Recent data indicates a significant increase in Bitcoin [BTC] miners transferring substantial portions of their holdings to cryptocurrency exchanges, raising concerns within the cryptocurrency market. Miner-to-exchange flows reached its highest point in five months on Jan. 1, prompting questions about potential implications for the trajectory of Bitcoin’s price.

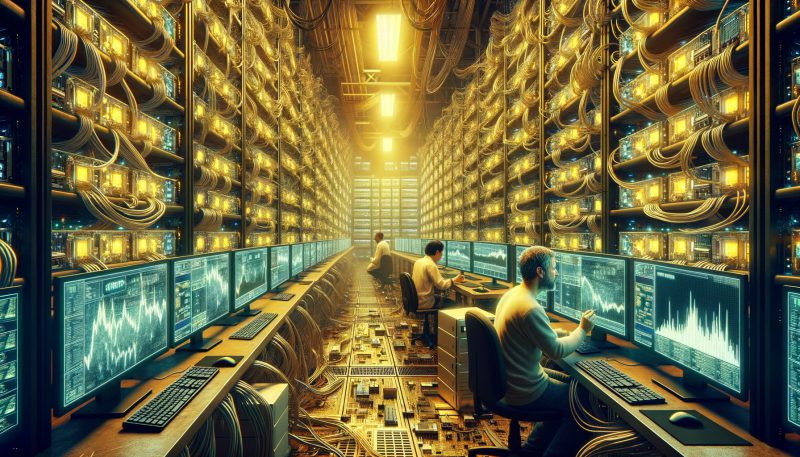

Bitcoin miners play a crucial role in the cryptocurrency ecosystem, serving not only as network security providers but also as substantial holders of the asset. Miners frequently sell their holdings to cover operational expenses related to the establishment and maintenance of mining infrastructure. However, these sell-offs can exert significant downward pressure on Bitcoin prices. Ali Martinez, an analyst revealed

Historical Patterns

CryptoQuant data underscores historical instances where increased deposits by miners on exchanges coincided with notable price drops. A similar scenario occurred in May 2023, resulting in a significant decrease in the value of Bitcoin.

Also Read: MicroStrategy’s Bitcoin Now Sits At $2.65 Billion Profit

Profitable Period for Miners

The recent surge in miner sell-offs follows a highly profitable period for miners in December 2023. Transaction fees soared to over $23.7 million on Dec. 16, driven by increased demand for block space during an Ordinals frenzy. The substantial rise in fee revenue propelled miners’ earnings to levels not seen since the peak of the 2021 bull market, offering a financial windfall for miners after enduring an extended bear market.

Rationale for Sell-offs

The profit surge in December appears to justify miners liquidating their holdings. Capitalizing on favorable market conditions raises questions about the sustainability of this trend and its potential implications for the broader cryptocurrency market.

The recent upsurge in Bitcoin miner sell-offs has instilled a cautious atmosphere among market participants. As investors evaluate the situation, it is crucial to monitor whether this trend is a short-term occurrence or indicative of a more enduring strategy. The convergence of miner behavior, market dynamics, and profitability creates a compelling landscape, underscoring the necessity for careful observation in the ever-evolving world of cryptocurrencies.

Also Read: Bitcoin Breaks $45,000: Eyes on $50,000 Before ETF Decision