Yesterday, the Altcoin leader, Ethereum, was at a crucial support line at $1,222 when the bears waddled in. As predicted in yesterday’s Ethereum price analysis, after failing the re-test, Ether’s value made a pit stop at $1,182 for a couple of hours, after which it only halted at $1,117, as visible in the chart below.

The price of ETH once again stands at a critical juncture. As it tried to maintain the support at $1,117.70, to be accurate, the bearishness in the market has remained. The panic has set in again, and investors are eager to know whether the bottom is in or more price shedding is expected.

Let’s look into the on-chain metric to understand the state of the traders.

Ethereum signals weakness

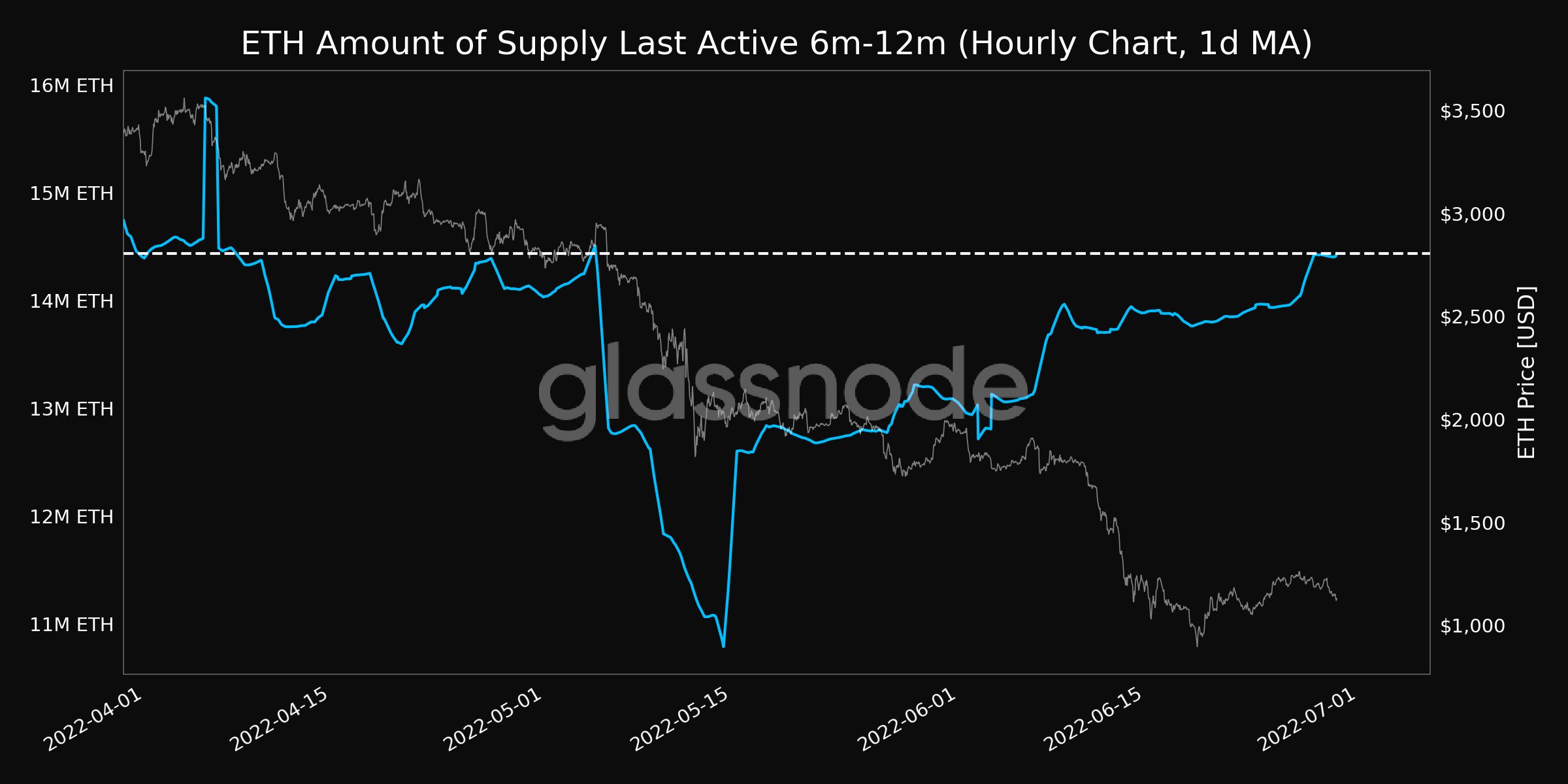

Data provided by Glassnode indicated increased activity in the amount of Ethereum supply last active between six to twelve months. Glassnode alerts noted that the abovementioned metric reached a 1-month high of 14,433,873.497 ETH.

This meant the hodlers and traders alike were trading ETH more than they were one month ago when the digital asset’s value was above $1,800.

Additionally, the sign of more sell-offs is visible as the Ethereum balance on exchanges was on the rise and hit a 3-month high of 21,581,770.924 ETH.

Often, most long-term holders keep their digital assets safe in an external wallet; however, given the price volatility, some amount of ETH may have been transferred onto the exchanges in case another sell-off is triggered.

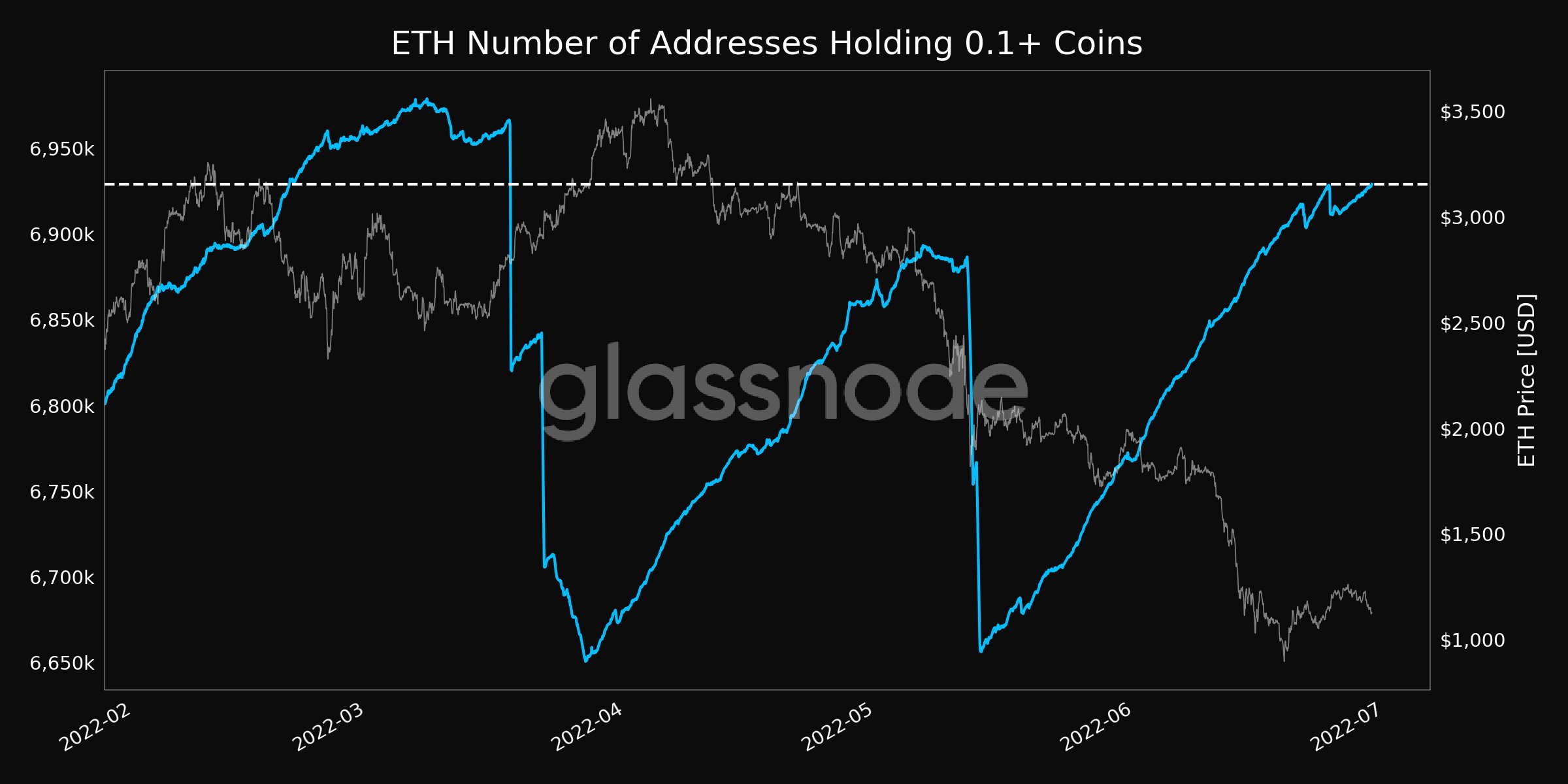

However, it wasn’t an all-bad scene for the traders, especially the investors waiting on the sidelines to buy more ETH. As the value of ETH remained low, the number of non-zero addresses climbed and reached an all-time high of 83,076,411. Meanwhile, the number of addresses holding at least 0.1+ coins reached a 3-month high of 6,929,126.

The short-term future

At the current price level for Ethereum, the selling pressure is high. If the bears decide to attack this level again and destabilize the price, ETH could head directly to the buying zone between $1,065 and $1,041.

The above chart highlights a lack of support between $1,117.70 and $1,065.03. If ETH stoops to the buying zone, we may see more activity from the traders. As ETH closes another quarter, this trend could play out over the weekend, and the traders must be aware of these levels.