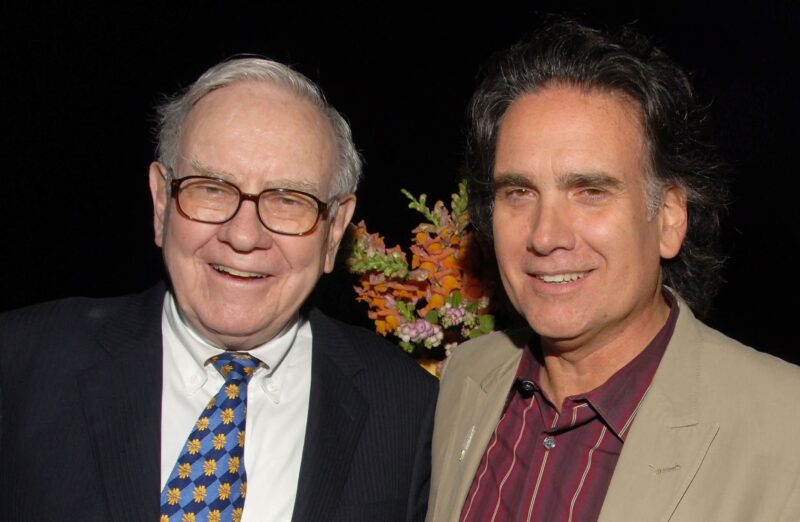

The story of Warren Buffett’s son and the Berkshire stock sale reveals an extraordinary choice between wealth and passion. Peter Buffett traded what could have been potential Berkshire millions for his musical dreams nearly five decades ago, a decision that continues to intrigue investors and wealth managers alike even today.

Also Read: De-Dollarization: J.P.Morgan Predicts the US Dollar’s Future in 2025

Why Buffett’s Son Sold Berkshire Stock And What It Means For You

A Life-Changing Inheritance Decision

The fascinating tale of Warren Buffett’s son and the Berkshire sale began with a $90,000 inheritance when Peter was just 19 years old. This sum, which actually came from his grandfather’s farm sale, was invested in Berkshire Hathaway stock by Warren himself. Peter understood at the time that this would be his only financial support from his father going forward.

Despite knowing that this money represented his entire inheritance, Peter made the somewhat surprising choice to sell his Berkshire Hathaway stock completely in order to pursue his passion for music and creative expression.

Peter Buffett stated:

“I don’t regret it for a second. I used my nest egg to buy something infinitely more valuable than money: I used it to buy time.”

From Stanford Dropout to Musician

After the notable Warren Buffett’s son Berkshire sale, Peter went ahead and purchased a modest San Francisco studio apartment and also upgraded his recording equipment. He even dropped out of Stanford University to dedicate himself fully to developing his musical abilities and production skills.

Had Peter held onto his shares until right now, their value would exceed an astonishing $500 million – a billionaire investor decision that very few people could imagine walking away from. Instead, he chose to follow his passion over potential wealth accumulation.

Also Read: CBDCs Pose Threat to Stablecoins, Not Bitcoin, Says COTI Co-Founder

The MTV Connection

The generational wealth transfer that Peter essentially declined led to an unexpected break in his career. When a neighbor asked about his profession at one point, Peter described himself as a “struggling composer.” This casual conversation actually led to an introduction to the neighbor’s son-in-law – an animator who was seeking music for a new cable station that turned out to be MTV.

This chance encounter ultimately launched Peter’s successful music career that now spans approximately 15 studio albums. Warren Buffett’s son Berkshire sale enabled this creative path that might never have materialized otherwise.

Warren’s Wealth Philosophy

The Berkshire Hathaway stock sale reflects Warren Buffett’s philosophy about wealth and career choices. The billionaire taught his son that work isn’t about making as much money as possible but more about doing something that you love.

This perspective essentially represents the deeper meaning behind Warren Buffett’s son Berkshire sale – prioritizing personal fulfillment over financial accumulation, a billionaire investor decision that challenges conventional wisdom about wealth building.

Also Read: Did BlackRock Just Front-Run the Next Crypto Boom? Might Already Own XRP

Time As The Ultimate Investment

Now 66 years old, Peter acknowledges the privilege that his initial capital represented in his early life.

Peter Buffett explained:

“Without those hundreds of unpaid hours spent fiddling with my recording gear, I would not have found my sound or approach.”

The Berkshire Hathaway stock he ultimately relinquished bought something he considered far more valuable – the time to discover his authentic creative voice and build a career on his own terms. This generational wealth transfer decision offers an alternative perspective on success for investors who might be contemplating their priorities.

The story of Warren Buffett’s son and the Berkshire sale remains a powerful reminder that while financial growth certainly matters, personal fulfillment and following one’s passion sometimes deserves equal consideration in long-term investment choices.