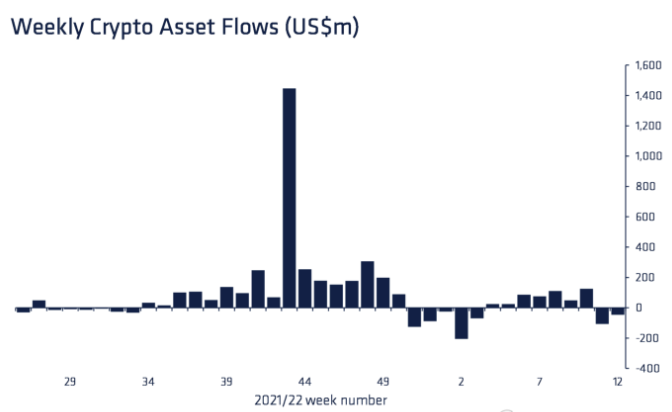

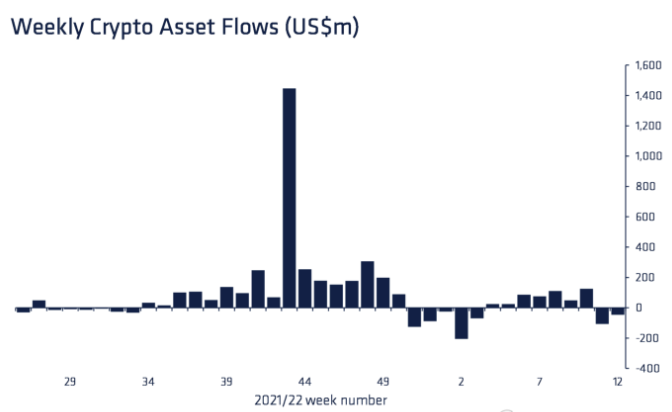

Crypto assets funds had witnessed 7 consecutive weeks of inflows since mid-January. However, the week before last saw the weekly flows slide into the negative territory, owing to the regulatory concerns in the U.S. market.

Last week too, the same outflow trend continued, but the number had shrunk by half [$110 million v. $47 million]. Outlining the main reason, CoinShares’ report brought to light,

“The same trend continued with outflows predominantly coming from North American providers, with outflows comprising 98% while flows in Europe were broadly flat. We believe the recent negative sentiment in North America is due to continued jitters over regulation and geopolitical issues caused by the Ukrainian conflict. Since the conflict began, we have seen trading volumes rise by 160% and 150%in Ukraine and Russia respectively.”

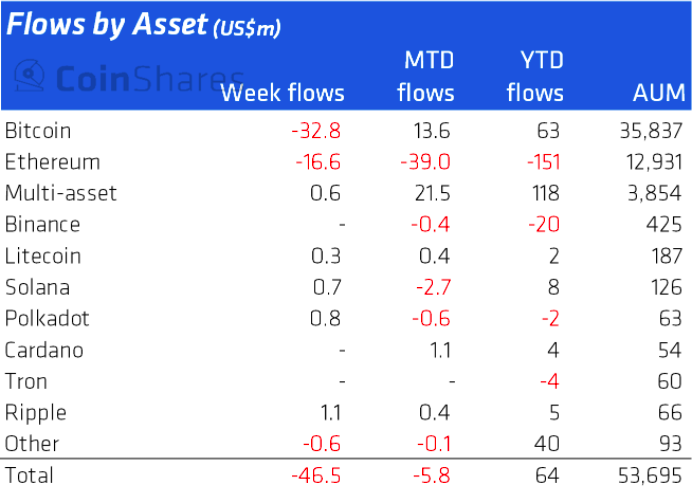

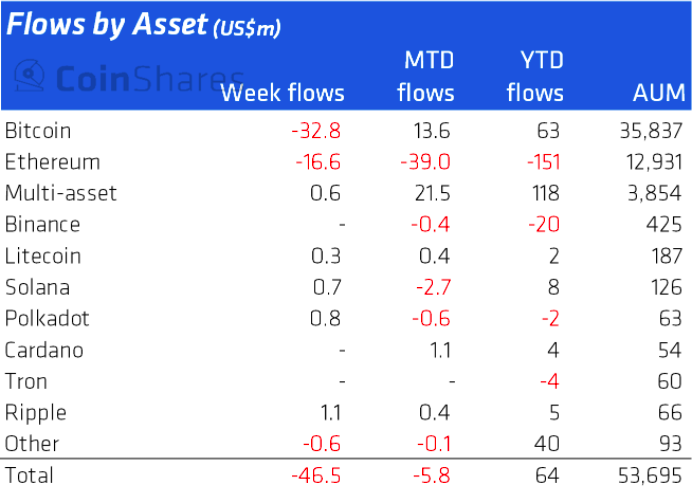

As far as coin-wise numbers are concerned, Bitcoin yet again saw the largest outflows, totaling $33 million. Ethereum followed next and registered close to $17 million in negative flows. Alts like Solana, Litecoin, Cardano, and XRP, however, noted minor inflows in the 0.3 million to 1.1 million range.

LT HODLers’ status

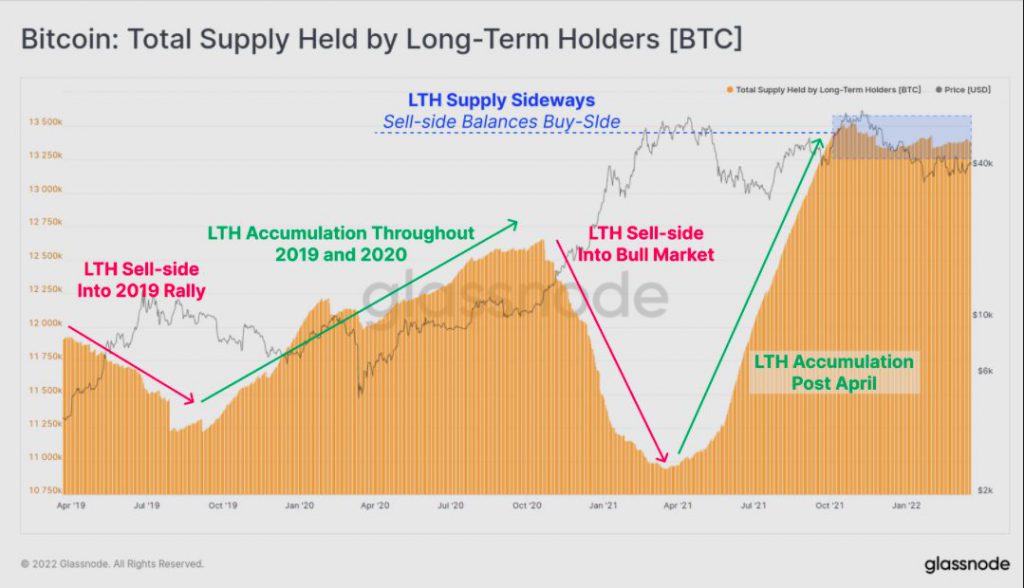

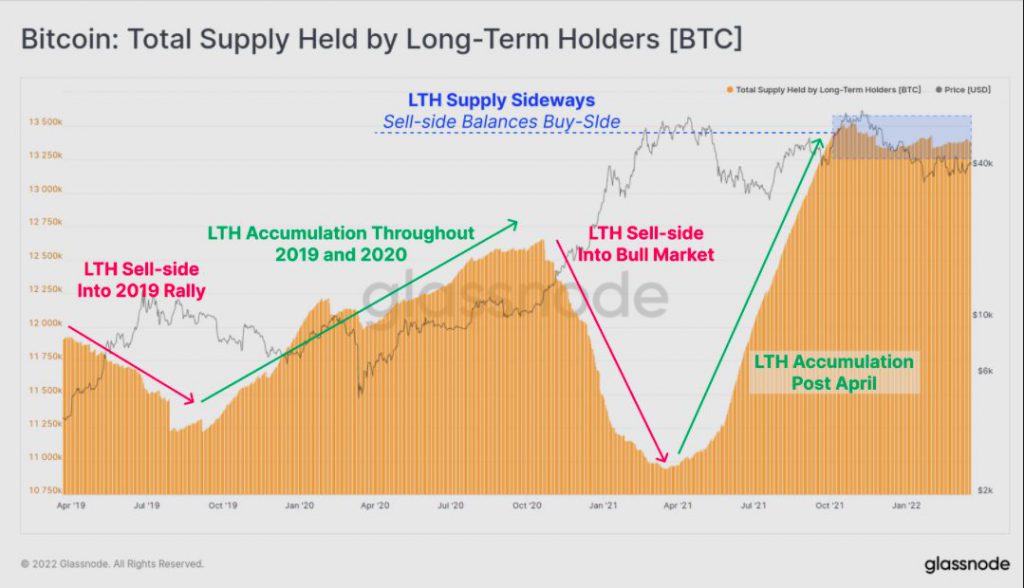

Leaving aside the macro-geopolitical and regulatory landscape, things aren’t that rosy for Bitcoin in its courtyard. The cumulative supply held by LT HODLers, for instance, continues to maintain its flat trend since October last year. This means that the sell-side and buy-side proceedings are fairly the same in number, thereby nullifying the net change in HODLings.

Outlining the said phenomenon, Glassnode’s report explicitly stated,

“This suggests that the volume of coins maturing into LTH status, is being met by equal spending pressure by this cohort.“

Thus, only when the buy-side starts weighing more, would the price of BTC be propelled to rally. In effect, institutions would also start re-accumulating coins and the negative flows would flip to positive.

At the time of press, BTC was trading around $43k, up by 11% on the weekly window.