The world’s largest Bitcoin (BTC) miner, Core Scientific, has filed an 8-K form with the SEC (Securities and Exchange Commission). As per the filing, the firm will suspend payments that are due in the next few days due to depleting cash reserves. The firm expected its fiat reserves to completely deplete by the end of the year, or sooner.

The SEC filing highlighted a “prolonged decrease in the price of bitcoin, the increase in electricity costs, the increase in the global bitcoin network hash rate, and the litigation with Celsius Networks LLC and its affiliates” as reasons for its decision.

Is the Bitcoin miner taking steps to counter its falling reserves?

The company’s management has been working hard to lower monthly costs. They have postponed building expenses, cut and postponed capital expenditures, and are trying to boost hosting income.

The Bitcoin mining company is also investigating many possible strategic options with regard to the capital structure of the company. These options include employing strategic advisors, obtaining extra funds, or reorganizing its current capital structure. To help the company analyze and assess potential strategic alternatives and steps to increase liquidity, the company has hired Weil, Gotshal & Manges LLP as legal counsel and PJT Partners LP as financial counsel.

Watcher Guru reached out to Core Scientific for a comment but has not received a response yet.

Are BTC miners still facing the brunt of the crypto markets?

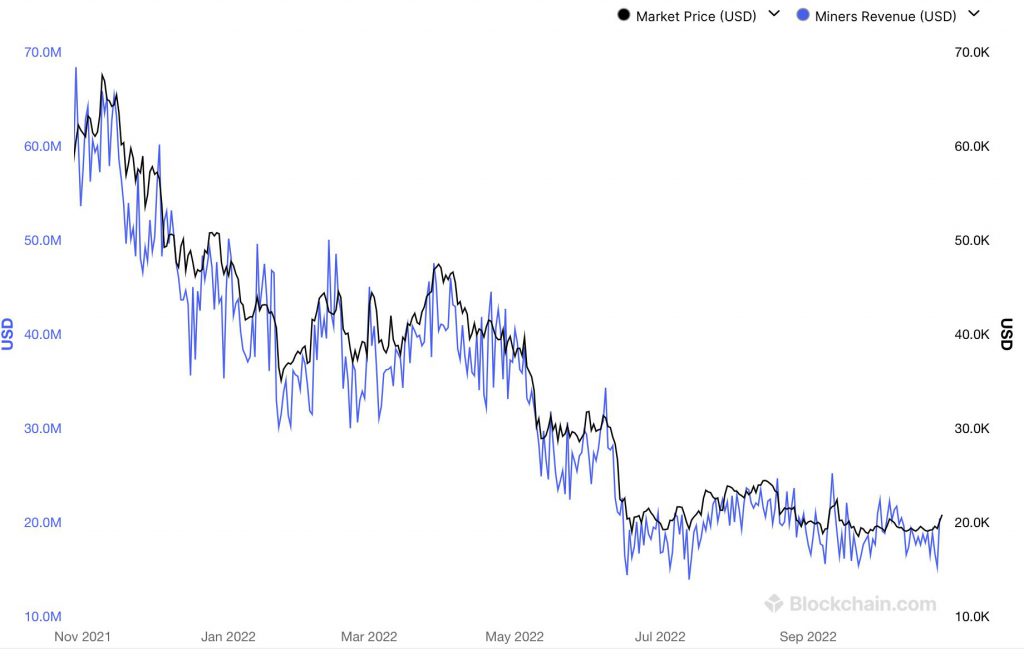

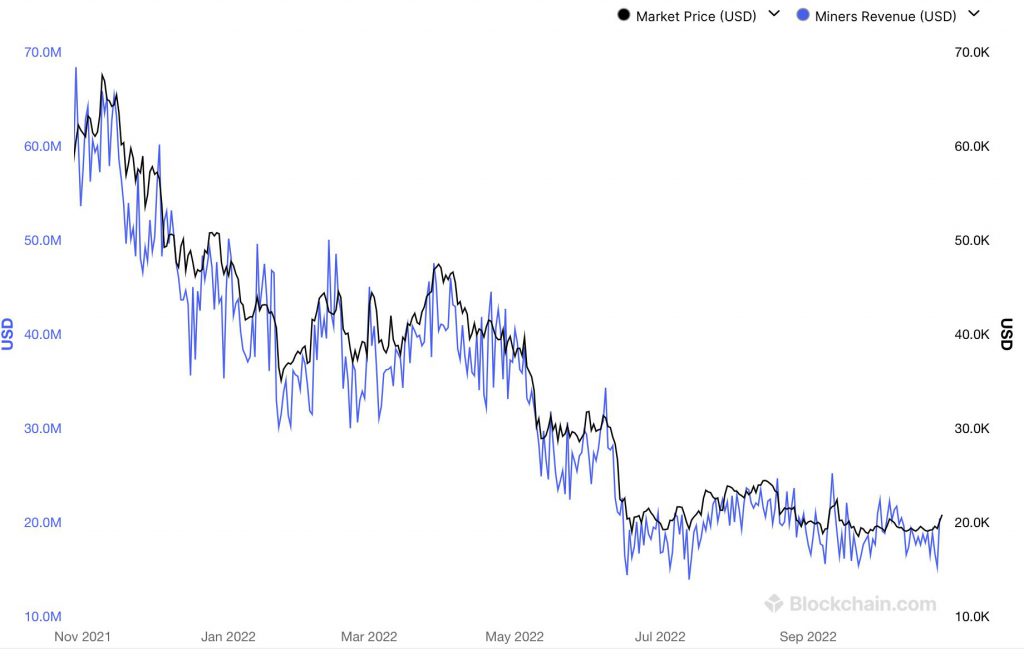

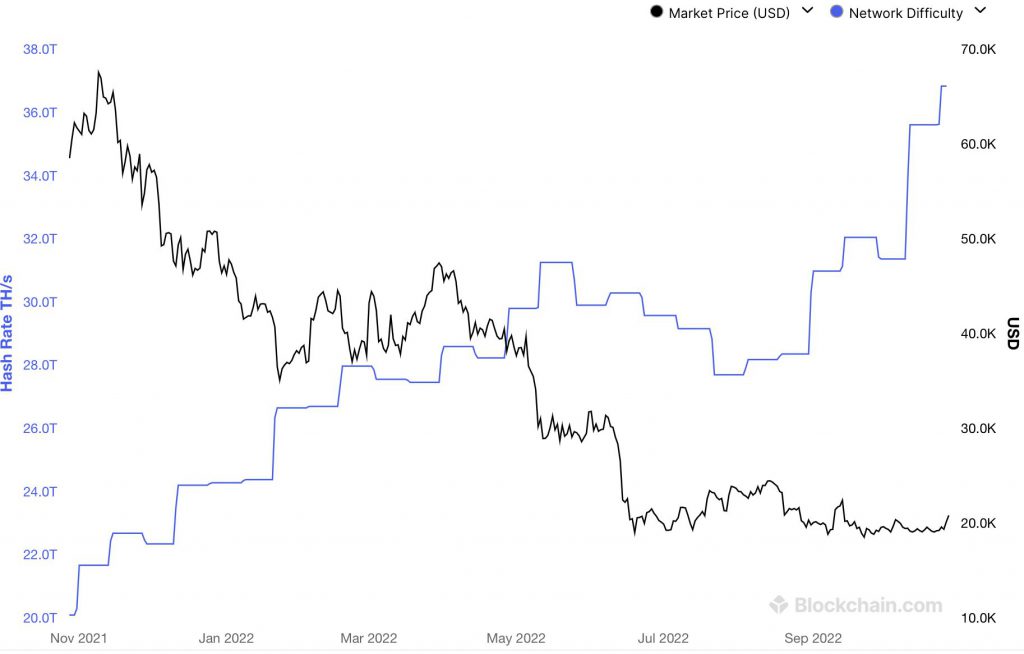

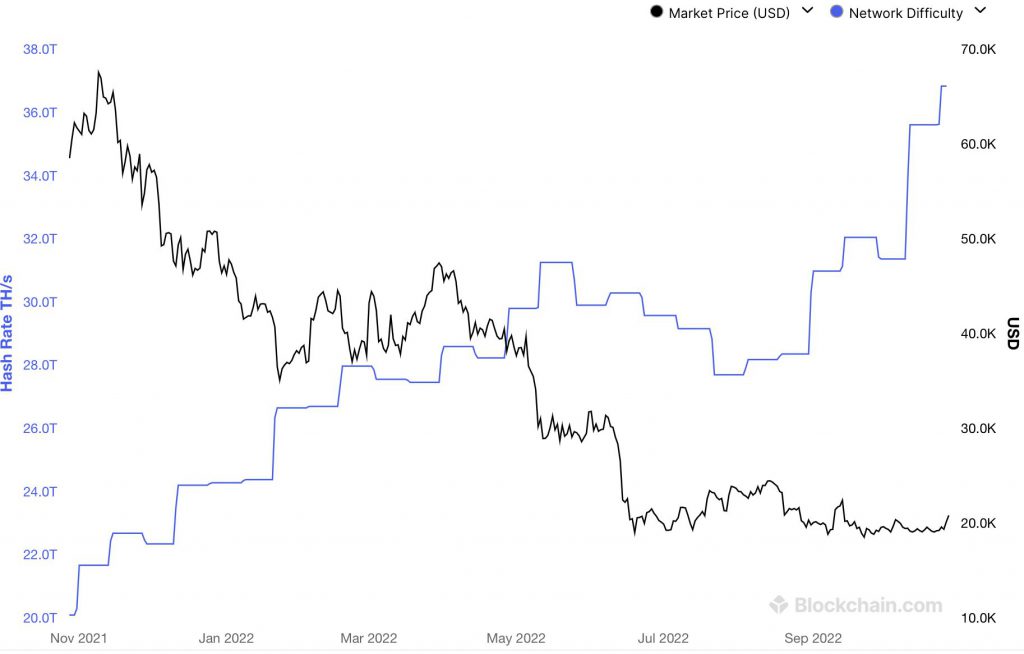

As per the data on Blockchain.com, BTC miner revenue continues to move sideways. Although the markets enjoyed a slight relief in the last two days, there has been no upward movement in miner revenues.

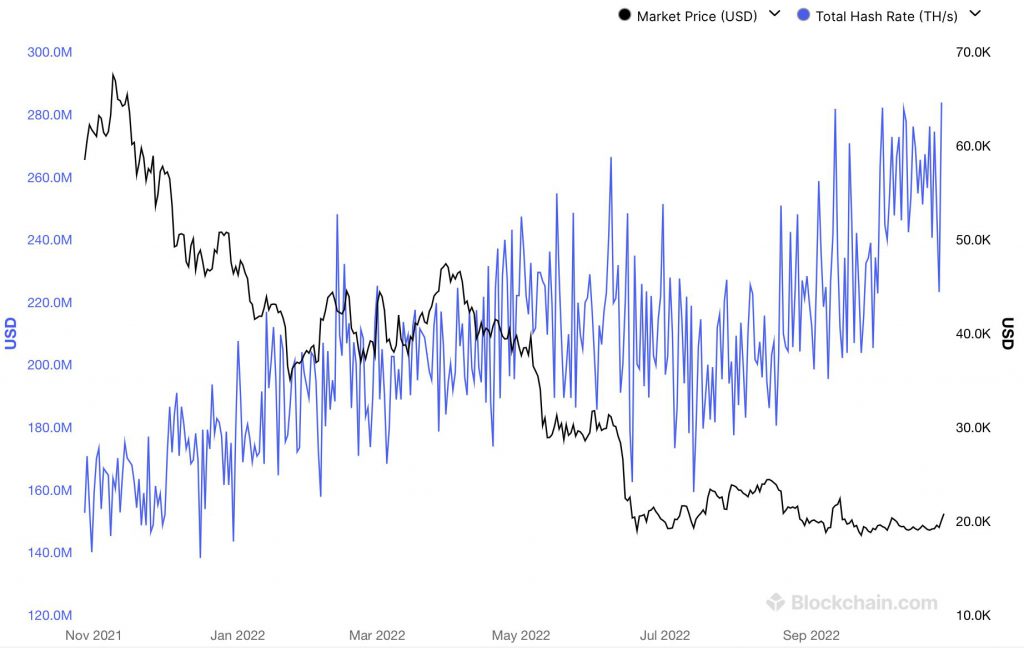

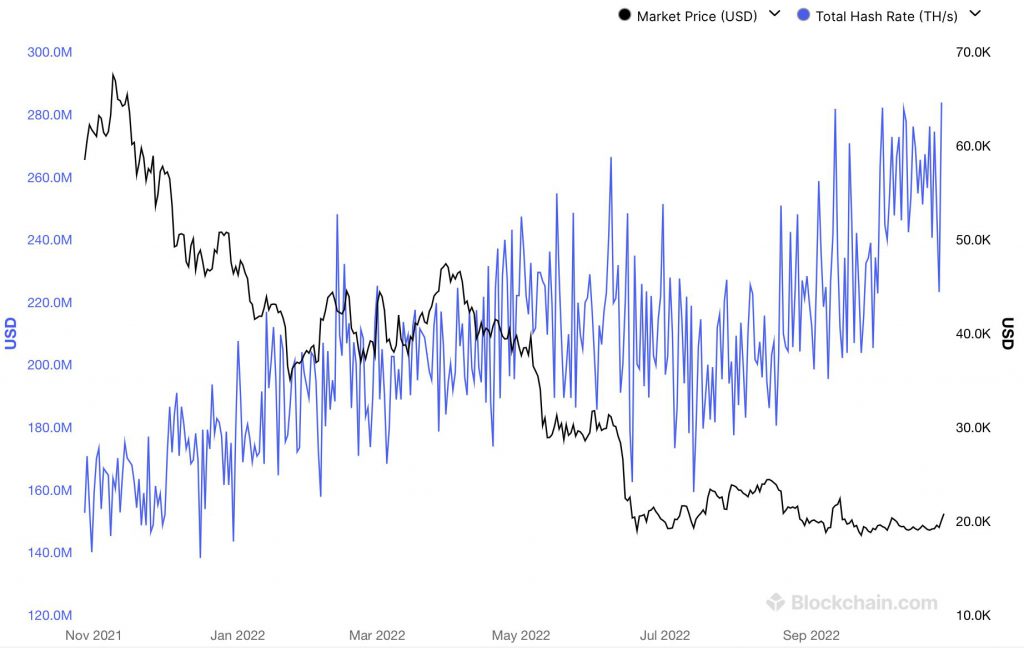

Additionally, Bitcoin’s hash rate is also on an upward trajectory.

Network difficulty, meanwhile, is at an all-time high. Hence, it is getting all the more difficult to mine on the Bitcoin network.

The data relates to the fact that the Bitcoin network is more secure than ever before. However, the incentive to miners is low. This puts pressure on existing miners to sell at a discount or to even close shop.

At press time, BTC was trading at $20,588.10, down by 0.1% in the last 24 hours.