The next BRICS summit will be held in South Africa in August and the bloc of five nations will decide on expanding the alliance. It is reported that the BRICS expansion could occur in August making the alliance rebrand itself as BRICS+. Among the 25 countries that have applied to join the BRICS alliance, five could be allowed entry into the bloc. Their entry into the group is almost certain and the announcement of the expansion could be made at the summit.

Also Read: BRICS: Saudi Arabia, Iran & Brazil Pay in Chinese Yuan, Ditch U.S. Dollar

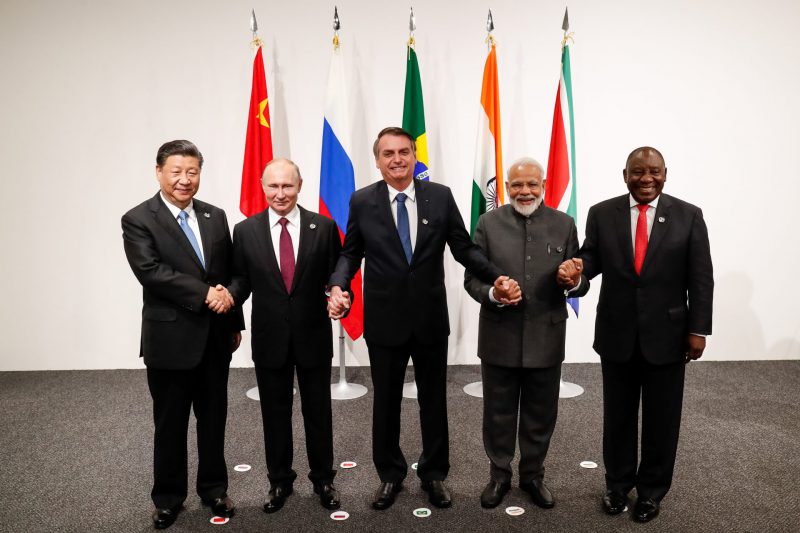

BRICS is an acronym for Brazil, Russia, India, China, and South Africa. The group is looking to take on the U.S. dollar by launching a new currency for global trade.

BRICS: 5 New Countries To Join the Alliance in August

Out of the 25 countries that formally sent their applications to join BRICS, only five could be inducted in August. The five countries likely to join the BRICS alliance are Saudi Arabia, the United Arab Emirates, Argentina, Egypt, and Indonesia. A senior government official confirmed the expansion plans to Business Standard on the condition of anonymity.

Also Read: BRICS: French President Emmanuel Macron To Attend Summit in August?

The expansion could make the alliance stronger in terms of GDP and purchasing power parity (PPP). Additionally, Saudi Arabia’s induction into the bloc could fund the New Development Bank (NDB) making it receive constant cash flow. The NDB struggled due to the U.S. sanctions on Russia and struggled to receive or lend new loans.

The NDB bank which was created to challenge the U.S. dollar wanted the dollar to survive. However, Saudi Arabia’s induction into the bloc would fund the bank making the alliance financially stronger and challenging the U.S. dollar. If Saudi enters the bloc and accepts the new BRICS currency for cross-border transactions, the U.S. dollar could be on the path of decline.

Also Read: What Happens if Europe Accepts BRICS Currency?

The Middle East nation is the largest exporter of oil to the U.S. and Europe sending millions of barrels every year. Also, if Saudi decides to make Europe settle oil payments in the new BRICS currency and not the U.S. dollar, the American economy could be hit. Read here to know how many U.S. sectors could face losses if Europe pays in the new BRICS currency.