Last Week, the Bitcoin mining hashrate crossed the 300 EH/s benchmark to clinch a new all-time high. At that time, it was reported that mining difficulty was also set to increase this week.

Read More: Bitcoin Hashrate crosses 300 EH/s to create new ATH

Now, post the latest adjustment that took place on Monday, Bitcoin mining difficulty surpassed the 35.61 trillion mark to create a new record high.

Largest hike since May 2021

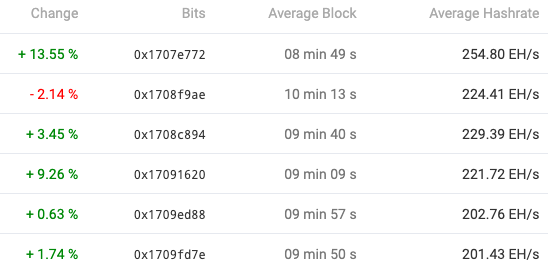

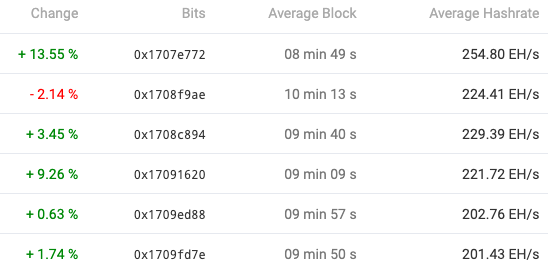

The last adjustment made Bitcoin’s mining difficulty drop. However, during the previous four instances before that, the difficulty saw inclinations in the 0.63% to 9.26% bracket. This time, however, it transpired into a whooping 13.55% hike.

Per data from BTC.com, the latest elevation is the largest since 13 May 2021. The number in August last year, however, stood quite close at 13.24%.

Resultantly, it now takes around 8 minutes and 49 seconds to mine one Bitcoin block on the blockchain.

The higher difficulty, on its part, implies an increasing cost of production per unit of Bitcoin mined because more hash power competition is entering the network. This is occurring at a time when miner revenues are already stressed due to the sluggish price of the asset. Theoretically, it should create increased income stress on the mining industry.

Electrical equipment challenges have further added burden on miners. Alongside selling BTC holdings to enhance liquidity, production numbers have also taken a hit.

Just last month, Core Scientific—a US-based mining company—sold 1576 BTC at an average price of $20,460 per Bitcoin. However, its self-mining operations produced only 1,213 BTC in September, accounting for an average of 40.4 BTC per day.

In fact, as analyzed recently, the macro trend remains to be congruent, with miners continuing to spend more Bitcoin than the amount generated.

Read More: Bitcoin: Top mining company sells 1576 BTC as sell-pressure rises