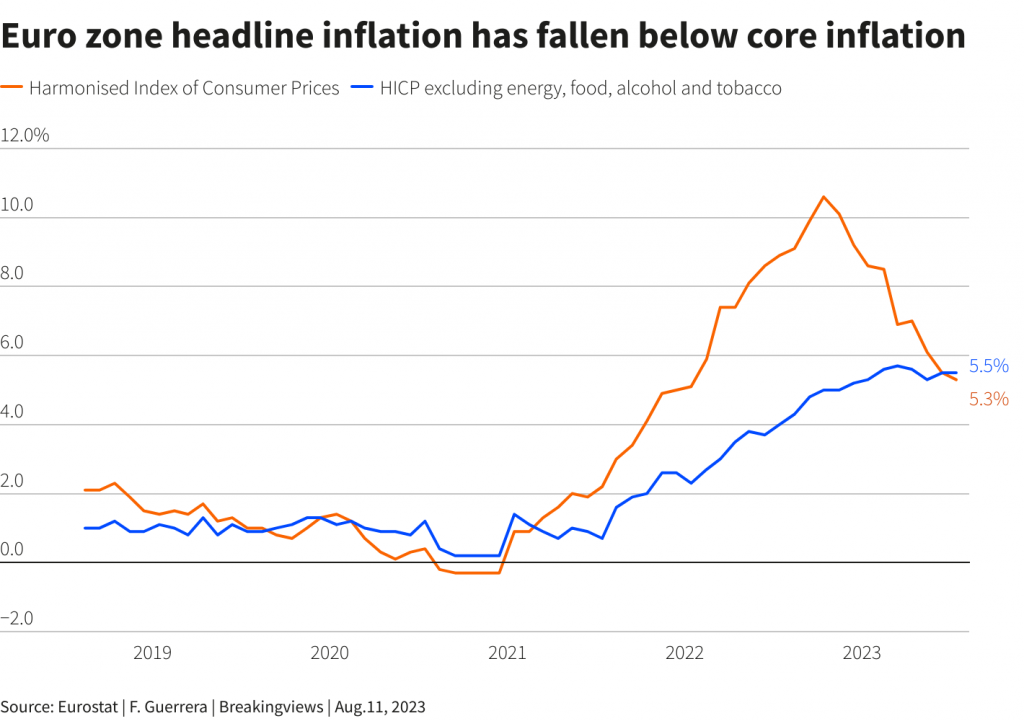

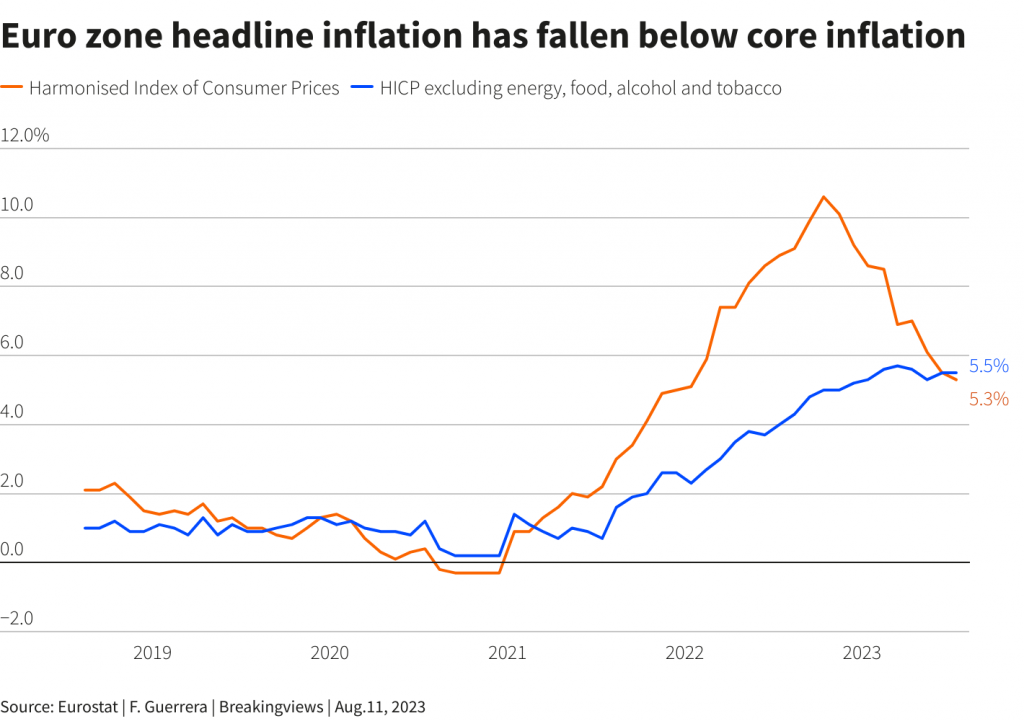

The Euro Zone’s headline inflation has halved in the previous nine months. The figure for the month of July stands at 5.3%. However, this is not enough for the European Central Bank (ECB). The central bank’s hardliners want to see core inflation fall below headline inflation before they consider cooling interest rates. Core inflation in the Euro Zone was at 5.55% for the month of July, above the headline figure.

Also Read: UK Headline Inflation Drops to 6.8%, But CPI Remains Unchanged

Furthermore, both headline and core inflation are way above the ECB’s 2% target. However, many said that the emphasis on core inflation might be misplaced. Some point to a 2011 study that mentioned core inflation is not a good indicator of where the headline figure will move. Another reason why core inflation is not a good indicator is that headline inflation is a better gauge of what consumers expect. Recently, U.S. Federal Reserve chair Jerome Powell said that headline inflation is “really what the public experiences.”

Furthermore, core inflation tends to follow headline inflation, another reason why there should be more focus on the latter. A recent ECB survey also found that Europeans are responding to recent headline rate cools. Consumers expect inflation to drop to 3.4% over the next 12 months, compared to 3.9% a month earlier.

Euro Zone inflation continues to worry authorities

In July, the Euro Zone’s inflation numbers fell to their lowest levels since the beginning of the year. However, with deposit rates at a record high of 3.75% and a weak economy, the ECB must make sure that its monetary tightening policies do not push the bloc into a recession. The Netherlands is the latest European nation to fall into a recession.

Also Read: Netherlands Enters Recession, Shrinks 0.3% in Q2 2023

According to Eurostat, headline inflation is increasing at 5.3% annually. However, core inflation, which excludes the volatile energy, food, alcohol, and tobacco, rose 5.5% YoY, which is near March’s 5.7% peak. This has led ECB hardliners like Joachim Nagel and Klaas Knot to suggest that rate hikes continue until core inflation nears 2%.