2022 was significant for a lot of reasons. While bad actors were eliminated from the industry, certain networks went about with major upgrades. The Ethereum [ETH] network underwent the Merge which opened doors to the proof-of-stake [PoS] realm.

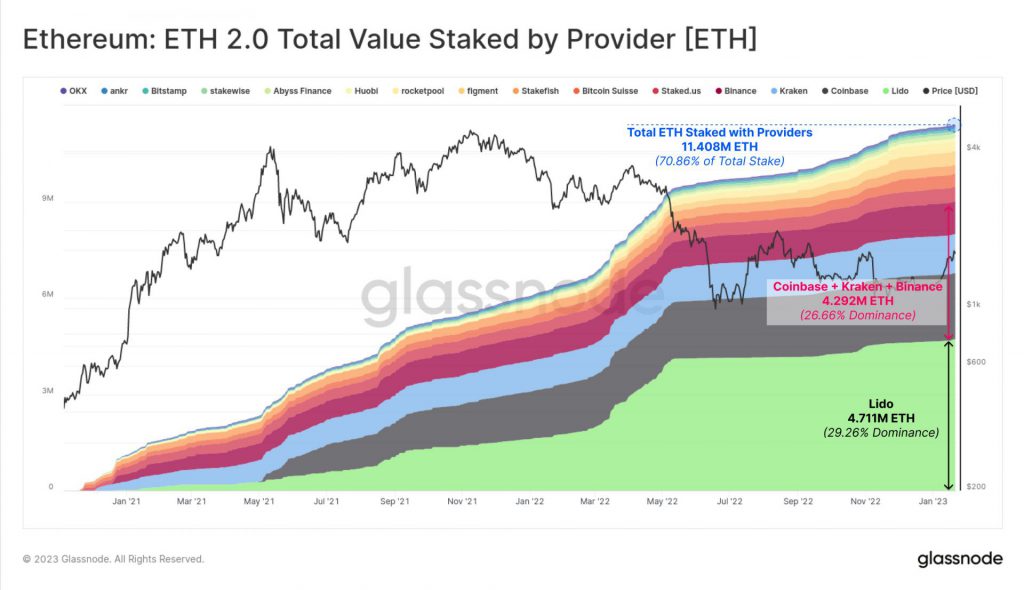

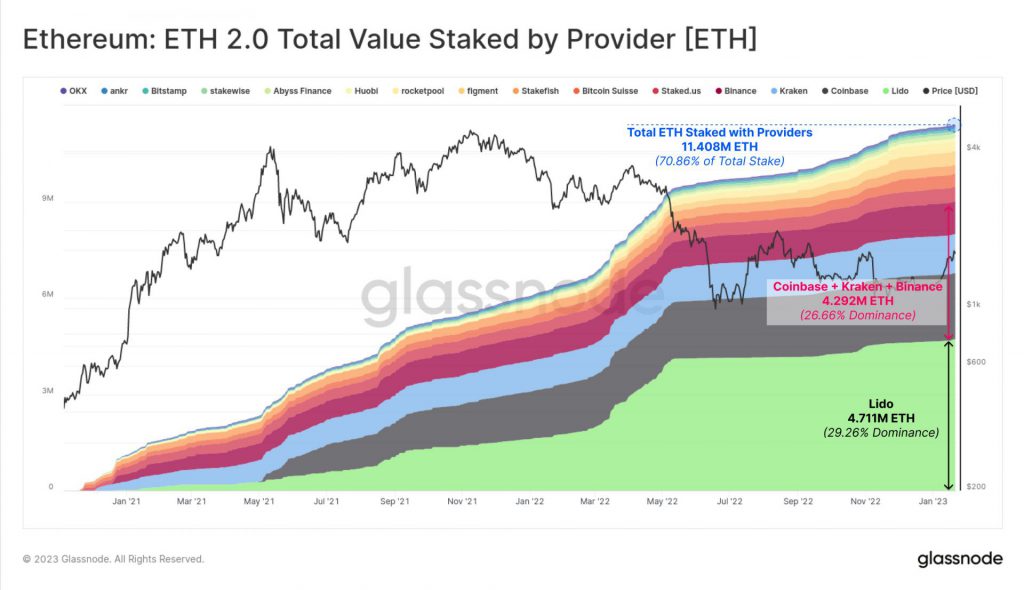

According to Glassnode, an astounding 16.101 million ETH is currently staked on the Ethereum Proof-of-Stake beacon chain. This accounts for 13.4% of the circulating supply. It should be noted that a significant 70.86% of the total stake was through staking service providers. 11.408 million ETH was divided between Lido, Coinbase, Kraken as well as Binance.

As seen in the above image, Lido accounted for 29.3% of the total ETH staked. Prominent exchanges like Coinbase, Kraken, and Binance were far behind amounting to 12.8%, 7.6%, and 6.3% respectively.

Lido undoubtedly outshines the rest of the market. However, the large proportion of Lido in the entire validator set raises questions about the possibility of censorship and centralization.

Nevertheless, when compared to its counterparts, Ethereum’s staking ratio is much lower. The current staking ratio of Ethereum, is around 14%, as opposed to coins like Solana, Cardano, and BNB, which have ratios of 71%, 72%, and 97%, respectively.

This further ignited tension among the Ethereum community. Several called out the network for already being extremely centralized.

Ethereum thrives amidst backlash

Ethereum’s shift to PoS was quite controversial as a multitude of community members were against it. Centralization was at stake, and the dismissal of miners caused chaos in the market. Despite this, the network was faring much better than the others.

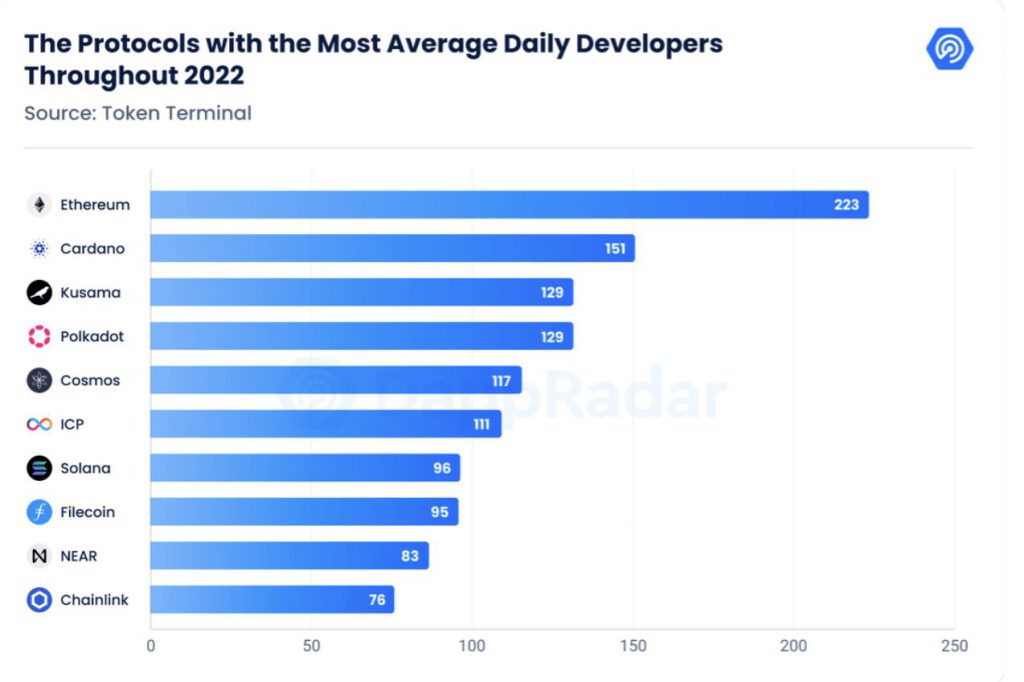

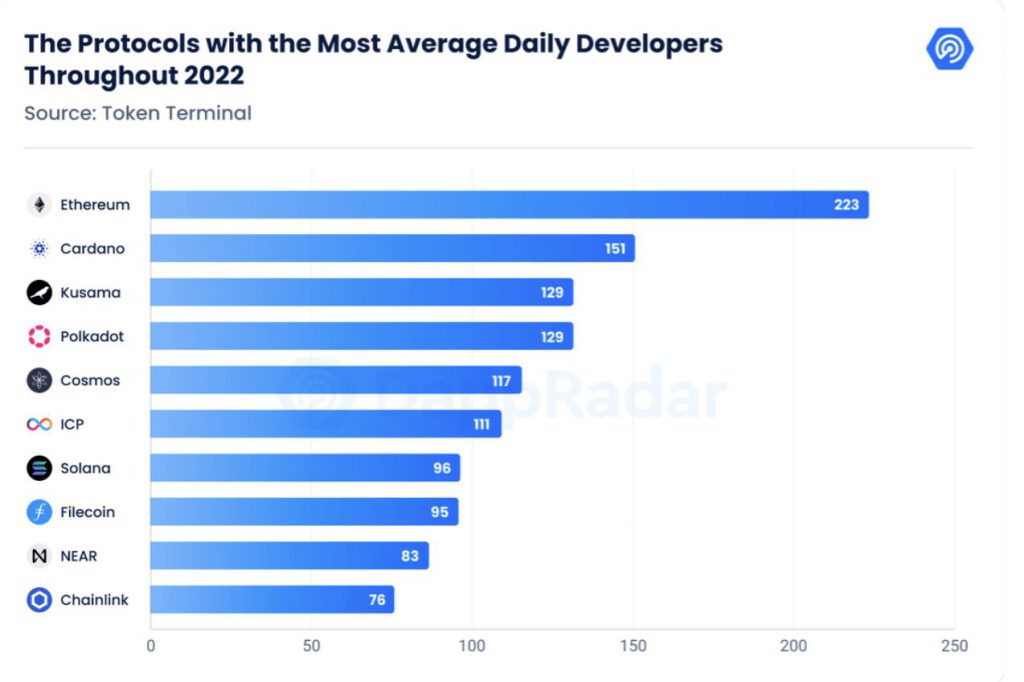

As per a recent report by DappRadar, Ethereum emerged as the most valuable network among Altcoins. Even though the development activity in the Ethereum ecosystem dropped by 9.37% in 2022, the network had the highest number of active developers.

The network flourished in terms of NFT sales as well. With 21% of the NFT market share and 21.2 million sales, Ethereum continues to be the best performer. Given that Ethereum holds the majority of the blue-chip collections, this did not come as a major surprise.

With regard to its price, ETH has performed fairly decent similar to its counterparts. At press time, the altcoin was trading for $1,633.56 with no major fluctuations over the last couple of hours.