It’s certainly interesting to see how fast market assessments change within the crypto community. From “2022 will be epic” to “crypto winter is here”, Bitcoin’s narrative seems to have taken a complete U-turn in just a few months.

Understandably, there is some precariousness in the market after BTC’s recent collapse below $37,000. However, a deeper dive into different market cycles would provide more clarity and help one understand the current nature of the market.

Bitcoin Market Cycles

Generally speaking, there are four types of market phases – accumulation, mark-up phase, distribution, and mark-down. In simpler terms, the market stays flat, rises, evens out, declines, and continues to ebb and flow through a continuous process.

Now, looking at Bitcoin’s daily chart, it’s clear that Bitcoin was in a markdown phase since November 2021. While many were expecting a re-accumulation phase to follow, BTC’s recent decline below $37,000 presented threats of an extended sell-off. This was because BTC’s range between $37K to $42K was historically concentrated with a large number of buyers, ideal for re-accumulation. However, this range now functioned as resistance after flipping bearish on 21 January.

Bitcoin URPD Underlines Important Support Zones

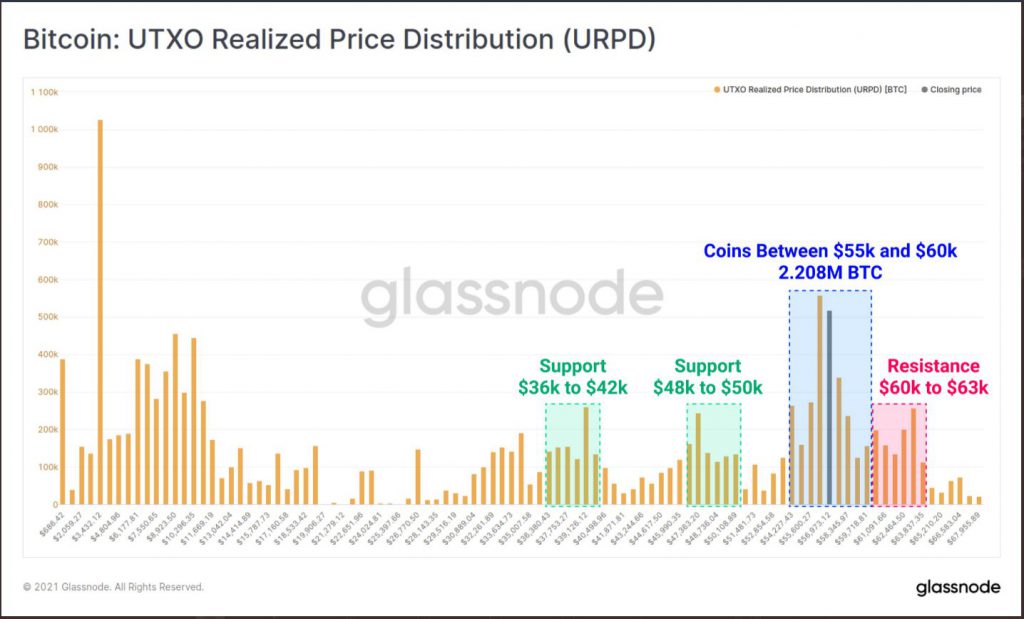

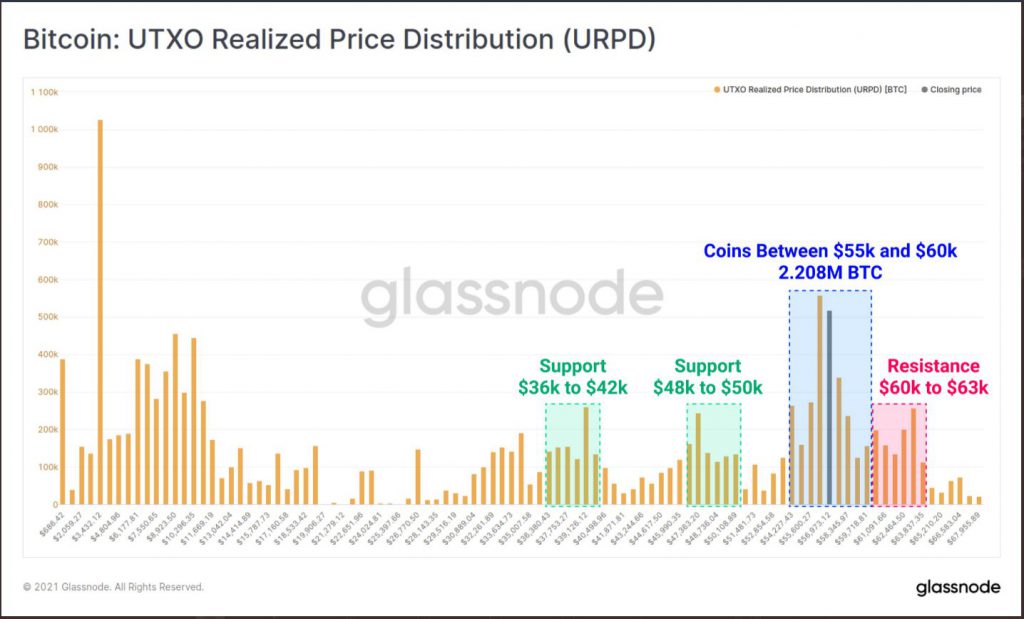

Now, when Bitcoin was trading around $56K in December 2021, a Glassnode report made some interesting observations. As per the report, BTC’s range between $36K-$42K acted as support after seeing a healthy traffic of BTC UTXO’s. UTXO’s, or unspent transaction outputs, are the amount of coins remaining after a transaction has been executed. UTXO realized price distribution (URPD) helps in understanding which price regions contain the highest number of buyers and sellers.

READ ALSO: Bitcoin remains on track towards $1 million by 2030: Cathie Wood

Unless Bitcoin holds above $37,000 this week, its markdown phase would likely extend to a more attractive buy zone. Such an area could be found between $32,000-$28,000, which was used for re-accumulation back in May-July 2021.

Whales Buying Early?

While whales have stepped into the mix, not all clusters are equally bullish on Bitcoin. Data from Ecoinmetrics shows that those holding between 100-1,000 BTC’s are still distributing their coins amid uncertainties in the market. Once BTC bottoms out at the next area of demand, we may see other clusters jump in and start aggressively buying the dip, leading to a re-accumulation phase.

READ ALSO: Cardano Price Prediction: Why ADA is at a critical position in the chart

Conclusion

Although Bitcoin’s crash has created some jitters, we would likely see signs of recovery once re-accumulation starts between $32K-$28K. After all, even if the winter is here, can spring be far behind?