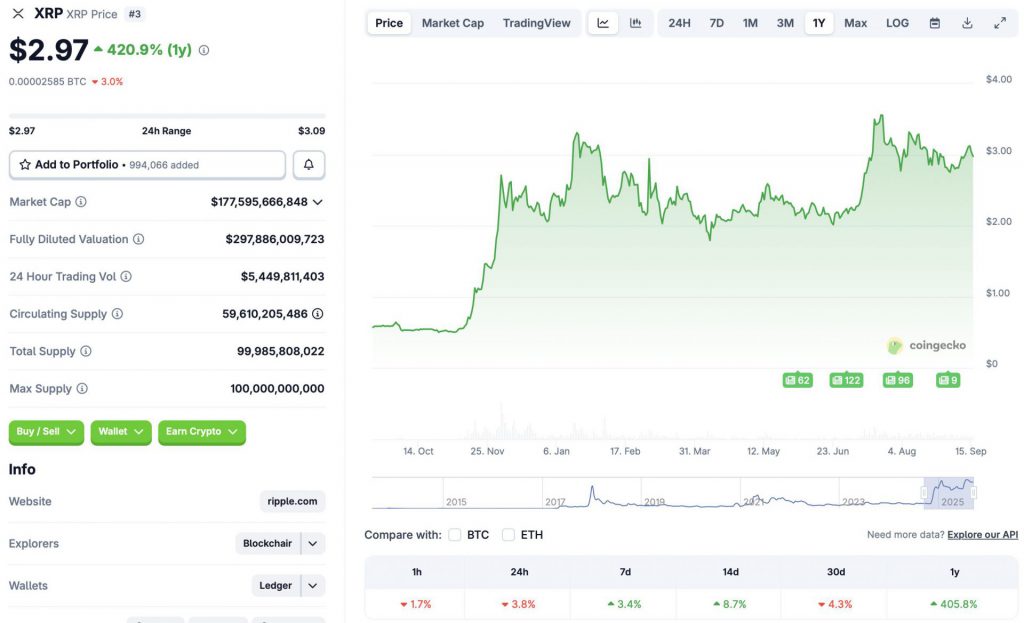

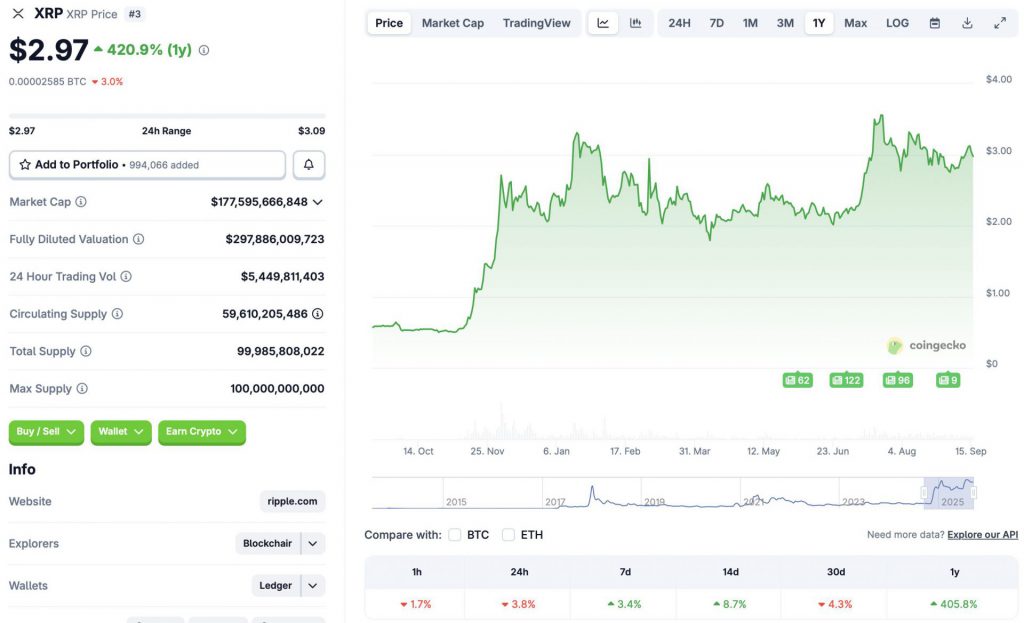

Ripple’s XRP token has taken a toll just before the Federal Reserve’s meeting. According to CoinGecko data, XRP’s price has fallen by 3.8% in the last 24 hours and 4.3% over the previous month. Despite the correction, the asset is still up by 3.4% in the weekly charts, 8.7% in the 14-day charts, and 405.8% since September 2024. Let’s discuss why the asset is falling, and if it will recover soon.

Is XRP Falling Because Of The Federal Reserve’s Meeting?

The Federal Reserve will have its two-day meeting on Sept. 16-17. Investors will keep a close eye on how things unfold and look for clues on the Federal Reserve’s next monetary policy stance. Inflation in the US has increased to 2.9% in August. The rise in inflation figures may have caused some worry among investors. The potential dip in sentiment may have led to XRP’s price dip.

Despite XRP’s price correction, there is a high chance that the asset will recover over the coming weeks. There is a very high chance that the Federal Reserve will cut interest rates by 25 basis points after its next meeting. A rate cut may lead to a substantial increase in risky investments. Such a development may lead to XRP reclaiming the $3 mark.

Also Read: The XRP Price Thought Ladder: $100, $1,000, $100K, $1M+

XRP’s price correction is not an isolated event. Bitcoin (BTC) has fallen to the $114,000 price level after its recent ascent to $116,000. Ethereum (ETH) also follows the market trend, facing a 3.1% correction in the last 24 hours. The market-wide bearish reversal is likely due to investors taking caution before the upcoming Federal Reserve meeting.

According to CoinCodex analysts, XRP’s price may consolidate over the coming weeks before facing an upswing. The platform anticipates the asset to surge to $3.43 on Oct. 7.