$8.7 – This was the price at which the 50th largest alt, Waves, was trading exactly a week back. Owing to the bullishness grappling the market over the past few hours, this token has been able to take off on its price chart. At the time of press, this token was trading at $19.6, after noting a daily incline of 53%.

How did Waves pull out a rabbit out of the hat?

Ever since the tensions between Ukraine and Russia started gaining steam, the volatility in the broader market started inclining. In fact, on 24-February, the same was at its year-to-day peak.

At that time, neither did Wave’s price react much nor did its volatility. Nonetheless, the valuation incline caused over the past day has been volatility-driven. As illustrated by the chart attached below, this metric is currently at its multi-month peak. Similar levels [1.97] were noted back during the asset’s bullish phase around July last year.

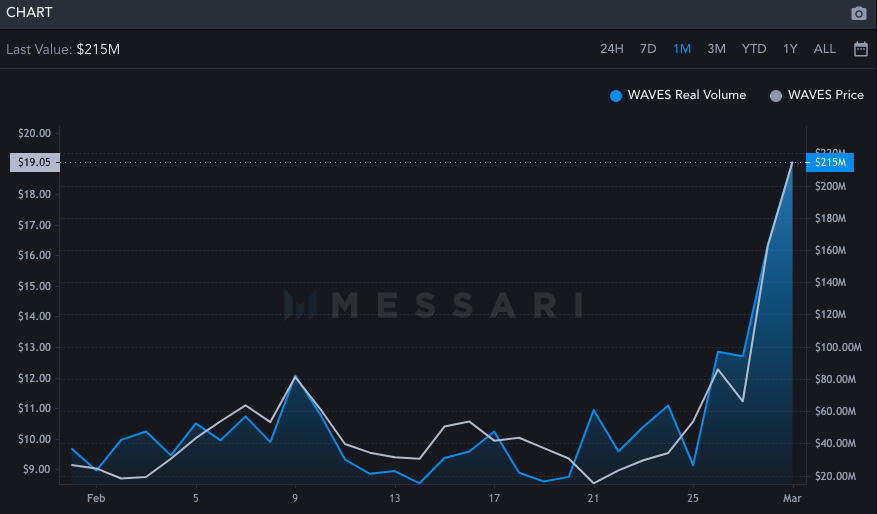

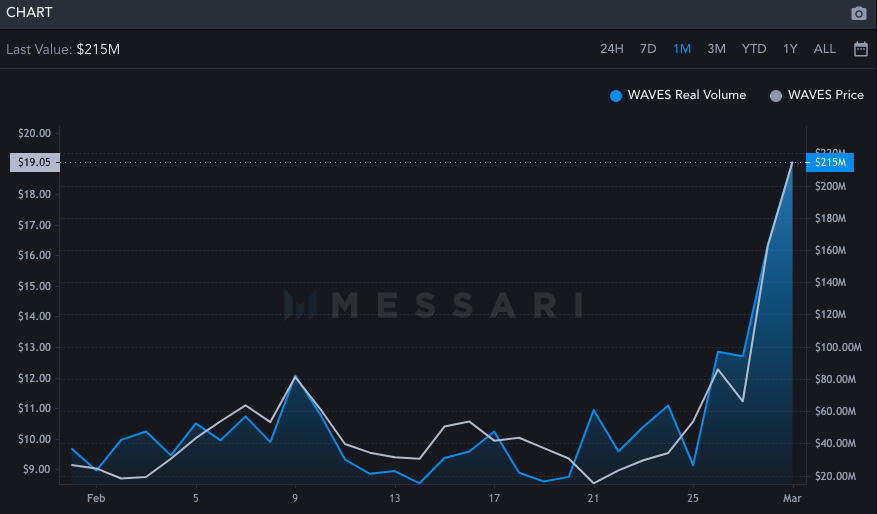

Alongside volatility, even market participants have been able to induce momentum via their market orders. As per Messari’s data, Waves’ volume was at its 1 monthly peak of $215 million at the time of press.

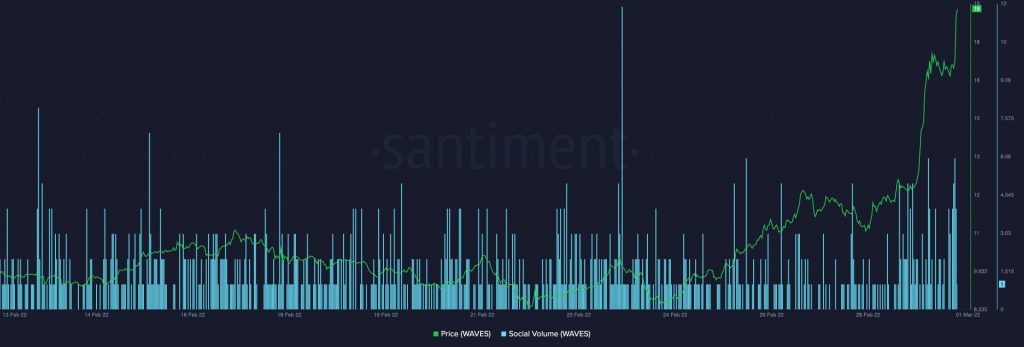

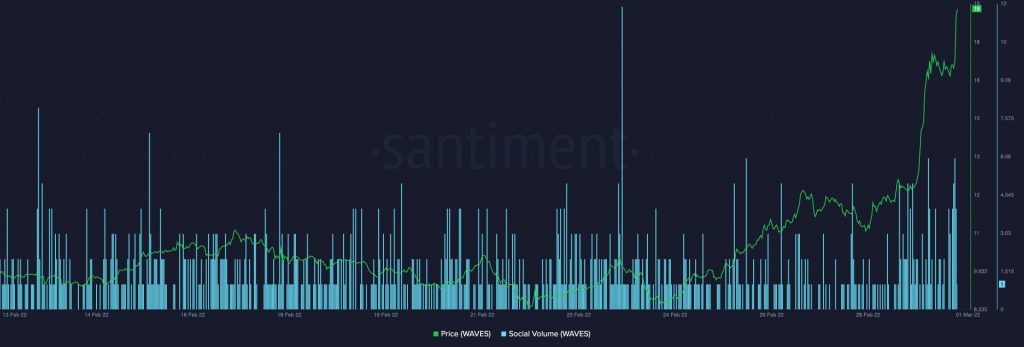

Furthermore, the social sentiment associated with this token has also been getting better of late. The number of Waves mentions on social circles and platforms like Twitter and Reddit has begun inclining. The rising spikes on Santiment’s chart attached below support the aforementioned narrative.

So, if the said factors continue refining over the next few hours, Waves’ price swing could get even wilder. However, if Bitcoin and the broader market succumbs, then it wouldn’t take much time for the buy orders to change to sell orders and volatility to negate the gains incurred so far.