Amidst the talk of de-dollarization, and the possibility of the rest of the world following suit, many have questioned the sustainability of the greenback. Moreover, as its reserve currency status could be threatened, can the BRICS countries eventually break the US dollar?

The BRICS countries have been clear about their hope to develop an alternative currency to the US dollar. Now, with the shifting power balance clearly seen in the collective surpassing the G7 nations in GDP (PPP), that should devastate the international standing of the United States currency.

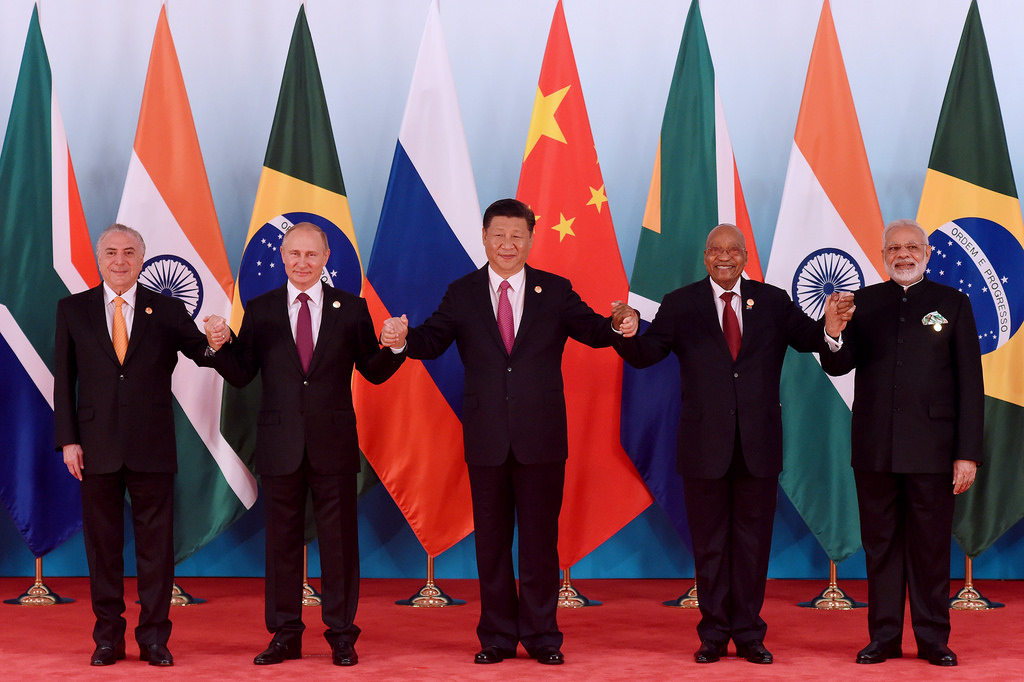

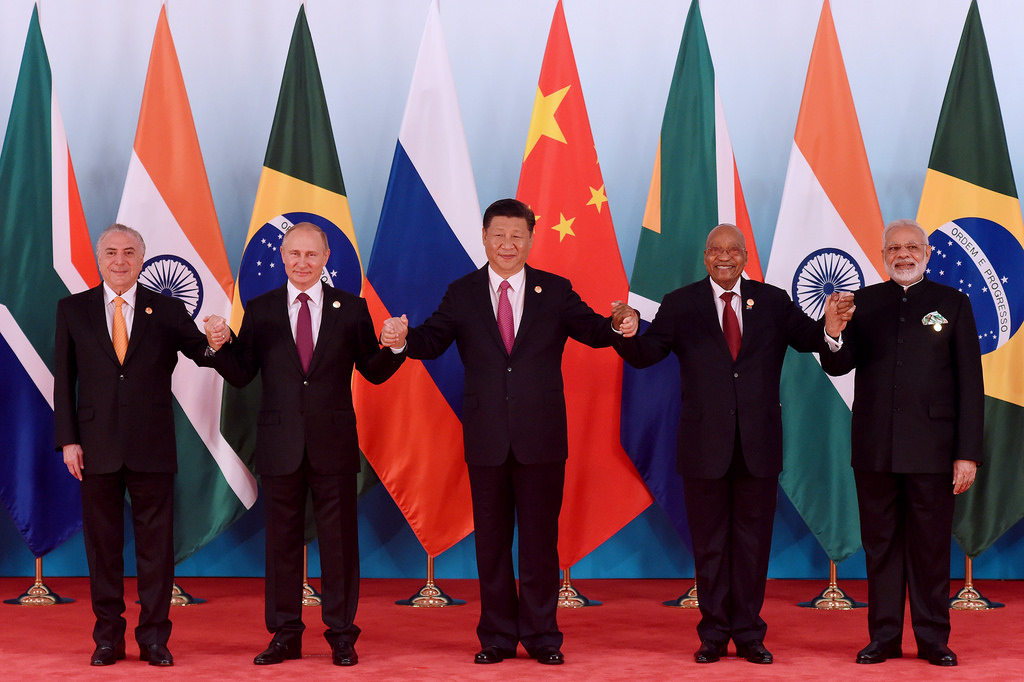

BRICS Nations Fight Against the Dollar

Initially, the development of an alternative international currency began out of necessity. Specifically, sanctions placed on Russia by the West due to the invasion of Ukraine separated the country. Subsequently, the international settlement required an alternate currency.

Later, the bloc of Brazil, Russia, India, China, and South Africa began their efforts at de-dollarization. Specifically, the implementation of a new global reserve currency that no longer allows outside control to come from the West. However, what makes the pursuit of those original five countries so important is that it is gaining traction.

Various other nations have begun to echo the sentiments originally issued by China and Russia. Moreover, Brazil’s president, Lula De Silva, was adamant in his agreement with the approach taken by BRICS. Stating his agreement with the understanding that global trade needs no longer be hindered by the American dollar’s relevance

Alternatively, the potential expansion of the BRICS nations begins to create yet another interesting dilemma. Specifically, ahead of the annual BRICS summit set to take place this summer, more than 19 nations have sought membership. Subsequently, creating a system that only grows, thus increasing the demand for international trade currencies that differ from the current system.

The nations have been clear about their desire to create an alternate currency. Specifically, foreign ministers have stated BRICS’ intention to prioritize the use of national currencies first. Subsequently, this led to an eventual currency agreement that is expected at some point this year.

Ultimately, how the BRICS currency does against the US dollar, depends on the strength of that currency. Moreover, as the BRICS nations come together to conduct more trade in their respective currencies, the US dollar has been floundering.

The Weakened State of the US Dollar

Ultimately, what makes the prospect of the BRICS nations breaking the US dollar potentially inevitable is the currency’s current state. Specifically, due to macroeconomic factors surrounding the greenback, it is certainly as weak as it ever has been.

Macroeconomic factors, combined with de-dollarization efforts, have led to a diminishing power for the US dollar. Additionally, the country itself is in the midst of a potential debt default. Moreover, as the political climate dissects what to do with a reached national debt ceiling, the dollar continues to fade in importance.

A potential debt default would be catastrophic and would rapidly accelerate the death of the greenback internationally. Yet, the currency is still facing tremendous opposition for the time being. The headlines routinely dissect a budding banking crisis and inflationary concerns, that represent a clear negative outlook for the US economy. Surely, the currency of that country is set to follow suit.

Global Movement Away From the Greenback

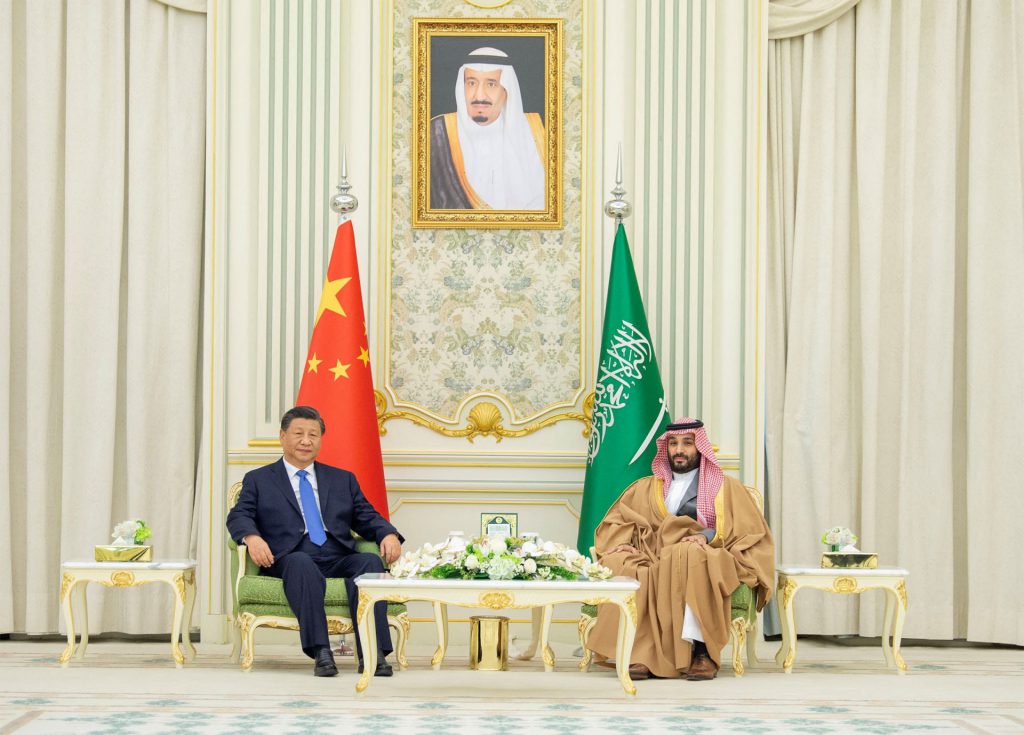

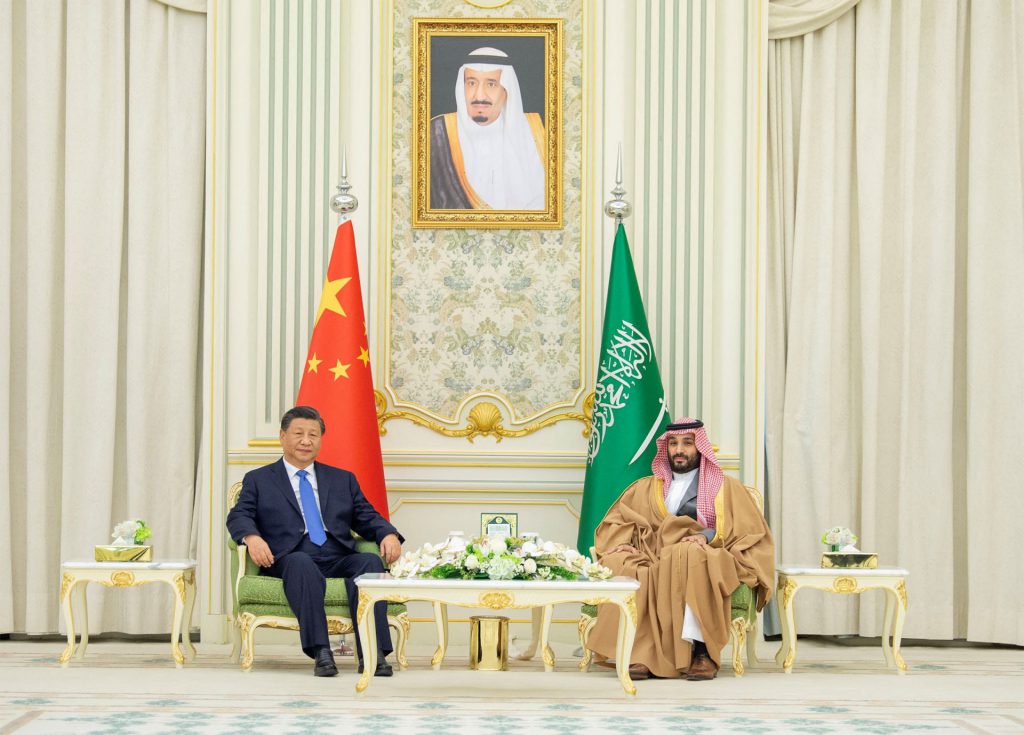

Alternatively, efforts to move away from the dollar have been thriving. The US Gold Bureau reported that Saudi Arabia decreased its US treasuries by 35.2% over the last two years. Additionally, in 2022, Saudi Arabia will only hold $119.4 billion, versus $184.4 billion in 2020.

Alternatively, Saudi Arabian oil deals with China are already being struck using the Chinese yuan. Contextually, China is the second largest consumer of Saudi Arabia’s oil, purchasing nearly 2 billion barrels per day. Conversely, those deals used to be conducted using the US dollar, but have signaled de-dollarization in action.

Although many have ensured that the dollar is still set to maintain its position of strength, how long could that sentiment be real? MSN reported that the greenback has fallen almost 8.6% since September. Moreover, it has seen its worst start to the year since 2018. All of this occurred amidst the most aggressive set of interest rate hikes since the 1980s.

Ultimately, what is bad news for the United States economy is typically good news for international trade. However, the question still remains: could the BRICS countries succeed and de-dollarize international settlements?

Can BRICS Really Break the US Dollar?

The answer to whether or not the BRICS countries can break the US dollar is a matter of perspective. Currently, on the trajectory of the country, the implementation of a BRICS currency will surely eliminate the greenback’s international relevance. Thus, it would hurt the currency’s international standing.

Subsequently, that development would undoubtedly create an eventual global reliance on the BRICS currency among the collective. Conversely, only time can answer what would then happen to the G7 nations and whether or not the dollar would truly be destroyed.

The economic environment that the country finds itself in surely lends itself to the belief that the BRICS actions could break the greenback. Moreover, a national debt default would have a catastrophic impact on the country’s economy. Subsequently crippling the power of the currency domestically, let alone internationally.

Verdict

So, to truly break the US dollar, it would rely on more than just the BRICS nations’ de-dollarization efforts. Still, there is no telling how the global power shift will continue to maneuver. Specifically, as the G7 nations are set to be upstaged in global economics by the BRICS, the prevalence of the bloc’s currency will only grow.

Could such a development make the collective currency unavoidable? Additionally, as BRICS is already discussing the growth of the collective, could the G7 nations soon be outmatched by sheer numbers alone?

Conversely, what is clearly a vital point to take away from this discourse is the validity of the question. Just two years ago, no one would have considered the US dollar a vulnerable currency. Yet, in 2022, there will be a clear discussion on its fading significance that has clear merit. Decades of dollar dominance have clearly presented the desire for something new.

Moreover, as BRICS potential expands, and unifies under the New Development Bank, the perspective becomes clear. We are undoubtedly at the earliest stages of de-dollarization, and the current trajectory does not look beneficial for the US dollar.