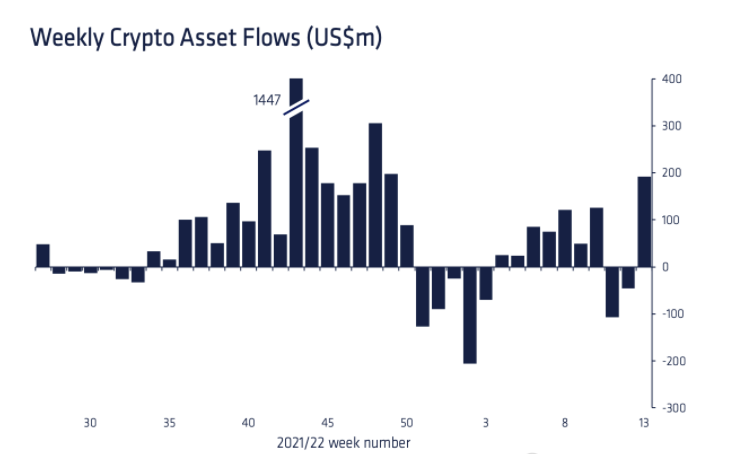

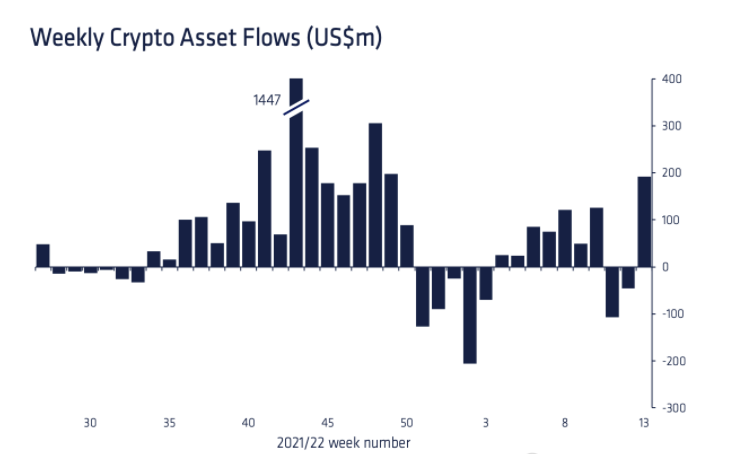

Crypto assets funds had witnessed 7 consecutive weeks of inflows since mid-January. The pendulum started oscillating more towards the outflow side over the last couple of weeks but made its entry back into the inflow territory with a bang last week.

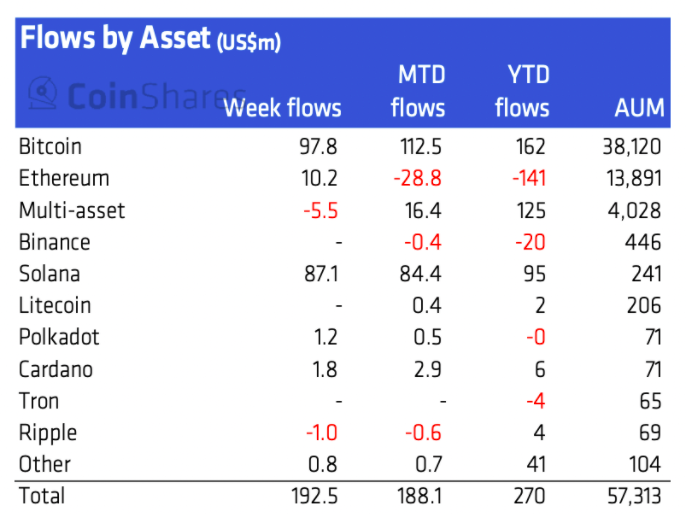

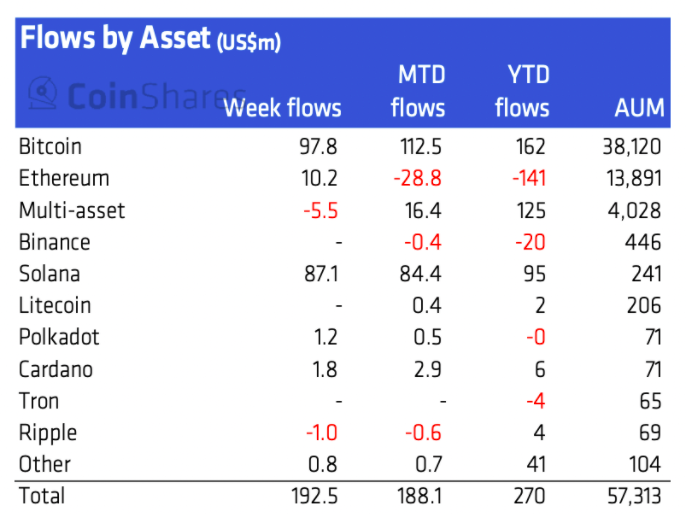

Per CoinShares’ latest weekly report, digital asset investment products saw inflows summing up to $193 million last week, the largest since last year’s mid-December.

Bitcoin paves the path

Per the report, investors focussed on Bitcoin which saw positive flows totaling $98 million last week, bringing year-to-date inflows to $162 million.

Alongside the institutional inflows, Bitcoin’s macro accumulation trend too has been going on in full fledge over the past few days. One of Santiment’s recent tweets highlighted that the number of large addresses HODLing 1k to 10k BTC had jumped by more than 8% since the Russia-Ukraine war was made official. The same, typically stood at its ATH last week.

Glassdnode’s latest newsletter too supported the said narrative and went on to highlight how people’s “conviction” w.r.t. Bitcoin has been getting stronger of late. It noted,

“However, the degree of accumulation that appears to have taken place during this consolidation range, especially in the face of world changing macro and geopolitical risks, is truly a signal of strength and conviction in Bitcoin.“

Solana follows right behind

Among alts, Solana saw the largest single week of inflows on record summing to $87 million, representing 36% of AuM. Highlighting the latest feat achieved by Solana, CoinShares’ report highlighted,

“AuM now sits at US$241m, making it the 5th largest investment product and the largest single altcoin other than Ethereum.”

Institutional interest in Solana has undoubtedly been rising of late. Just last week, for instance, CoinShares joined hands with FTX to launch the world’s first Solana exchange-traded product [ETP].

The AuM under Grayscale’s Solana trust too currently stands over $10.36 million, with the holdings per share sitting at $1.1. The same witnessed a daily change of over 12%.

Thus, with the market in its recovery mode, the cumulative inflow numbers can be expected to remain in the same positive territory going forward.