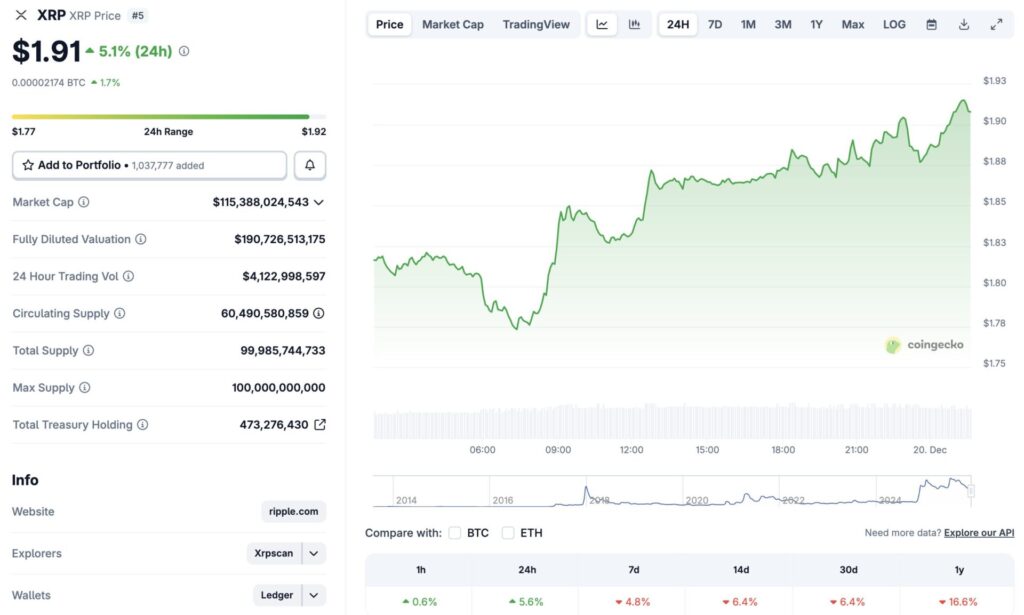

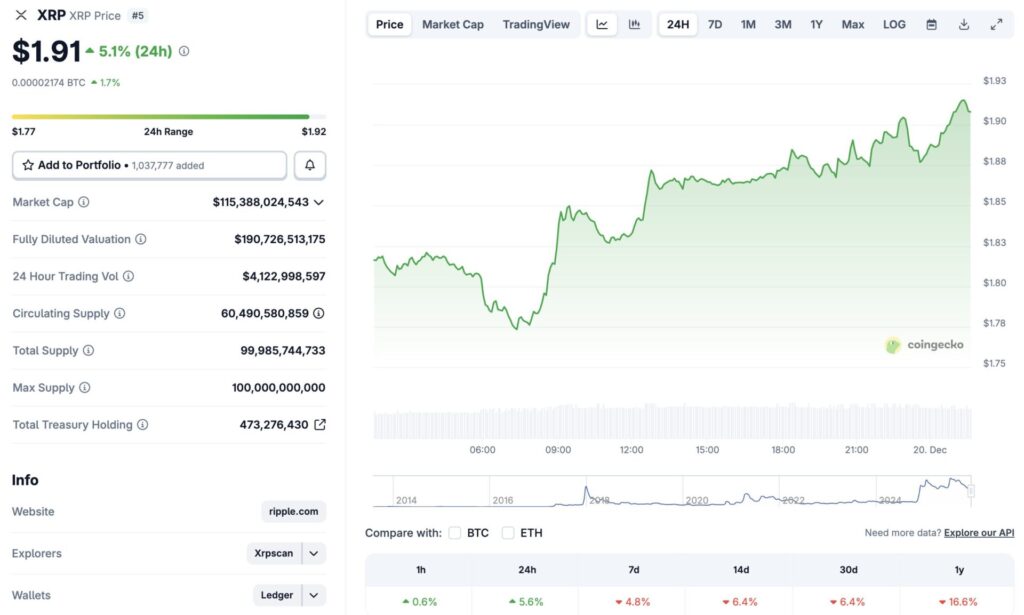

The cryptocurrency market is showing signs of a rebound, with Bitcoin (BTC) reclaiming the $87,000 price level after its recent dip to sub-$85,000 levels. Ripple’s XRP token is also following the market rebound. According to CoinGecko data, XRP has rallied 5.6% in the daily charts. Despite the turnaround, XRP is still trading in the red zone in the other time frames. The asset’s price has fallen 4.8% in the weekly charts, 6.4% in the 14-day charts, 6.4% over the previous month, and 16.6% since December 2024. Let’s discuss if XRP will continue its current rally and reclaim the $2 mark, or will it face a correction.

Will XRP Rally To $2, Or Will It Fall Again?

XRP’s latest price rally follows the Bank of Japan’s recent interest rate hike. The central bank raised rates to their highest levels since 1995. The market rally is surprising, given that rate hikes often lead to funds moving away from risky assets, such as cryptocurrencies.

XRP’s rally could be due to increased ETF inflows. XRP ETFs saw approximately $30 million in inflows on Thursday, Dec. 18, 2025. ETF inflows have played a key role in the market cycle of 2025. Bitcoin (BTC) and Ethereum (ETH) climbed to new peaks in 2025 due to high ETF inflows. A similar pattern could emerge for XRP as well.

Another reason for XRP’s rally could be that investors are buying the dip. The asset’s price fell to $1.77 on Dec. 17, the lowest price level since April of this year. The cheap rates may have become attractive to investors buying for the long term.

Also Read: XRP Gets a $4.42 Price Target

While the rally is welcome, it is unclear if XRP can reclaim the $2 mark or not. The market is still quite fragile, and fresh volatility could wreak havoc at any moment. Given that investor sentiment is still down, there is a high chance that we are looking at a dead cat bounce and are nowhere near the end of the bear market.