Institutional interest in Bitcoin had faded away to some extent during its consolidation phase in February. However, such players made a U-turn and re-entered back into the crypto arena with a thump last week.

As highlighted in a recent report, digital asset investment products noted inflows summing up to $193 million the week before last, with Bitcoin single-handedly contributing $98 million.

Institutional interest associated to Bitcoin continues growing

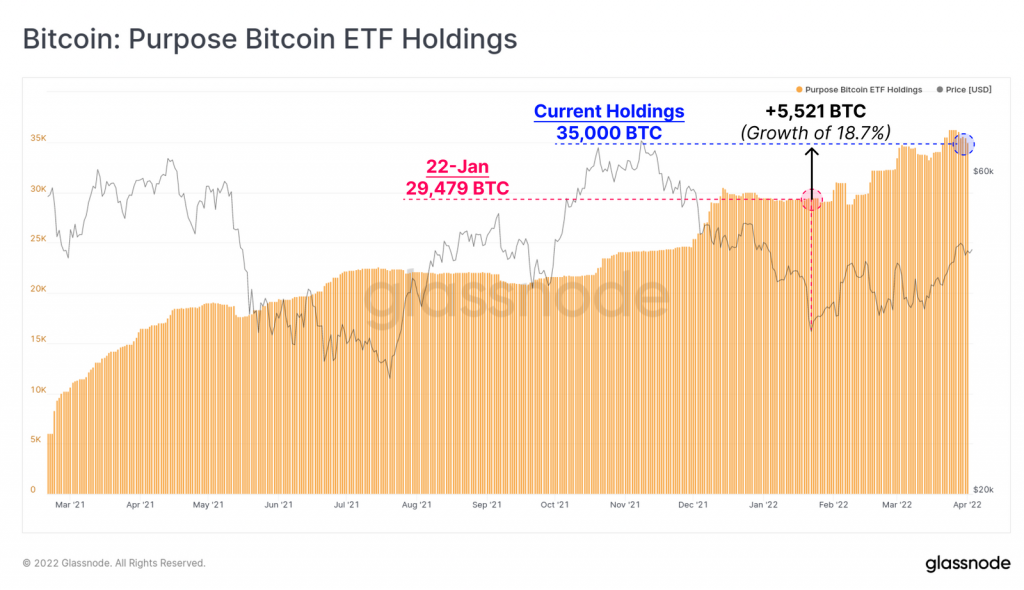

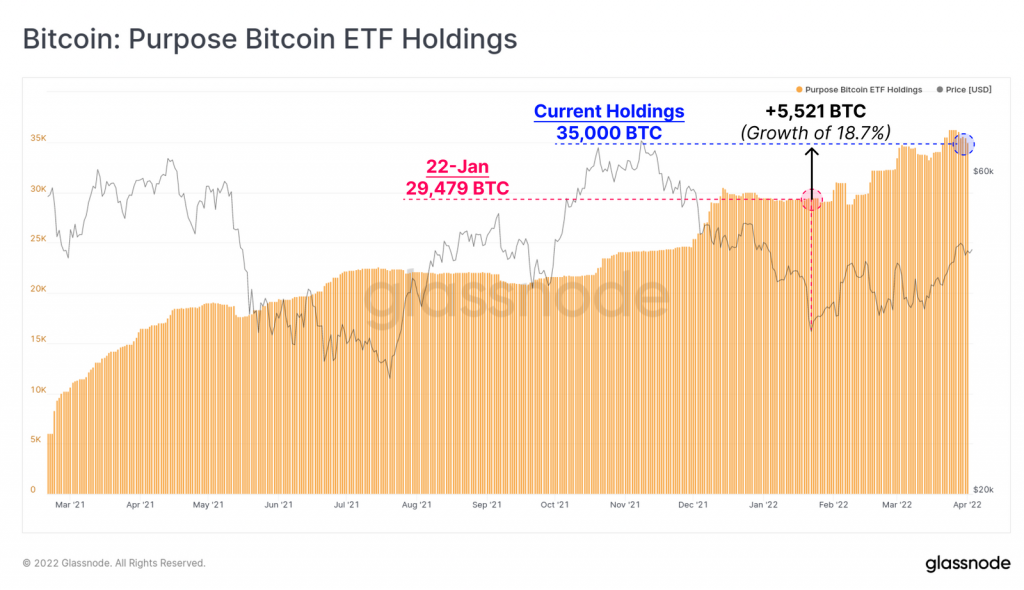

Bitcoin inflows into Exchange Traded Funds [ETFs] have gradually been rising. Purpose ETF continues to account for the lion’s share of inflows amongst all its other Canadian counterparts.

Per data from Glassnode, the Purpose Bitcoin ETF currently holds 35k BTC. Curiously, it has seen net inflows of 5,521 BTC since the 22 January price lows. The same translates into a net growth of 18.7% of total BTC holdings at this time, amidst a storm of macro and geopolitical headwinds.

The Purpose Bitcoin ETF now has $1.627B in assets under management.

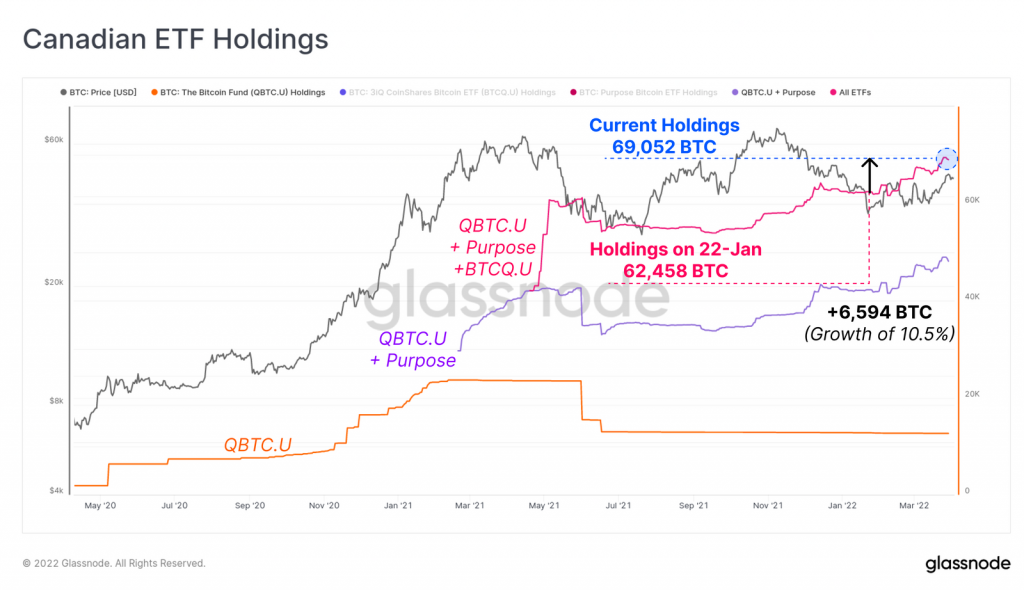

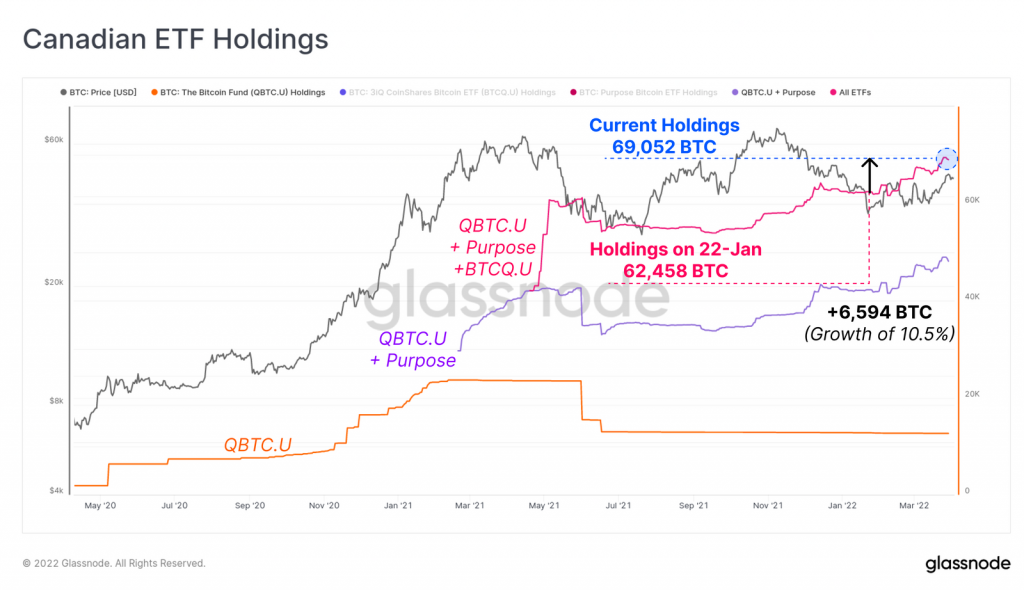

The broader picture has also improved significantly. The total HODLings of all Canadian ETF products have risen by 6,594 BTC since late January, reaching an all-time high of just over 69k BTC (0.36% of circulating supply).

Well, inflows into both ETF products, despite the numerous macroeconomic and geopolitical headwinds of recent months, does point signal one thing – market participants’ belief and conviction, w.r.t. Bitcoin, railing back on track.

Highlighting the same, Glassnode’s latest newsletter noted,

“What is most impressive is the general increase in Bitcoin demand across ETF products available in Canada, despite the plethora of headwinds such as conflict in Ukraine, commodity price rises and shortages, and tightening monetary condition.”

It added,

In general, the market appears to be viewing Bitcoin and its role in the future economy with a somewhat renewed optimism.“

The Bitcoin market has seen weeks of historically strong accumulation, which has been fairly widespread participation across wallet cohorts. The same has been highlighted in a few of our earlier articles. Alongside them, large public buyers such as LFG and MicroStrategy have also renewed emphasis on Bitcoin as pristine collateral and that, to some extent, has managed to re-stir in some optimism.

Thus, as long as the macro-accumulation trend is on and institutions continue to play their part well, Bitcoin’s macro bullish thesis is set to remain intact.