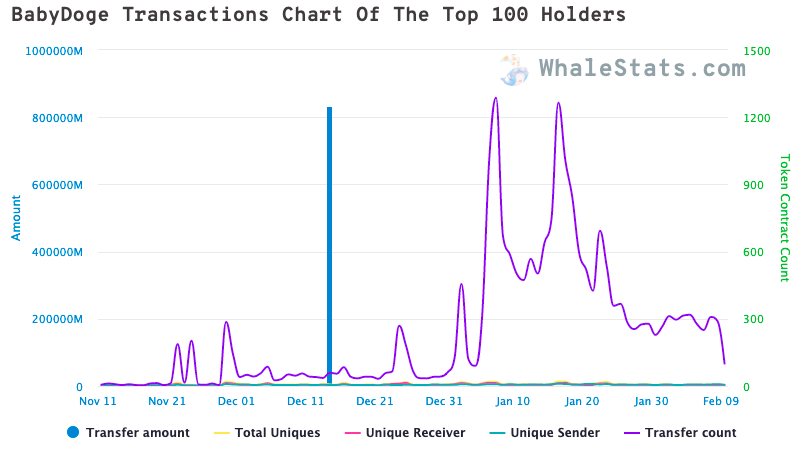

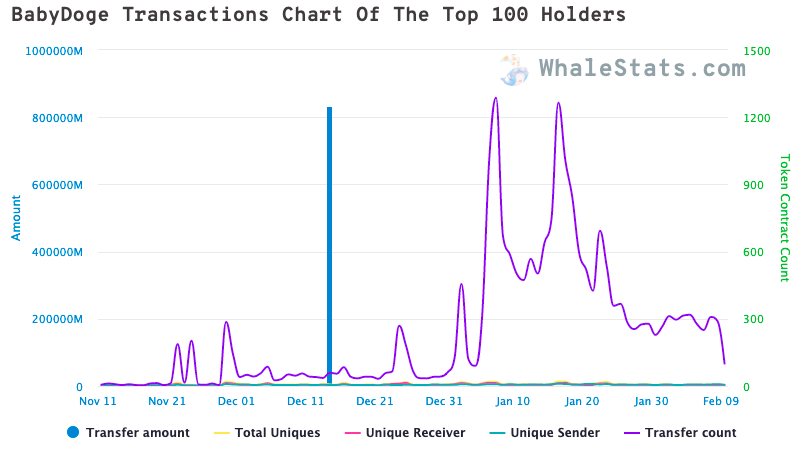

At this stage, it should be noted that transactions carried out by the top 100 HODLers of the coin have been declining since mid-January. Data from WhaleStats brought to light that the value of transactions on Wednesday, in particular, had dunked down to a multi-day low.

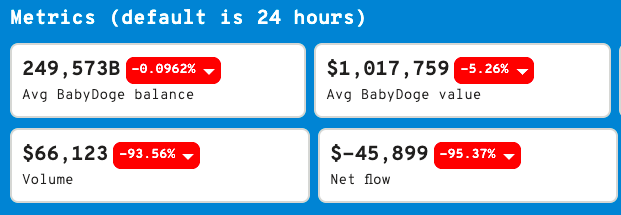

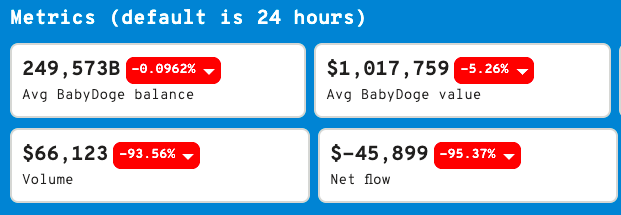

Further, the state of other metrics also seemed to be deteriorating at press time. The average balance of the said HODLers had dipped to a number below 250k billion [249,573 billion, to be precise]. In effect, the average value of the tokens has also dunked by 5% in the 24-hour timeframe.

To make the scars even worse, the top-HODLers transaction volume had shrunk by 93% in the same timeframe, while the net flow too continued to post a congruent negative figure.

Thus, until and unless these the top HODLers take charge and start doing some heavy-lifting again, BabyDoge Coin would find it challenging to recover.