Ethereum’s price has been flirting with $3k since yesterday. Riding on the back of the positive market sentiment, the king alt went on to breach the said level for the first time in three weeks.

Over the past day, ETH’s price has hardly displaced. After noting a minor 0.8% dip, the alt king was seen exchanging hands at $2957 at the time of press.

What do Ethereum’s metrics say?

Exchange flows have, by and large, been negative for Ethereum since mid-March. The largest spike in the said time frame was noted on 15 March, with the cumulative outflow reflecting a value of 357.7k ETH. On other days, barring 21 March, the negative flows had been oscillating in the 2k to 71k ETH range.

Outflows or negative values on this indicator simply mean that the reserve supply is decreasing. The same also indicates the presence of buy-side momentum in the market. So, at this stage, it wouldn’t be wrong to assert that ETH’s price has organically been pulled up by bulls.

Owing to the demand in the market, the circulating supply held on exchanges has dipped to 11.3%. Interestingly, similar levels were observed only back in September 2018 before this.

Alongside, the daily active addresses on the network also continue to revolve around fairly high levels. The same highlights the brewing interest of market participants. At the time of press, over 665k addresses were actively engaged with the network.

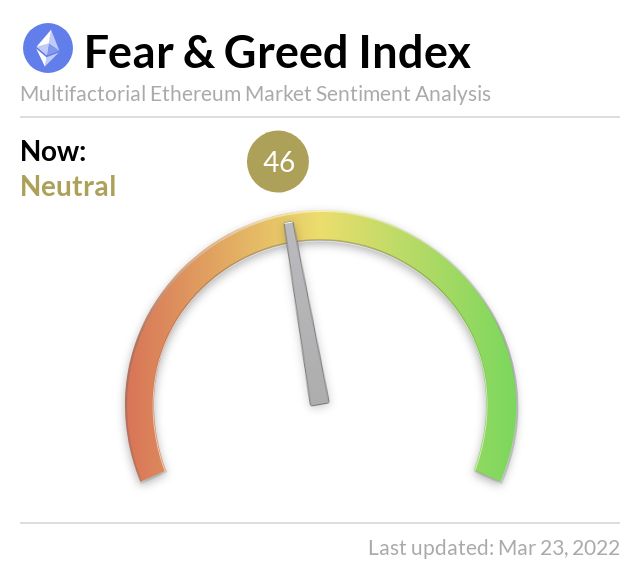

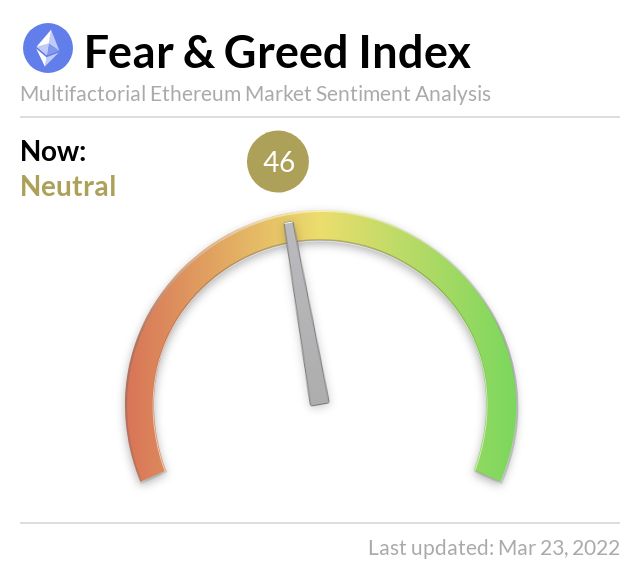

The ‘fear factor’ in minds of market participants has also gradually started diminishing. Ethereum’s Fear and Greed Index has been hovering in the ‘neutral’ territory over the past few days. The same, however, was revolving around the lower 30s bracket last week, indicating that the market was engulfed in fear back then.

All the aforementioned factors point towards the fact that the Ethereum market is currently quite stable and the upswing that we’ve noted on the micro-frame has been buyer-driven.