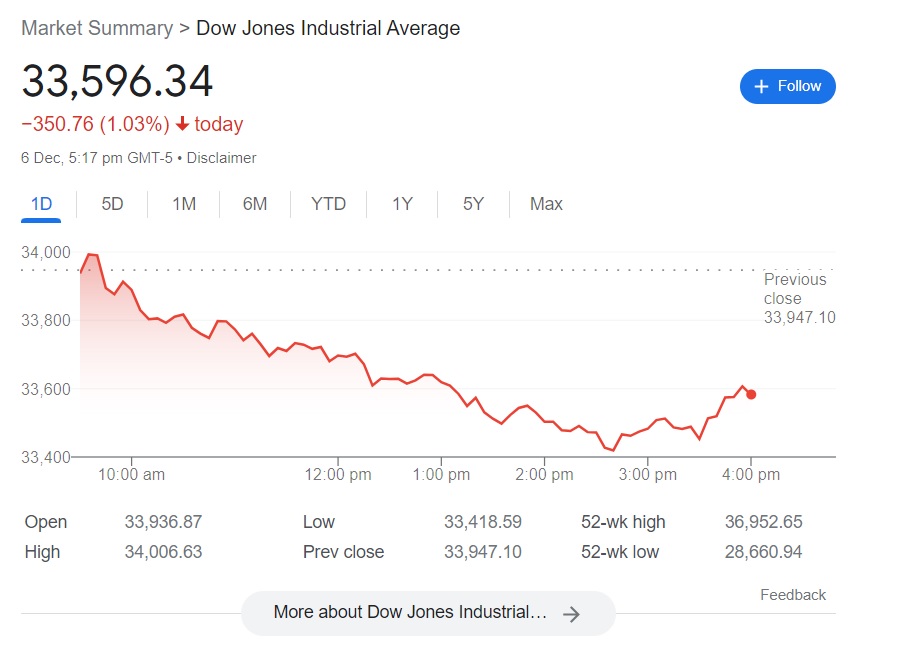

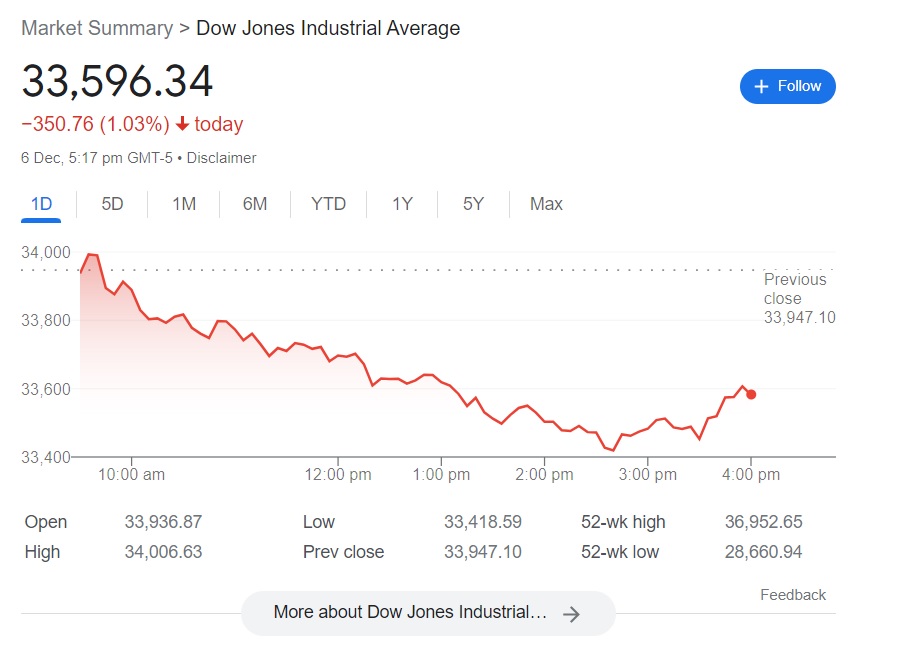

Bitcoin slipped to $15,500 levels in November 2022 after the FTX and Alameda Research fallout caused panic in the industry. BTC clawed back to $17,000 but it is retracing at press time. The crypto markets are entering the red territory as Dow Jones fell 350 points on Tuesday. The markets crumbled under the possibility of an interest rate hike as the S&P 500 faced losses for four consecutive days.

However, the market slump was seen as an opportunity for a handful of investors who took an entry position when Bitcoin slumped between $15,500 to $17,000.

Also Read: Jim Cramer Advises Investors to Sell their Crypto: ‘You Can’t Beat Yourself Up’

How Many Investors Purchased Bitcoin Between $15,500 to $17,000?

Data from UTXO Realized Price Distribution (URPD), a metric that indicated the percentage of BTC supply across a specified market price shows that 8% of the Bitcoin supply was bought between $15,500 and $17,000.

The dip was seen as an entry point for investors as BTC was lucrative between the $15.5K to $17K levels. There is demand for BTC at this point that could increase investors’ risk-apatite giving it support in the indices.

Also, data from Glassnode shows that investors owning 1 Bitcoin have reached nearly 1 million in 2022. At present 958,909 wallets own 1 Bitcoin and the numbers could spike when BTC slumps in price again. The wallets owning a minimum of 1 BTC could cross the 1 million mark by the end of 2022.

Also Read: Will Bitcoin Reach $500,000 in 5 Years? Mike Novogratz Has the Answer

However, taking an entry position in Bitcoin at the current level of $17,000 remains to be risky. The markets are expected to dip as the U.S. stock markets are in murky waters that could make leading cryptos slump further.

Also Read: Top 3 Cryptos to Watch After Fed Chief Jerome Powell’s Speech

At press time, Bitcoin was trading at $17,025 and is up 0.1% in the 24 hours day trade. BTC is down 75.3% from its all-time high of $69,044, which it reached in November 2021.