XRP price prediction 2050 analysis actually reveals potential valuations reaching around $45 as the network burns roughly 985,000 tokens annually. The XRP token burn rate is creating some deflationary pressure right now while recent Ripple $200M XRP transfers and ongoing SEC XRP decision delays are shaping long-term crypto investment strategies for this digital asset.

XRP Price Prediction 2050, Token Burn Rate, SEC Decision & Transfers

Annual Token Burns Are Actually Driving XRP Price Prediction 2050 Scenarios

The XRPL is burning approximately 2,700 XRP tokens each day, which totals around 985,500 tokens annually. This XRP token burn rate removes roughly 25 million tokens by 2050, representing about 0.025% supply reduction. Three different scenarios emerge for XRP price prediction 2050 based on various adoption levels.

In the moderate scenario, banks and fintech adoption drives 6-8% annual growth, pushing prices to somewhere between $18-25 without burns. With the XRP token burn rate psychological effect, valuations actually adjust to $20-28 by 2050.

The second scenario envisions XRP becoming a major liquidity hub, where adoption grows at 12-15% annually and could push prices to $150-250. With increased burns, the adjusted range moves to $180-300.

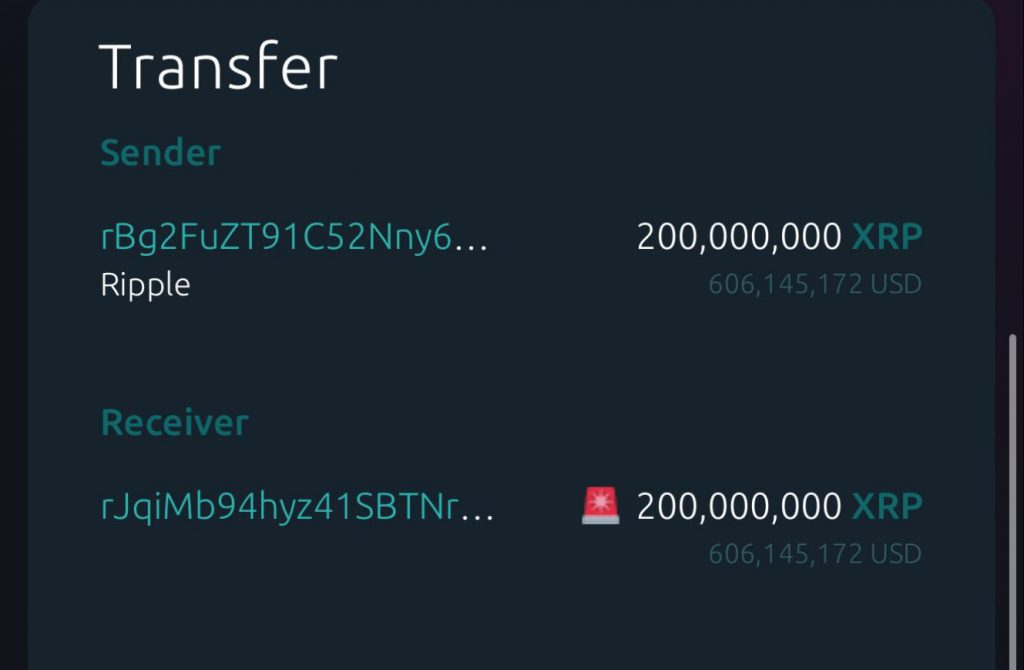

Recent Ripple $200M XRP Transfer Signals Strategic Moves

Recent blockchain data shows a massive Ripple $200M XRP transfer to an unknown wallet. The transaction involved 200 million tokens moving from Ripple’s address to an unknown destination, sparking speculation across the crypto community.

JackTheRippler reported on August 18, 2025:

“BREAKING: 200 million #XRP, worth $606,145,172 was transferred from Ripple to an unknown wallet! Something is happening behind the scenes”

🚨BREAKING: 200 million #XRP, worth $606,145,172 was transferred from Ripple to an unknown wallet!

— JackTheRippler ©️ (@RippleXrpie) August 18, 2025

💥Something is happening behind the scenes💥 pic.twitter.com/q0rekyBHB4

Ripple Van Winkle stated:

“200M $XRP moving off Ripple’s books is no small play. Could be OTC settlement, institutional onboarding, or prep for liquidity use cases. When size like this shifts → narrative usually follows. Eyes on what unfolds next.”

TraderMG had this to say:

“200M $XRP on the move? That’s not a transfer, that’s a migration.”

200M $XRP on the move? That’s not a transfer, that’s a migration.

— TraderMG (@TraderMG_) August 18, 2025

SEC XRP Decision Delays Impact Long-Term Investment Right Now

The SEC XRP decision timeline shows delays until October for two ETF applications right now. CoinShares faces an October 23 deadline while 21Shares awaits October 19 approval for their Core XRP Trust, which has been delayed multiple times.

200M $XRP moving off Ripple’s books is no small play.

— Ripple Van Winkle | Crypto Researcher 🚀🚨 (@RipBullWinkle) August 18, 2025

Could be OTC settlement, institutional onboarding, or prep for liquidity use cases.

When size like this shifts → narrative usually follows.

Eyes on what unfolds next.

Finance Bull shared on X that he’s convinced about the fact that:

“The SEC can’t stop XRP ETF approval, but it’s buying time with this delay. The SEC is using this tactic to cause XRP’s price to drop, so its members can buy the dip before the approval drives the digital asset’s price significantly higher.”

Bloomberg raised XRP ETF approval probability to 95%, supporting the long-term crypto investment thesis. The delays are actually creating accumulation opportunities before potential approval-driven price surges affecting XRP price prediction 2050 models.

Regardless of this degree of these regulatory delays, the interplay of XRP token burning rate policies, strategic Ripple 200M $XRP transfers, and the eventual SEC XRP ruling outcomes makes XRP a long-term crypto investment opportunity with substantive potential approaching the desired 45 dollar target by the year 2050.