Cybercrime and hacks have increased dramatically along with the crypto industry’s rapid growth. Criminals are well aware of the lucrative possibilities in the developing industry, hence it is no surprise they have infiltrated the sector.

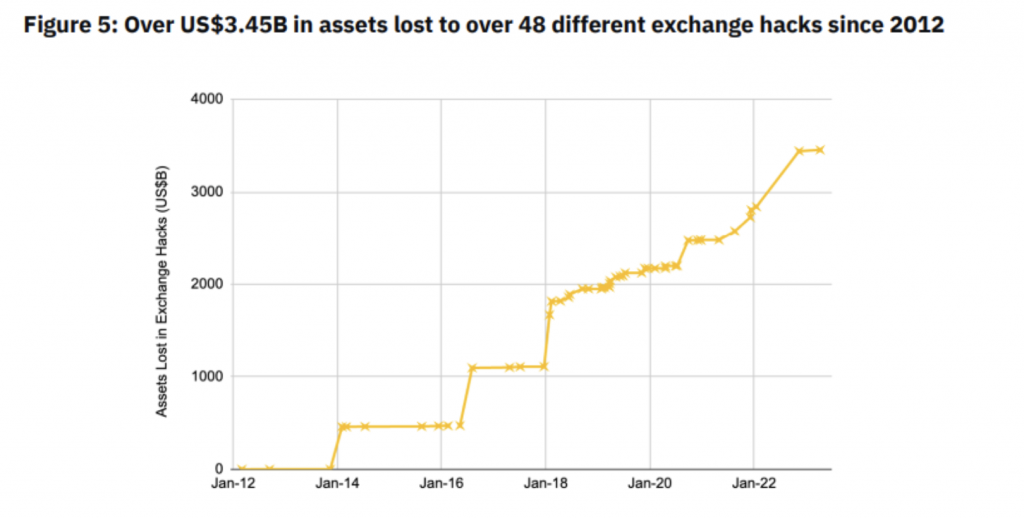

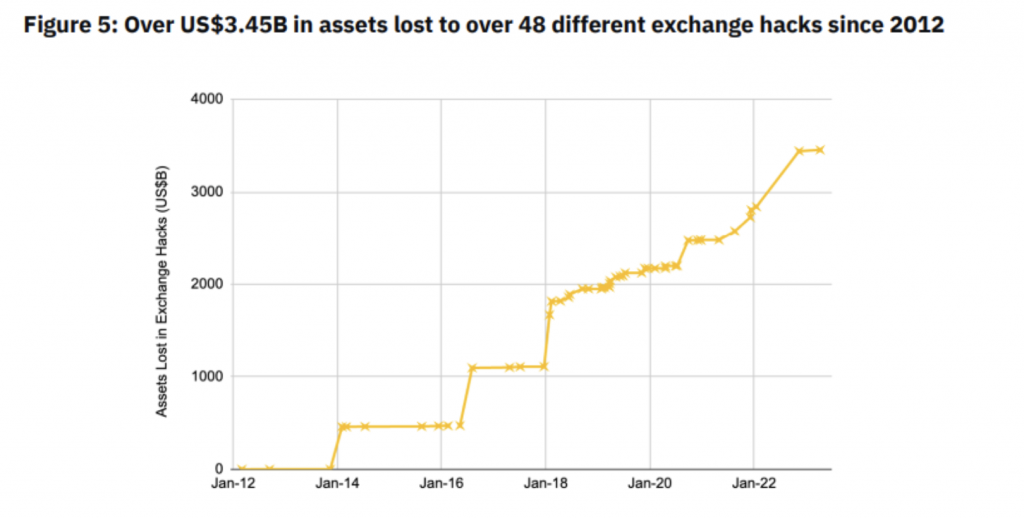

According to a study by Binance Research, more than $3.45 billion in assets have been lost in 48 different crypto exchange custody hacks since 2012. As per Binance Research, the number of attacks in the sector has only grown over time. In the first three quarters of 2022, more than $2.5 billion was stolen by crypto hackers.

As per the report, hot wallet hacks are the most common theft (29.4%). Other methods include bugs (3.9%), malware (3.9%), protocol vulnerabilities (2%), data leaks (3.9%), and internal staff mistakes (2%) among others. Some attackers use a combination of different methods (2%). Meanwhile, 23.5% of attacks remain unknown.

Why is crypto so easily stolen from exchanges?

The general issue, according to the Binance Research team, is how cryptocurrency trading platforms handle and store client funds. The report stated that,

“While the top tier exchanges, such as Binance and Coinbase, store their customer assets in cold storage, this is unfortunately not the case for all exchanges.”

The report further added that “verifying whether the exchanges truly adhere to cold storage remains challenging.”

It is also important to note that identity fraud involving big exchanges’ popular crypto wallets has been very common recently. On the dark web, accounts from Kraken and Coinbase that have been validated as stolen are reportedly being sold for $600-$800.

The study advised using institutional custodians who maximize asset security and protection to solve this pervasive issue. Moreover, the team advises using cold wallets rather than hot ones. The use of cold wallets has become a popular practice, especially after the FTX collapse in November 2022.