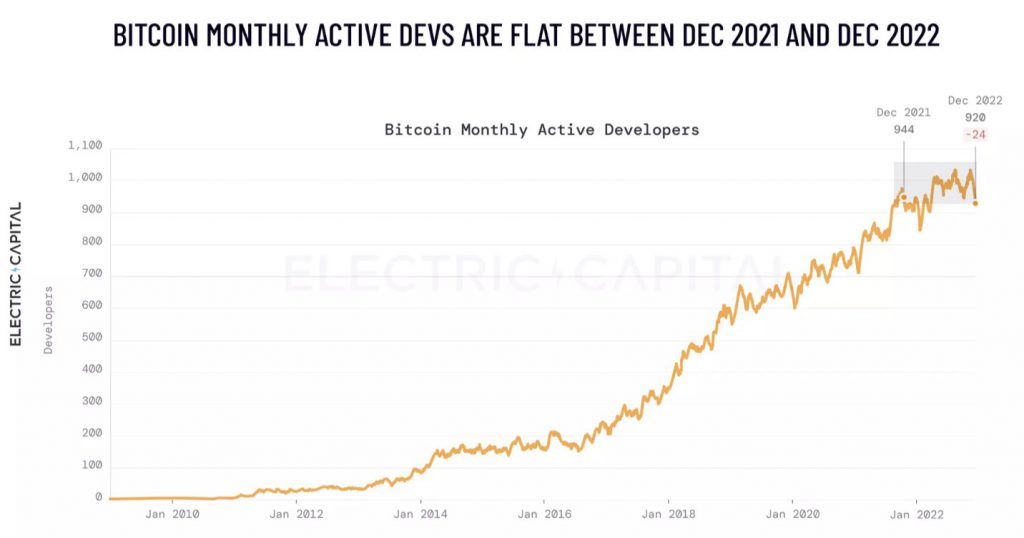

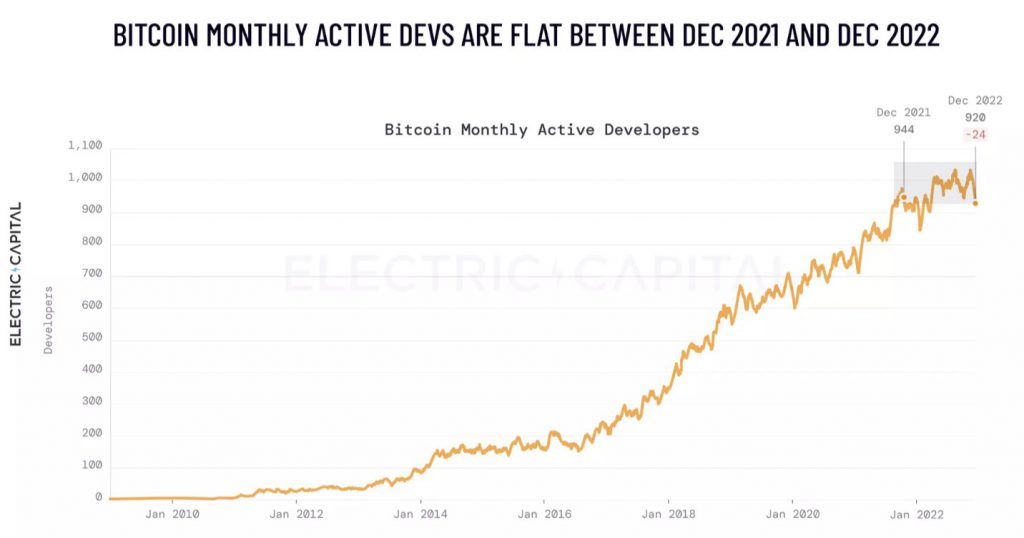

The first open-source cryptocurrency, Bitcoin [BTC] came to be 14 years ago. In over a decade of its existence, the king coin has seen several ups and downs. But its developer activity has witnessed parabolic growth since the time of its launch.

A recent report released by Electric Capital highlights developer activity in the cryptocurrency ecosystem. Starting with monthly active developers, Bitcoin saw a 3x rise from 372 in 2018 to 946 in 2022.

However, these developers were also affected by the bear market and decided to take a back seat. As seen in the below chart, monthly active developers dropped from 944 in December 2021 to 920 in December 2022. This 24 percent plummet could be linked to FTX’s crash as well as the market conditions that pushed BTC down to mid $15K.

Nevertheless, since 2017, Bitcoin has accommodated 1,000 new developers per year. Before this, new developers ranged from 400-500 every year. A total of 1,580 new developers first appeared on the scene in 2020. 1,921 and 1,908 developers joined the network in 2021 and 2022, respectively.

Back in 2018, during crypto winter, 1,607 decided to get on board the Bitcoin ship. This further implies that nearly 100 developers have joined every month since November 2017.

Increased developer activity is certainly good for the network but it may also act as a catalyst for future rallies.

Here’s how Bitcoin’s consistent developer activity could benefit its price

Bitcoin’s value is frequently questioned by many. Several suggest how the asset’s price is driven by mere speculation. A few others noted how the asset lacks intrinsic value. Therefore, BTC’s rallies are often deemed to be “bubble-esque.” However, things could soon be changing for the industry. With more developer activity, the potential increases for a secure network.

With an increase in developer activity, the use cases and innovation pertaining to Bitcoin are likely to witness a pump. A rise in these aspects could certainly lure several into the ecosystem further raising the demand and eventually pushing the price of BTC. Therefore, Bitcoin’s future rallies could entail more intrinsic value than mere speculation.

At press time, Bitcoin was trading for $21,243.78 with a 0.30% daily increase.