The United Kingdom’s Office for National Statistics [ONS] revealed revised data illustrating the state of the economy on Friday, March 31. According to the report, a 0.1% growth was registered in Q4 last year, implying that the U.K. officially dodged a recession in 2022. The same marks an incline from the initial estimate of no growth [0.0%].

Contributing factors

The construction sector had a good quarter and registered a 1.3% growth. In fact, other sectors like telecommunication also fared well. Commenting on the latest revised figures, ONS Director Darren Morgan said,

“The economy performed a little more strongly in the latter half of last year than previously estimated, with later data showing telecommunications, construction and manufacturing all faring better than initially thought in the latest quarter.“

The latest data pointed out that living standards rose for the first time in more than a year in the U.K. This likely means, the cost-of-living crisis is easing. Specifically, the household saving ratio increased to 9.3% in Q4 2022, up from 8.9% in the previous quarter. Elaborating on the same, Morgan said,

“Households saved more in the last quarter, with their finances boosted by the Government’s energy bill support scheme.“

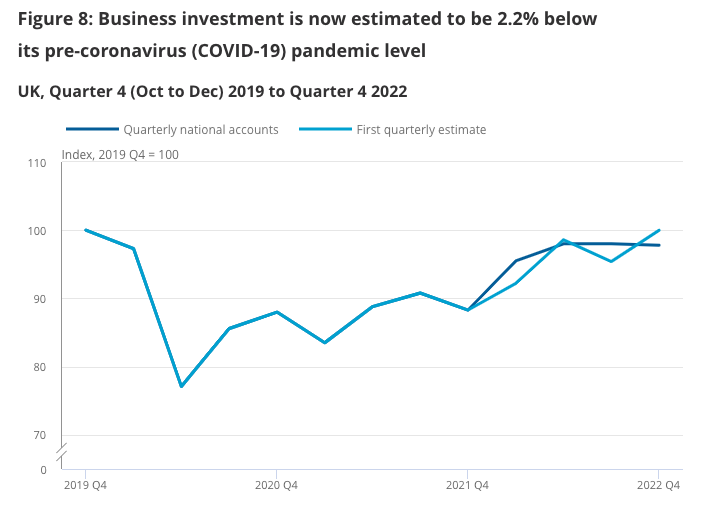

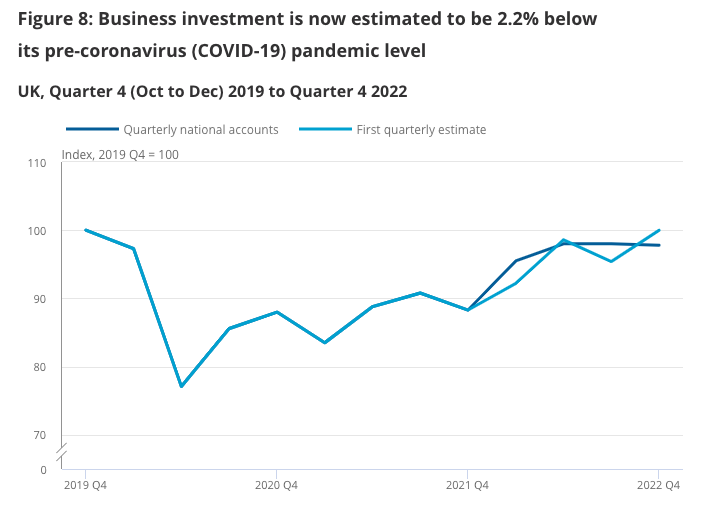

Alongside, the U.K.’s balance of payments deficit with the rest of the world also shrunk. The increased foreign earnings by U.K. companies, especially the ones in the energy sector helped foster the same. It should be noted that business investment is now estimated to be 2.2% below its pre-pandemic level, revised down from previously being equal. The ONS report noted,

“Its implied price increased by 0.7% in Quarter 4 2022, an upward revision from the first estimate of a 7.2% decline. These revisions are because of updated estimates in particular for transport products, as well as seasonal adjustment changes.“

Source: ONS

The Chancellor of the Exchequer, Jeremy Hunt, went on to assert that that “there is underlying resilience in the U.K. economy.” In fact, the overall outlook has now brightened. Per Independent Economist Julian Jessop, there’s “a bit more momentum than expected going into 2023.”

Leaving aside the U.K., even in the U.S., inflation seems to be cooling down. The CPI fell to 7.1% in November last year, a number lower than expected. Likewise, it further dropped down to 6.5% in December and 6.4% in January this year. The number was even lower in February, with the CPI reading dropping to 6%.

Also Read: U.S. Inflation Rate Falls to 6% in February