Central bank digital currencies (CBDC) and stablecoins have captured the attention of world governments. This is demonstrated by various countries embracing CBDCs and performing pilot studies to incorporate CBDCs into daily life.

Some of the most recent advances include the UK’s Bank of England moving closer to launching its CBDC, Hong Kong planning to lay the foundation for e-HKD, Japan’s Digital Yen CNDC pilot, etc.

Also read: Shiba Inu Burn Rate Soars by 4467%, 654 million SHIB Burned

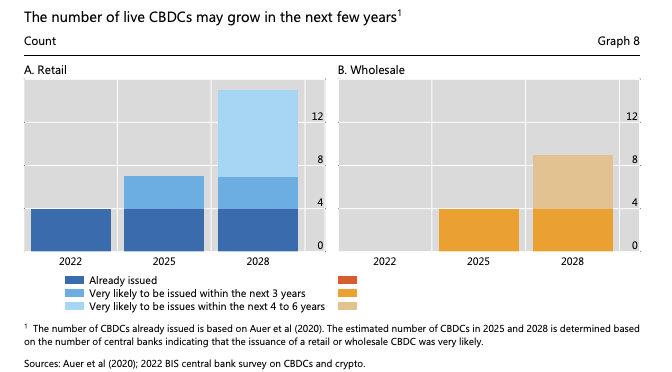

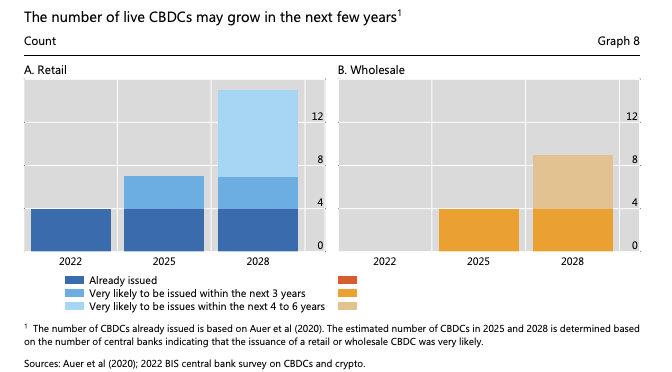

Now, according to a recent survey by the Bank for International Settlements (BIS), over 93% of banks globally are exploring CBDCs. Additionally, over 15 retail and nine wholesale central bank digital currencies are estimated to be up and running in circulation by 2030.

BIS’s survey covers over 86 central banks’ analysis

The survey, which went live on July 10, questioned over 86 central banks on what their motivations and advancements are with CBDC and whether they are working on wholesale, retail, or both.

The survey uncovers that more than half of the global central banks are running pilot tests for CBDCs. Additionally, almost a quarter of these banks are already in their pilot CBDC project mission.

Also read: Cathie Wood’s ARK Rumored to be at Forefront of Bitcoin ETF Race

According to the data, only four central bank digital currencies are currently in circulation. These include the Eastern Caribbean, Jamaica, Nigeria, and the Bahamas. However, 68% of these central banks also expressed their unreadiness to launch their central bank digital currency soon.