A recovery effort this week has brought Dogecoin closer to its April peak of $0.18. Support from Binance Smart Chain whales and large holders suggest that the DOGE rally could be here to stay and a further increase is not outside the realms of possibility.

Following a 9% correction on 11 April, Dogecoin steadily reconstructed its price on the chart. The meme coin has risen for four consecutive days, becoming the highest weekly gainer among the top 15 coins by market cap.

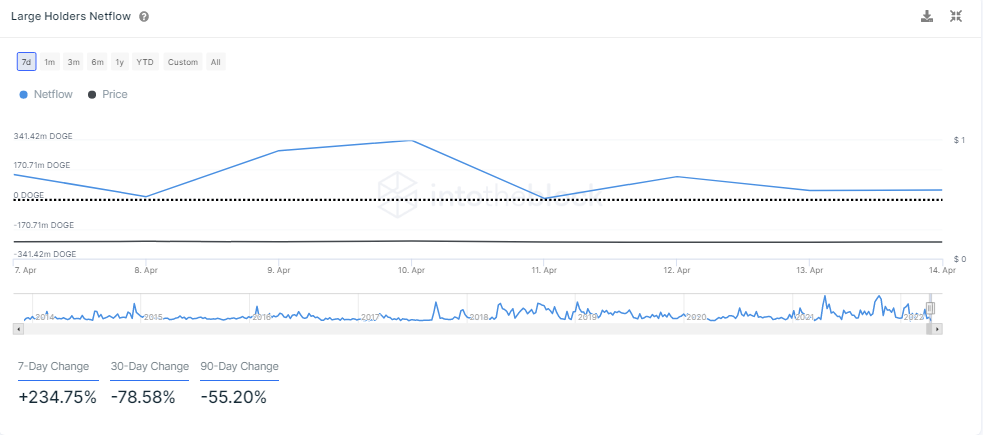

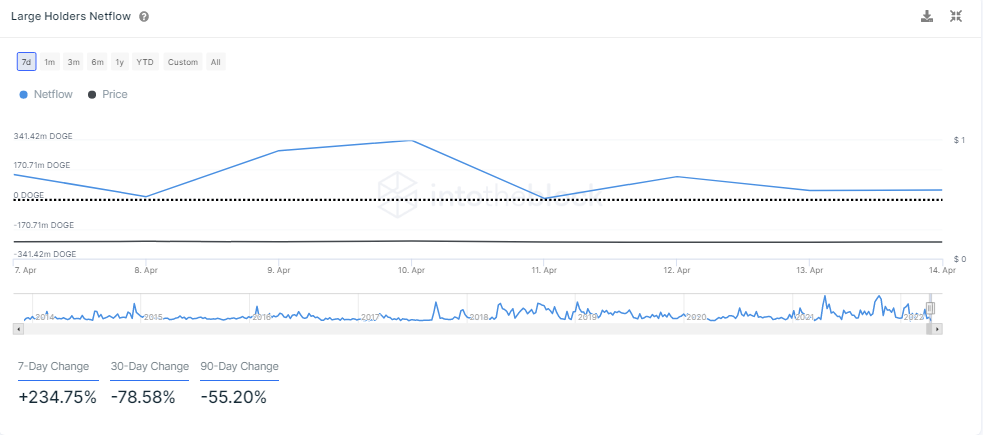

Part of Dogecoin’s bullish narrative comes from a rising interest among Binance whales and support from large DOGE token holders. The above chart showed that large holders NetFlow was up by over 230% for the week, indicating that addresses holding at least 0.1% of the circulating supply were buying DOGE post its 6 April correction.

Interestingly, Binance Smart Chain whales were too restless for another Dogecoin correction and ramped up accumulating even as the DOGE’s price was trading at a 5% premium to yesterday’s close. Data from Whalestats showed that Dogecoin was among the most purchased tokens and most used smart contracts by the top 100 BSC wallets over the last 24 hours.

Dogecoin Price Strategy

While whale accumulation across the board is generally a good sign for a sustainable rally, DOGE’s price looked even more enticing after breaking above its 20-SMA (red). A mid-line rebound on the RSI and a potential bullish crossover on the MACD also meant that DOGE’s market was technically sound for more short-term gains.

A quick glance at Dogecoin’s daily chart showed that a decent buy opportunity was available. To profit from the same, traders can set up buy orders at $0.154, slightly above its immediate resistance. Take-profit can be set at April’s high of $0.18, while a stop-loss can be maintained at $0.12. The trade setup carried a risk/reward ratio of 1.08.