The 2022 bear market was extremely detrimental for an array of reasons. Bitcoin’s slump throughout the year had a major impact on the mining industry. High electricity costs and weather conditions, followed by decreasing prices in the market, drained the possibility of profitability. Last year, BTC’s hash rate suffered gravely as it dropped to new lows.

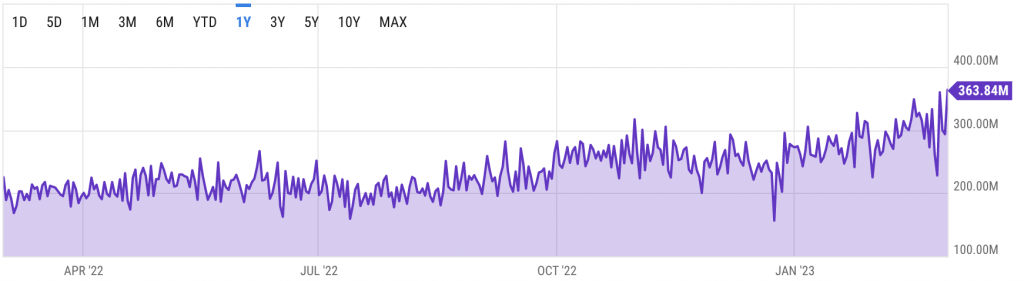

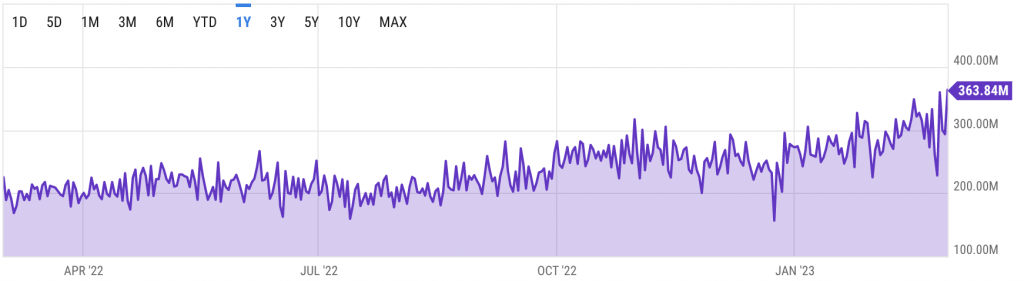

The king coin, however, managed to revive itself in 2023. Earlier today, Bitcoin’s hash rate hit an all-time high of 363.84M TH/s.

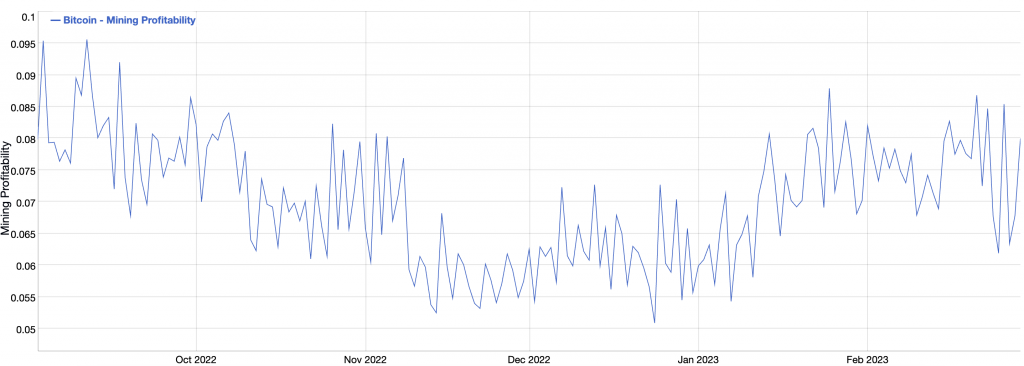

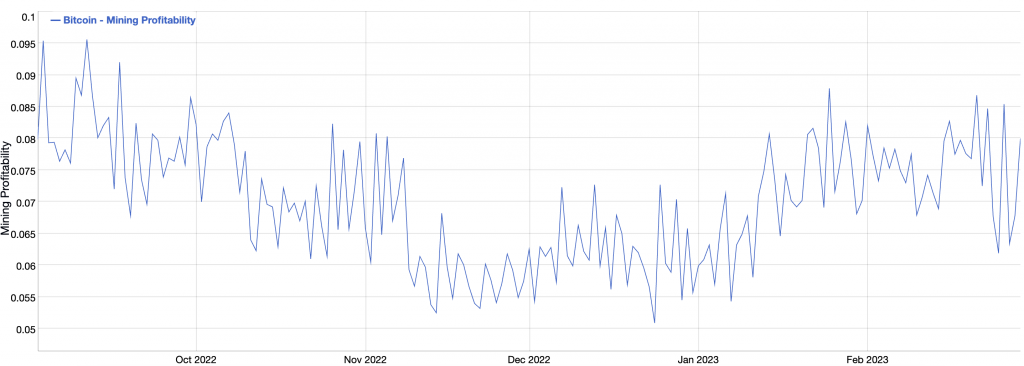

Consequently, the mining difficulty also hit a high of 43.05 T. All of these were an indication of the fact that miners were veering back into the market. Even though mining profitability hasn’t witnessed a massive surge, miners are still doing better than they did in November and December of 2022.

Currently, Bitcoin mining costs 0.0736 USD/day for 1 THash/s. This surge could be attributed to Bitcoin’s recent rally. Just last month, BTC managed to rise to a high of $25,134.12.

Bitcoin miner reserves plummet by over 3K BTC

There are multiple narratives pertaining to Bitcoin’s potential leap over the $30K zone. However, miners seemed to be impatient as they went on a selling spree. According to analyst Ali Martinez, BTC miner reserves dipped by 3,835 BTC. This means that miners sold nearly $88 million worth of BTC over the past week.

At press time, the king coin was trading for $23,449.81 with a 1.72% daily drop. With $25K acting as a strong level of resistance, the $30K dream was questioned.

However, this selling spree may not be entirely bearish. Miners could be selling their holdings to fulfill their electricity and maintenance costs. Nevertheless, the community is seeking another rally that would bring profit to the Bitcoin mining market.