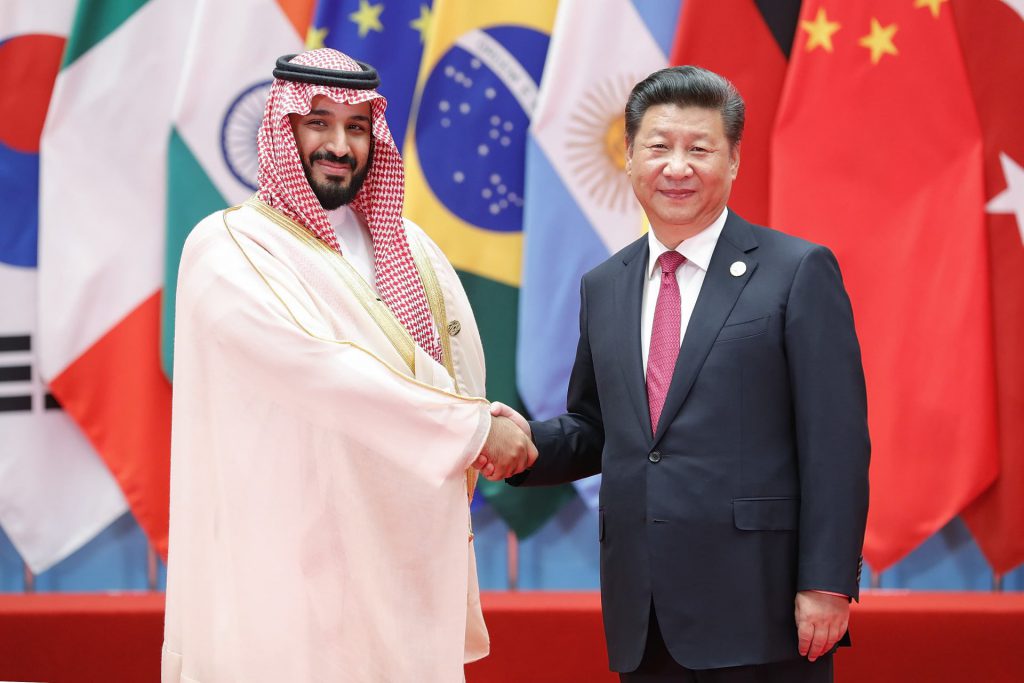

BRICS members China and Saudi Arabia have kick-started the de-dollarization efforts by keeping the US dollar out for cross-border transactions. China and Saudi Arabia officially signed a $7 billion currency swap deal that favors their local currency the riyal and yuan. The three-year agreement allows trade to be settled in local currency with a cap of 50 billion yuan or 26 billion riyals. Therefore, the US dollar will play no role in trade for up to $7 billion between the two BRICS members.

Also Read: Argentina to Decline BRICS Membership & Support US Dollar

The trade deal is more symbolic than an agreement indicating Saudi Arabia’s willingness to step away from the US dollar. China is on a campaign to convince other countries to trade in local currency and end reliance on the US dollar.

The Xi Jinping administration is internationalizing the Chinese Yuan in an attempt to dethrone the US dollar’s global reserve currency status. Signing a $7 billion currency swap deal with Saudi Arabia is a big milestone in the de-dollarization initiative.

Also Read: Germany to Launch Digital Euro to Counter BRICS Currency?

Additionally, China has already signed a currency swap agreement with new BRICS member Argentina early this year. Therefore, China is now the flag-bearer of the de-dollarization initiative and is advancing in its motive of a dollar-free world.

BRICS: China & Saudi Arabia’s Currency Swap Deal to Limit US Dollar Usage Up to $7 Billion

The new BRICS member Saudi Arabia is the world’s largest oil exporter. If China and Saudi Arabia use the agreement to settle oil trade, then other developing countries could follow suit. Read here to know how many sectors in the US will be affected if BRICS stops using the dollar.

Also Read: Gold Price Prediction Nov 2023: Will It Rise to $2,100 or Dip $1,900?

The US dollar is the de facto currency for oil and the BRICS members are now looking to change the way oil trade is settled. The move will strengthen the native economies of developing countries and give their local currencies a boost in the markets. In conclusion, the US dollar has more challenges to face in the coming years from BRICS and other developing nations.