MicroStrategy, a well-known business intelligence firm, has emerged as a significant player in the crypto sector. This is particularly due to its substantial investment in Bitcoin. Presently, MicroStrategy is enjoying an impressive unrealized profit of $2.65 billion from its Bitcoin holdings. This is a clear indication of the remarkable surge that has propelled the cryptocurrency’s value beyond $45,000. The company’s strategic entry into the realm of Bitcoin, led by its executive chairman Michael Saylor, has not only reinforced its status as the largest corporate holder of BTC but has also become a focal point for investors and market observers.

MicroStrategy’s Bitcoin Reserves

MicroStrategy’s initial venture into Bitcoin has proven to be fruitful. It now holds a remarkable treasury of approximately 189,000 BTC, valued at around $8.5 billion based on current market prices. This substantial holding has positioned MicroStrategy as a pivotal player in the cryptocurrency market, demonstrating the company’s foresight in allocating a portion of its treasury to this digital asset.

The recent surge in Bitcoin’s value has resulted in considerable unrealized profits for MicroStrategy, surpassing the $2 billion threshold. Despite the overall market volatility affecting stocks related to cryptocurrencies, MicroStrategy’s shares defied the trend, experiencing an 8.5% increase on a day marked by a broader slump in the sector. This noteworthy performance underscores the positive impact of the company’s strategic decision to integrate BTC into its corporate treasury.

Also Read: MicroStrategy Now Holds 189,150 Bitcoin (BTC) Worth $8.1 Billion

Michael Saylor’s Ongoing Bitcoin Acquisition Strategy

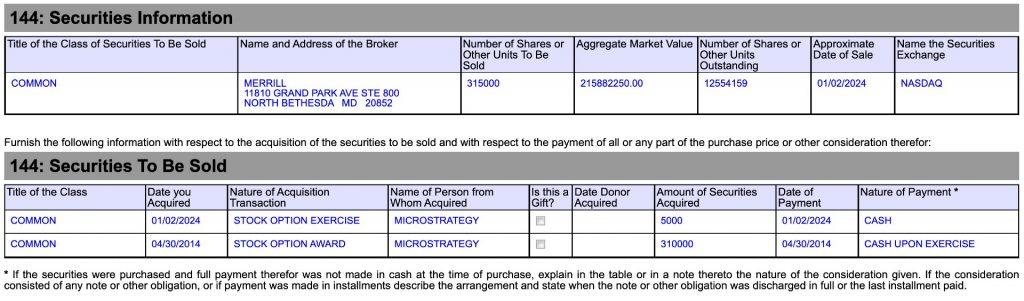

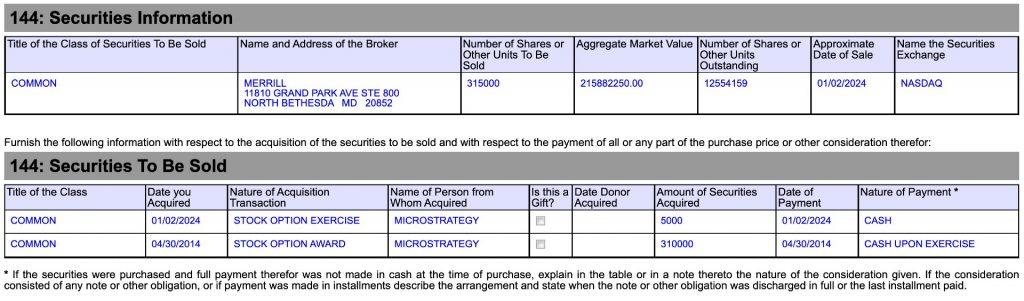

Saylor, the driving force behind MicroStrategy’s Bitcoin strategy, has adopted a proactive stance to capitalize on the surge in cryptocurrency value. As revealed in a recent filing with the United States Securities and Exchange Commission (SEC), Saylor has commenced the sale of $216 million worth of MicroStrategy stocks. This four-month-long process, initiated on Jan. 2, involves the daily sale of 5,000 MSTR shares with the objective of fulfilling personal obligations and augmenting Saylor’s personal Bitcoin holdings.

Saylor’s commitment to expanding his BTC portfolio was emphasized during MicroStrategy’s third-quarter earnings call on Nov. 2. He outlined his plan to liquidate 5,000 MSTR shares daily for four months, emphasizing the dual purpose of addressing personal obligations and accruing more BTC. Despite these personal sales, Saylor underscored that his stake in the company’s equity remains “significant.”

Regulatory Factors and Future Prospects

As the cryptocurrency community eagerly awaits the potential approval of a spot Bitcoin exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission in the coming weeks, MicroStrategy’s position in the market gains further significance. Approval of a Bitcoin ETF could pave the way for increased retail and institutional investment, potentially driving Bitcoin’s value even higher.

MicroStrategy’s bold entry into the realm of Bitcoin has not only positioned the company as a frontrunner in corporate cryptocurrency adoption but has also resulted in substantial unrealized profits. Michael Saylor’s ongoing stock sale to fund additional Bitcoin acquisitions reflects a sustained commitment to the digital asset.

Also Read: MicroStrategy Buys Additional 14,620 Bitcoin (BTC) Worth $615M