The integration of exchange-traded funds (ETFs) and Bitcoin was a historic moment for cryptocurrencies as investment hubs sought to tie digital assets with traditional means of finance. To capture the ever-rising demand for cryptocurrencies, global asset manager VanEck Digital Assets aims to launch a new ETF that tracks Bitcoin miners.

A filing with the US Securities and Exchange Commission revealed that the VanEck Gold and Digital Assets Mining ETF would oversee securities within an index tracking the performance of gold mining and digital assets mining businesses.

The regulatory filing comes soon after the asset manager laid the groundwork for its ETF plans back in December 2021. The firm had detailed its investments in futures contracts, exchange-traded products (ETPs), and other alternatives concerning gold or bitcoin.

Leading Bitcoin’s miners in the US have enjoyed a bit of a purple patch of late. Third-quarter results for 2021 showed a 2,500% year-on-year surge in total revenues for Riot Blockchain, a 6,000% jump for Marathon Digital, and a 560% increase for Bitfarms.

Record 2021 But Troubles Lie Ahead

Data aggregator The Block Research said that Bitcoin miners made more than $15 billion in revenue during 2021, helped by a rising Bitcoin value that peaked in November. The firm noted that China’s clampdown of crypto mining did not hamper miners’ profit and revenue figures. The research firm added,

“Despite several countries cracking down on crypto mining and countries like China even banning it, there was a rise in the revenue generated by Bitcoin miners by 206 percent in 2021“.

However, some analysts believe that rising energy costs could lead to consolidation within the mining industry. Josh Olszewicz, head of research at Valkyrie Funds recently told Bloomberg

“If the electricity cost keeps rising, that’d prevent them from mining with as much profitability.”

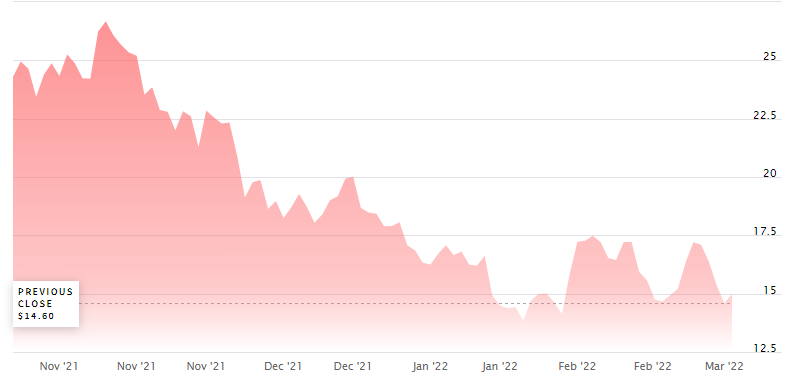

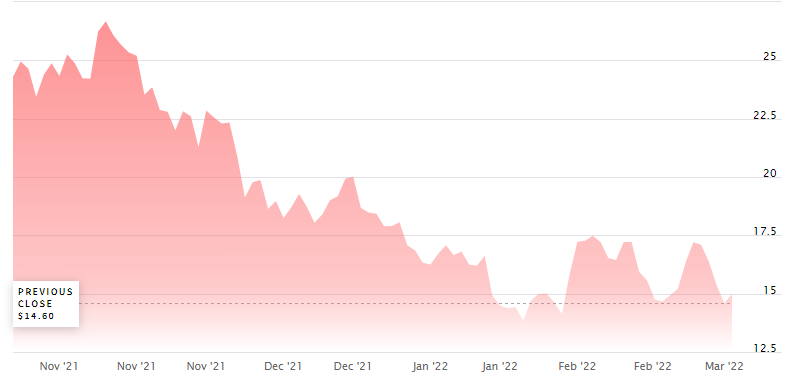

Notably, shares of Valkyrie Bitcoin Miners ETF were down as much as 48% on 3 March, compared to its peak in November.