In a spectacular beginning to 2024, Bitcoin has surged past the $45,000 threshold, marking a noteworthy achievement for the world’s leading cryptocurrency. This surge coincides with increasing optimism regarding the possible approval of exchange-traded spot Bitcoin funds. This development has the potential to significantly impact the crypto market.

Bitcoin’s Impressive Ascent

Bitcoin, attained a 21-month pinnacle at $45,488, demonstrating a notable 154% increase in the previous year. This surge represents its most robust performance since 2020, emphasizing the resilience and appeal of BTC despite its price fluctuations. Although BTC is presently valued at $45,344, it remains considerably distant from its record high of $69,000 in November 2021.

The current Bitcoin Fear and Greed Index, standing at 71 (indicating Greed), mirrors the optimistic sentiment and increasing confidence within the cryptocurrency market. As BTC continues to captivate investors’ attention, analysts are contemplating whether the crypto will surpass the $50,000 mark before the eagerly anticipated approval of Bitcoin ETFs.

Also Read: 1,314 Bitcoin Rigs Seized in Indonesia’s Battle Against Electricity Theft

Speculations on Spot Bitcoin ETF Approval

Voices in the cryptocurrency community are progressively expressing confidence in the approval of spot BTC ETFs. Reports suggest that approval may materialize as early as the week commencing Jan. 8, 2024. This regulatory development is viewed as a potential catalyst for Bitcoin’s surge. It could potentially pave the way for more institutional investments and wider mainstream acceptance.

Matrixport’s Confident Projection

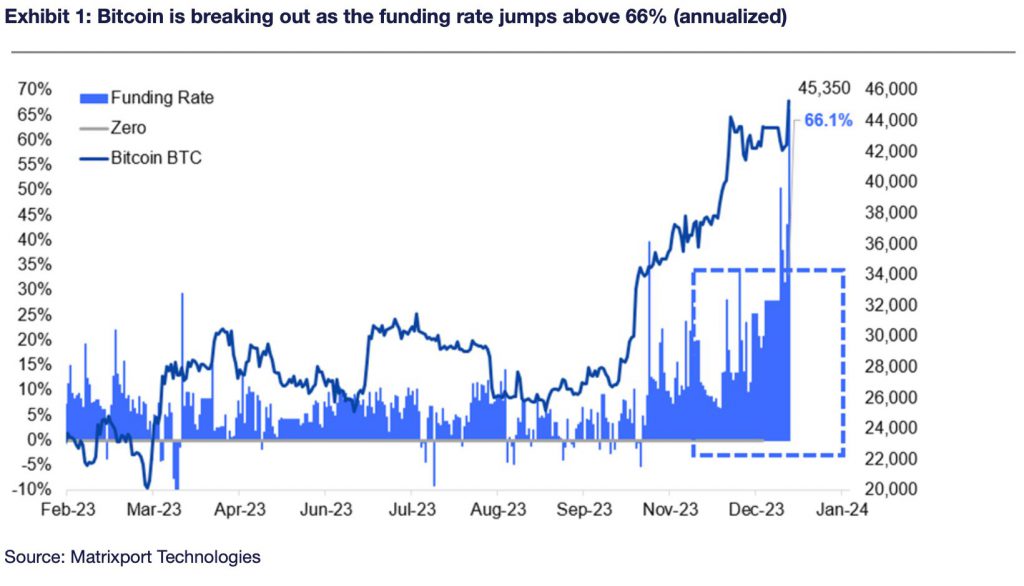

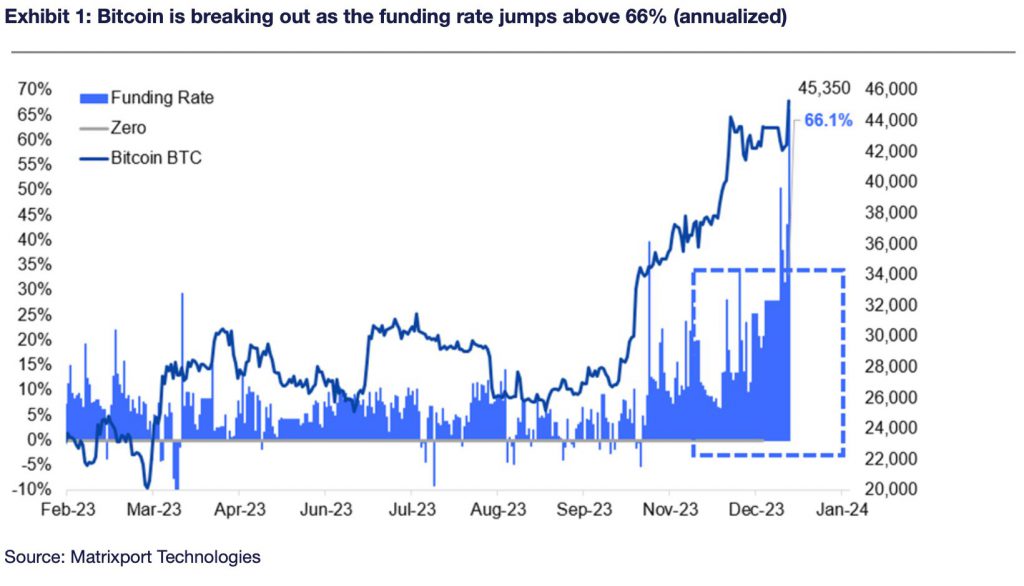

Matrixport, a prominent crypto financial services platform, predicts a surge in Bitcoin’s value to $50,000 in January. This optimistic outlook is attributed to various factors. This includes the imminent approval of Bitcoin spot ETFs, heightened institutional investments, supply shortages, and historical trends. Collectively, these elements create a positive atmosphere for BTC, propelling it to new heights in the initial months of 2024.

Anticipating Altcoin Season

Matrixport’s projection also hints at the possible initiation of an altcoin season, with funding rates expected to rise to 66%. As BTC gains momentum, investors may diversify their portfolios by exploring opportunities in alternative cryptocurrencies. This anticipated altcoin season could further contribute to the overall positive sentiment within the crypto market.

Also Read: Bitcoin’s Record Exodus: Largest Single-Day Outflow in 12 Months

As BTC sustains its upward trajectory, surpassing the $45,000 mark, attention is now focused on its potential to reach $50,000 in the upcoming weeks. The speculated approval of spot Bitcoin ETFs, coupled with supporting factors like increased institutional investments and supply shortages, adds to the optimistic narrative surrounding Bitcoin’s prospects in 2024. Investors and enthusiasts eagerly await further developments, anticipating a landmark moment for BTC and the broader cryptocurrency market in the early months of the new year.